Get Into Oil Before It Hits $100 Per Barrel

In This Episode

On this week's Stansberry Investor Hour, Dan and Corey are joined by Cactus Schroeder. Cactus is the founder and president of Chisholm Exploration – an oil and gas exploration and production company. As an oil expert with more than 40 years' experience in the industry, Cactus brings his vast pool of knowledge to the podcast for all things oil.

Cactus kicks off the conversation by describing the current economics of the oil industry, why rig counts are deceptive, what's happening with the Haynesville Shale and Marcellus Shale, and the upside in natural gas. He also explains why the Barnett Shale has become so attractive, how Chisholm Exploration differs from the oil majors, and how these larger companies essentially control the price of oil...

Five companies now control about 80% of the Permian [Basin]. You've got Chevron, Exxon, Diamondback, OXY [Occidental Petroleum], and Conoco. And those five companies control about 80% of it. So there's not really room for any little guy anymore.

Next, Cactus discusses why his company prefers oil to natural gas, earthquakes as a side effect of drilling, and how the Biden administration has been hampering exploration and pipeline development. He also details his experience in the Eastern Shelf region, including both good and bad wells and royalty interests.

Lastly, Cactus covers the oil major he finds the most interesting today, the green-energy movement, and what's on the horizon for oil. He brings up Saudi Arabia cutting oil production in an effort to make prices reach $100 per barrel, the consequences of the war in Gaza, and the ongoing fight between land ownership and mineral rights in different states. Here's why Cactus believes you should invest in oil today...

You use [energy] every day of your life, and you need to understand a little more about it. And I think not only is it a good investment, particularly at this time, but it's also a hedge against if oil prices go to $200 a barrel or natural gas prices go to $10. If you own some of this stock, it's a hedge against what's going to happen to you as these prices fluctuate.

Dan and Corey close things out by discussing the consequences of the Drug Enforcement Administration moving to reclassify marijuana as a Schedule III drug. They analyze what has been happening with cannabis stocks since the announcement and the tax implications behind the move. Plus, they talk about Starbucks' recent disappointing earnings report and what weight-loss drugs becoming more available could mean for the economy and certain stocks.

Featured Guests

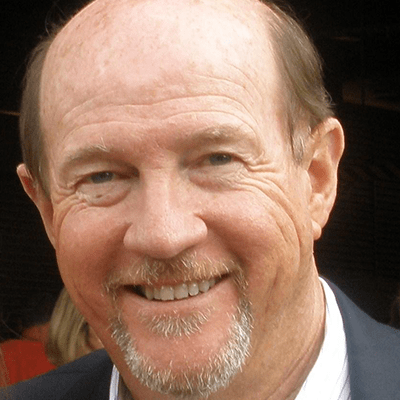

Cactus Schroeder

Founder and president of Chisholm Exploration

Cactus Schroeder is a Texas wildcatter with more than 40 years of experience in the oil industry. He is the founder and president of Chisholm Exploration, an oil-exploration company operating in the Eastern Shelf.

Transcript

Dan Ferris: The 2024 Stansberry Research Conference and Alliance Meeting is back this fall in Las Vegas. And for the first time ever, they've extended their early bird discounted ticket pricing, which means if you reserve your seat today, you can save $450 off your ticket. Head over to www.vegasearlybird.com to find all the details and get your discounted ticket. The Stansberry Conference is truly one of the best business, mixed with pleasure, industry events out there. Past speakers have included Shark Tank's Kevin O'Leary, Dennis Miller, and Steve Forbes. And of course, all your favorite Stansberry editors will be there, too, including yours truly. I mean, I hope I'm one of your favorites.

I look forward to this event every year, it's great getting the chance to meet our listeners from the show, whether it's chatting during a break, or grabbing a beer at the end of the day, or whatever. So I hope you're planning to join us. It's a great event, go to www.vegasearlybird.com to get your discounted ticket before prices increase. That's www.vegasearlybird.com. So come on out and find me in Vegas, and say hello.

Dan Ferris: Cactus, welcome to the show. It's always a pleasure to see you.

Cactus Schroeder: You too, Dan. It's been too long. Looking forward to revisiting with you.

Dan Ferris: Yeah, so actually I think the last time we ran into each other might have even been the – I feel like it was at some conference or other. Maybe in Las Vegas at the Stansberry Conference.

Cactus Schroeder: Right, right.

Dan Ferris: So been a while. And if you've been on the show before, it was before my time because I went and looked through the archives, so you're effectively a new guest to the show. So we should tell our listeners who haven't heard from you in some time who you are and what you do and to me, if somebody said, "Who's Cactus?" I'm like he's a real, honest-to-goodness Texas oilman, period. That's like the full description.

Cactus Schroeder: Exactly. That fits me to a tee.

Dan Ferris: And who better to talk to about that business than someone who actually does it, right? So the first thing I guess I want to talk about is I'm sitting here in front of my computer, and I'm looking at $78 or so for WTI crude. Folks can make money at $78, can't they?

Cactus Schroeder: No doubt. Yes, it's – they're getting where they're drilling a lot longer laterals, they're – the economics are looking better between the higher oil prices, and people look at the rig counts, and the rig counts are going down, however, what they're not seeing is that instead of drilling one-mile-long laterals like we used to, now we're drilling three-mile laterals. And so those three-mile laterals, that one rig is drilling the equivalent of three wells five years ago. So it's – rig count is a little bit deceptive.

Corey McLaughlin: Yeah, that's definitely something you don't hear from Wall Street people these days when they're talking about what's going on with oil.

Cactus Schroeder: The other thing that's going to be interesting in the future is these horizontal wells are only ever like 5% recovery factor, and so 95% of the oil is unrecoverable with today's technology. You know, five, 10 years from now, we'll be able to go back and hopefully harvest another 5, 10, 15% from these wells.

Dan Ferris: Wow. Did not know it was that low. I knew it wasn't particularly high, but I didn't know it was that low. So that's very interesting. Cactus, what's your history in "gassier" plays? Any?

Cactus Schroeder: Most of what I've been doing has been in the oil plays. I've been looking at Haynesville, Marcellus. I have a good friend that just sold out to Tokyo Gas in Haynesville. He's been there for probably five or six years and was backed by Quantum, which is a local firm around here. They're actually – main offices are in Houston, but they originated in a little town outside of Aberlin called Albany. And anyway, they gave him, I think, $800 million, and he turned it into $2.7 billion. So they just closed that deal a month or two ago. So I keep my eye on it, but it's a little far away for me. That's far east Texas, right along the Louisiana line. Of course, the Marcellus is up in Pennsylvania, but I've been trying to follow that through Porter because he's done such a good job with investigating EQT and everything that they've done. And so those two areas are probably going to be supplying the majority of the United States' gas for a long time.

Dan Ferris: Right. And I find gas really interesting now because it's just been obliterated. It's just – the pricing has just been obliterated, and unless you're in Permian with essentially negative break evens, not a lot of folks are making a huge amount of money with gas right now, which is, for investors, that can be an ideal entry point.

Cactus Schroeder: Exactly. I mean, there's so much more upside in natural gas than there is downside. They've already got it so low at $1.50, that's just – you're barely able to even break even. And so I think that that is probably going to change once we're able to get – once the Marcellus is able to put in an LNG facility and ship to Europe. I think that's going to have a big effect on the prices. And then also they're currently building a pipeline from the Permian through Mexico to the West Coast, and that will have a big effect. The thing that I worry about there is the cartels are essentially going to have to be paid off. I don't know exactly how that's all going to work. In Mexico, you never know, but I do know they've got it – all the money raised for it and they're starting construction on that. So that's going to be very interesting to see how that plays out. That will give Permian gas going to the Orient and it'll get the Marcellus gas going to Europe.

Dan Ferris: Yeah, and just for the listeners' sake, when you say "affects the price," gas is a little bit more expensive in those places, Europe and Asia.

Cactus Schroeder: Oh yes. I think there in the winter, in some of those European winters, it gets up to $25, $30. So you're talking about a multiple that's huge.

Dan Ferris: Yep. And obviously, there's an arbitrage factor, but that will take a little time to kick in.

Cactus Schroeder: Exactly.

Dan Ferris: It's potentially really an interesting development here, and not one that's going to happen in five minutes either, right. It's not like we're waiting for next month.

Cactus Schroeder: That's true. It's getting closer and closer all the time. I have doubts about that pipeline on the West Coast, but just as soon as – if Trump does get elected and allows the pipelines to be built out where we can put an LNG facility in the water and start shipping it out, I don't think that's going to take a terribly long time, but you're going to – it's not going to be next month or next year. It's going to take a couple years to get it done, but I think they've got everything all lined out to get it done, and will also make EQT a vertically integrated major gas company. And so that's going to be very interesting to see how they handle all of that.

Dan Ferris: Yeah. And I find gas also interesting for the reason that I find things like copper, and even to an extent uranium, and frankly oil interesting because you can buy an EQT or a couple other kind of big cap, well-run companies and expect a really awesome return over the next – I don't know, just say few years to several years. In other words, you don't have to take a lot of risk buying a lot of garbagy little companies that you don't know what's going on in them. You can buy the sort of blue-chip natural gas producers and expect to do really well.

Cactus Schroeder: Exactly. I think that's a wonderful strategy.

Dan Ferris: Yeah. And it's exciting because, let's face it, natural gas is not exactly known to be – it's known to be a pretty volatile commodity, right. I mean, we're sitting here talking about how the pricing has been just obliterated, and that happens with gas. It's obliterated and it soars and it's obliterated and it soars. And yet here we are, it's really kind of calmed down and just settled in way under $2 here, and yet EQT is still making money. I just think it's – as an investor, few things are more exciting than this to me because of the – just the risk-reward proposition. What's the risk-reward proposition that you face in your business? When you go directly at it, you get the financing, you drill the holes. What's that like?

Cactus Schroeder: Mine is more wildcatting exploration where I'm trying to find new, smaller traps of oil, whereas theirs is more of a mining operation. They know what they've got. Their biggest hurdles are pipelines and the technology to drill longer laterals and recovery factors and those type of things. So whereas these major oil companies used to be more into exploration, now it's more – I call it mining because they know what's there. They've got to decide how we're going to get it out, how they're going to get it to the end user, what regulatory problems they have, what – and also furthering their technology. I'm not sure about the recovery factors on natural gas. I'm sure they're a little higher than the oil recovery factors, but I haven't seen any official figures out on that. I have to dive into that a little deeper.

But what I try to do in my business is if I can find – it's much smaller scale. I try to find a prospect that would give somebody 10- or 15-to-1 return on their money, however, I've got the risk of dry holes, whereas the majors, it's more of a mining operation, they're going to make a well every time they drill. So mine comes with inherently more risk, but it also comes with more reward as well when you do find those good fields that could give you a 10-to-1 return on your money. Then it's – it makes it more like a business than a crapshoot at a casino.

Dan Ferris: Right. So exploration is an interesting topic, because gain, in those other actual mining industry, like just pick one, copper, what you see is before about 2005 or 2006 or so, the peak of the housing bubble, lots of new discoveries made every year. Then after that date, after about 2006, there are, I think, four years where no new discoveries were made, and now just for regular sort of GDP growth globally, Robert Friedland, one of the big entrepreneurs in the space, says we need eight Escondido mines, eight of the largest copper mine in the world just to keep the economy humming along, the global economy going, and they don't exist. So what's the situation in oil? Are we – is there a dearth of exploration? Are there enough guys like you out there wildcatting?

Cactus Schroeder: I missed a little bit. There was a gap in your audio, but anyway, are there enough guys now? Yes and no. I'm a dying breed. I'm a mom-and-pop-type shop. I'm very small. I've got two or three employees, but I've got a group of people when I get ready to drill a well, I've got my drilling contractors, my loggers, my dirt people, the people with the dozers that build location, all these different people that I contract with to drill my wells.

The one thing that I do see, particularly the Permian Basin, which is the most important basin in the United States, it basically delivers 50% of our oil output in the United States. So all the others – Alaska, Oklahoma, California, Louisiana, they all together provide about 50%. Permian provides 50% of the oil. But what I see there is it's such a consolidation. Really, five companies now control about 80% of the Permian. You know, you've got Chevron and Exxon and Diamondback and Oxy and Conoco. And those five companies control about 80% of it. So there's not really room for any little guy, or very seldom is there room for a little guy. Where I drill is on – they call it the Eastern Shelf, which is the eastern part of the Permian Basin, and it's much shallower. My wells that I drill are anywhere from 3,000 to 6,000 feet deep, whereas when they're out in the basin, they've gone out there and they're basically at four different benches of wolf camp, and those wells are typically anywhere from 7,000 to 10,000 feet deep, and then they'll drill three miles.

So now the new play out there – and I think the reason that these companies are buying up everybody is there's a new play called the Barnett. Well, the Barnett Shale play was the first horizontal play in Fort Worth Basin. It's in the Fort Worth area. And so now these companies are going back deeper, drilling in the Barnett, and having a god bit of success. And so they'll be able to control that, and they also can control the oil prices to a certain extent. Between OPEC and those companies, they're not going to go crazy like an independent does. When oil prices back in '15, '16, '17, they were $30, $40 a barrel. You had companies like Pioneer or the equivalent thereof, and they were – they just kept right on drilling, but they were drilling all the best locations first that could make money at $30 oil. Now there's not a whole lot of production left out there that you can make money at $30. It needs to be $40 or $50.

And so now that they've come back and they've secured all this acreage and they've got all their infrastructure in place – pipelines and refineries, the electrical, the water, all of that is in place, then they can go back and drill that Barnett Shale and probably there are other zones deeper than that that they can go into and tap into the oil reserves there as well.

Dan Ferris: Right. Cactus, are we running out of oil?

Cactus Schroeder: No, we're not. It was kind of interesting at one time when peak oil and you kind of scratched your head a little bit. The oilfields are going to eventually play out to a certain extent. You look at what they're doing in Saudi Arabia. That's the ultimate oilfield. But if you look at what's in the Permian Basin, you have oilfields that are in the wolf camp that cover literal whole entire counties. And so from an aerial aspect, it probably is on the same level as Ghawar and – but this is in the very early stages of exploration, whereas Ghawar was discovered, I think, in the '40s or '50s. At some point, that field is going to become non-commercial, but what I question is that's conventional. What about the shale? They haven't even tapped into the shale. That's – we're not going to be having any peak oil anytime in our lifetimes or our kids or our grandkids most likely.

Dan Ferris: I see. Yeah, that was – as soon as you mentioned Ghawar, I was like, well, it's still conventional, which is amazing considering how long it's been going. So you like oil, you're not that much into gas, but you admit gas has got a lot more upside than downside right now. Is that just too different technically, or like, you're a wildcatter and that's who you are and that's what you do and that's all there is to it? You're just not going after the gassier stuff because it's just not what you do. Is that correct?

Cactus Schroeder: Well, the production on the Eastern Shelf where I am is primarily oil. We have a little bit of associated natural gas, but the gas that I produce is maybe a 10th or a 20th of the income that I get from oil, whereas in the Permian Basin, it's a bigger percentage. Even though it's oilfields, they have a higher GOR, gas-oil ratio. And they have to go places with their gas because they can't produce just the oil without the gas with it. So as you're bringing that up from the ground, you have a conglomeration of water, oil, and natural gas. And then once it gets on the surface, we separate out the water, the gas, and the oil, put the gas in the pipelines, oil in the oil tanks, and the water we inject back into disposal wells.

So that's another thing that's a little shaky out there right now is we've been putting all this water into these different zones, putting water back, and you would think that the pressure would equalize, but it doesn't really work that way, and now it's causing some earthquakes. I was in my very first earthquake in Lubbock, Texas, about a year ago, and I was in the eighth floor of a nice hotel, and I'm with my family, and all of a sudden, our cocktail table starts shaking. And they were like, well what's going on? I said that's an earthquake. But that's the first one I've experienced. And they haven't done any damage, but railroad commission which governs all the oil and gas in Texas, they're looking into it, and there's got to be some other places to dispose of water or another way in which to dispose of water in order to keep these earthquakes from happening.

Dan Ferris: Earthquakes in Texas.

Corey McLaughlin: We had one here not too long ago either, over in Baltimore. Or New Jersey, at least. But Cactus, that kind of brings me to a question I had for you about regulation, legislation. It's always kind of in the news. I mean, what legislation is kind of, I don't know, either making life hard or influencing things too much or significantly in your view? You talk about the natural gas export decision a couple months ago. Just wondering when you think of legislation, what do you think about?

Cactus Schroeder: Well, Texas is a very friendly oil and gas environment, and so when you're building pipelines or wanting to build an LNG facility out on the water in the Gulf Coast, it's a lot easier to get things done, but when you look at what Biden has done, like he shut down the wilderness area in Alaska, so that exploration has been shut down. He shut down pipelines that they were wanting to try to take gas from Pennsylvania out to the water where they could put it in these LNG facilities and ship it all over the world. So he shut down a lot of those areas, but I don't think he can shut down Texas.

But the two biggest gas areas are Marcellus and Haynesville. Haynesville is closer to the Gulf Coast, a lot easier environment. There's probably – I'm going to guess close to 10 different LNG facilities where they're freezing the natural gas and shipping it all over the world. But Marcellus is basically supplying the East Coast and the Northeast with gas for their winters and heating and cooling.

The other regulatory thing that I see them doing is they're trying to shut down gas stoves, and all the chefs across the Northeast are going nuts because all chefs want to cook with gas. It's much easier to control the heat gas-wise than electric-wise. So I mean, my wife loves these cooking shows, and they're all up in an upheaval over that. They're a little bit more on the liberal side, being really creative chefs, but you're going to take away their gas, they're going to be very unhappy.

Dan Ferris: Yeah. That's insane. I feel like that's one of the things that they kind of talk about and talk about and talk about, and then they'll go do something else and say, well, we're not going to take away your gas stoves, but we will do whatever else they want to do. But as we were talking a minute ago, you mentioned Pioneer, and I just happened to be on OilPrice.com, and I see this headline in front of me, Exxon 60 billion Pioneer deal set to create energy supergiant. So you mentioned how, for example, five majors control 80% of the Permian. When you see a deal like this, does it have anything to do with what you do? Do you care about it at all?

Cactus Schroeder: Of course I follow it, but they're in such the big leagues. I mean, if I'm going to go out and drill a well, it's going to cost me less than $1 million. The wells they're drilling are generally $10 million to $12 million wells, and so they require 10 times the capital that I do. And I'm 69 years old, none of my kids want to take over my oil company, so I'm kind of slowing down a little bit. I'm still drilling some, but as much as I like to follow it, I'm too – at my age, I don't really want to go to Wall Street and raise a bunch of money and say, "Hey look, I want to try to buy some properties." Because really, every acre of land out in the Permian is leased. It is all held by production leases, so you're not going to go find a prospect over there and go up to a landowner and say, "Hey, I want to lease your land." That's just – it's all been tied up.

Dan Ferris: And you're not bumping up against these guys in the Eastern Shelf?

Cactus Schroeder: What's interesting is some of the small guys that have been [inaudible] that have kind of sold out and they recapitalized, they're actually coming over here in the Eastern Shelf Permian Basin. We're starting to – we started about, I'm going to say five or six years ago drilling horizontal wells in conventional zones in sandstone reservoirs. And we've had some luck with it, but we're still on a learning curve. We've found some really good wells, and we've drilled some really bad wells, and we don't know why the bad ones are bad and the good ones are good. We've got ideas about it, and we're still working on it, but these things evolve over time and trying different things, different frack jobs, different lateral lakes, different – we're trying all kinds of different things, and we've made a lot of progress, but we're still not where would like to be. In those instances, what I try to do is I try to get in front of these plays and put together blocks of acreage and [inaudible] them to somebody that's capitalized and I don't have to worry about the day-to-day operation. I just take a royalty interest and let them have at it.

And so, for instance, I put together back in 2011 to 2012, I put together blocks of acreage in Eagle Ford. We came in there and we drilled the Eagle Ford and then now there's another zone that they're going back not. I just got some new division orders where they're going back and redrilling an area that I drilled up 10, 15 years ago. So once again, the new technology and new pay zones have enabled us to keep on producing and doing new things out there.

Corey McLaughlin: I'm curious of those majors – of the majors that you mentioned and talk about, and technology, which ones might be the most forward thinking in terms of – or putting the most energy or investment into that?

Cactus Schroeder: If you take a step back and look at them, I think Exxon's one of the best run corporations in the world. I think they're just amazing at what they do and how methodical they are at it. They look out five, 10, 15 years of what they want to do. The ones that I kind of think might be interesting because they're finally changing their tune are Shell and BP that were going all in for this green stuff, and they can see that they're not making a penny on it, so they're changing their business plan to go back after oil, and I think, well, maybe those companies have more upside than an Exxon or a Chevron. I'd have to look at it a little closer before I recommended it. That's just my initial perspective of it.

Corey McLaughlin: Yeah. No, it's something we've talked about here with just the whole green energy push and what influence that is having on everything else. Pick whatever you want to talk about. It's just – it's interesting that conversation, and it does – I don't know, I guess I'm just curious to hear your thoughts on that too.

Cactus Schroeder: Well, there was so much money thrown at green energy, and it's all flopping. And so those people are not going to continue putting money into things that aren't making money. BlackRock was such a big deal with their ESG or whatever their deal is. And they're having to take a step back and say we're not making money, and because they put all those regulations because there's so many different boards, state of Texas has said bye. We're not doing business with you anymore. They sold all their BlackRock stock, and I think Louisiana's getting ready to do that as well, or may have already. And so some of those companies are going to have to change what they're doing or they're going to suffer the consequences.

Dan Ferris: Yeah, it's just another version of go woke and go broke.

Cactus Schroeder: I do like that saying.

Dan Ferris: Yeah, I mean, it's, you know, Anheuser-Busch, Disney, now actually Porter argues that maybe Starbucks is one of these because they started letting homeless people come in and use the bathroom, and he said it turned them from a business into a charity, and now their results are sucking wind. They're doing terribly. So you know, at some point, reality does kick in. Reality kicks in and we all want our standard of living, so we know it's based on oil and gas and it's not based on a whole lot else. Maybe we'll see more nuclear or something. That's growing around the world, although not in the United States so much. But yeah. You know what, though, Cactus? I'm grateful to the climate people because they kind of turned oil and gas into a better bet for me.

Cactus Schroeder: I appreciate it. If I had a glass of wine, I would cheer you there.

Dan Ferris: Yeah. Thank you. Thank you, climate-scam nuts. But day-to-day, you and your friends aren't wringing your hands about these people though, right, as you go about your business.

Cactus Schroeder: Right. We just go about our business, and our business has always been terribly cyclical, and I don't know what's driving Saudi Arabia to – I mean, they've really pulled their production back, and they're really wanting to fight for that $80 to $100 price per barrel. And so I think that's done somewhat artificially, and what's going to change their mind, I don't know. I don't know if they're in with Russia. I know Biden has tried to put pressure on them to – so that the oil prices will go down, and they're not – they're just not caving in. But the next thing I see on the horizon that when Israel goes ahead and invades southern Lebanon or southern Gaza, I don't know – and they essentially annihilate the rest of the loss, what is the rest of the Arab world going to do with that going down. I've seen some predictions of $100 oil, or who knows, but I don't think Biden will have a big effect on what Israel's going to do over there. Middle East things are constant turmoil and constant change, and there's no way to predict what's going to happen next.

Dan Ferris: Right, and Brent crude is already $83 today as we speak, so $100 isn't that far off.

Cactus Schroeder: It's not, but – and as it climbs to that price range, is Saudi going to go ahead and put more of those barrels on the market, or are they going to still defend that particular price point?

Dan Ferris: Right, and OPEC is not just Middle East. It's – there's other countries that probably – I would imagine that you have a harder time – if you're OPEC, you probably have a harder time keeping track of whoever, Venezuela or Nigeria or somebody, right?

Cactus Schroeder: The other thing I worry about is we've had 10 million people come across our border, and the majority of them are not our friends And cherished events are going to become more widespread, and are they going to be more at trying to kill as many American people as they can, or are they going to try to attack our infrastructure, our electrical grid? Texas Monthly wrote a big article on the Houston ship channel about 15 years ago, and I'm going, boy, that was irresponsible journalism because all they did was they painted out a plan for a terrorist to take out all of our energy. If you want some kind of terrorist event in the Houston ship channel, that would be catastrophic for us. So anyway, I don't know what all they've got going on, but you know whatever it is it's not going to be good for any of us.

Dan Ferris: Well, I would imagine that immigration is a more urgent concern for folks who live in, say, I don't know, Abilene than for me. I live in the northwest. We never think about it.

Cactus Schroeder: You're basically not affected, and so – but they're going to be spreading their tentacles all across the land, and who would have thought there would be an immigrant problem in Chicago and New York and Philadelphia and D.C. and Boston? I mean, a lot of people really look down on our governor because he's shipped all these immigrants to places across the United States so they could get a taste of what we're having. We're not even shipping 3 or 4% of what's coming across the border out across the United States, but we've got a lot of mayors squealing.

Dan Ferris: So returning to the topic of oil and gas, you mentioned that you're 69 and your kids don't want to take over the business, but you're still doing it. You can't stop yourself. You're 69, man, and you've made a – you're a resounding success. Shouldn't you be on a beach somewhere?

Cactus Schroeder: Well, actually, I just got back from Florida, so that wasn't too bad. But it's in my blood. I enjoy doing it. I will continue to do it, not at the pace that I used to do it, but the good thing about what I do is I can do it at my own pace. I'm not – I don't have to meet a budget every month. I don't have to find another barrel of oil to keep my doors open. I've got to – I love the risk-reward and the – whenever you find a nice well or oilfield, you're going, oh yeah, this is great. and then it's kind of an adrenaline rush. So that's part of it that I do like. I guess the part that I don't like is the regulatory, and now so many landowners are very onerous because, through the years, people in Texas that have big ranches and own land everywhere, they still sell the land, but they'll keep the mineral rights. Well, the guy that owns – that's bought the surface doesn't want anybody to come on his land. Well, in Texas, the dominant state is the mineral state, so if I have leased minerals under a piece of land, that landowner cannot keep me out. And so that has created problems, and I understand their problem, but they have to understand my problem as well in that I've purchased these rights, and I've got to – if we're going to make any money, I've got to go drill these wells. And so it's created a good bit of tension. Not very often, but occasionally it'll end up at the courthouse, and they always lose because it's all cut and dried as far as the state law of Texas.

But different states are different ways. I think in Colorado at one time, they were wanting to pass legislation where if you were drilling a well, you had to be like 2,000 feet away from any structure on that land. Well, what's a structure? A barn, house? And that didn't pass, but it came real close to passing. And I can understand that to a certain extent from some people. I mean, when the shoe's on the other foot, you get a different perspective, and so I don't try to run over anybody. I just try to explain the things and these folks, and anybody that buys a big tract of land, let's say they buy a 1,000-acre ranch, they pay millions of dollars for that ranch. They should be savvy enough to know to consult with an attorney if they don't know about and also real estate agents, what the laws are and if they've got any mineral rights. Now they're not only trading mineral rights... they're trading wind turbine rights, solar rights, so you can retain those if you sell a tract of land. Or you can retain a certain percentage of them. So it's – Texas law is being rewritten as far as wind turbines and solar panels going as well.

Dan Ferris: Right. So after the Marcellus just kind of blew up and became a big play, I remember all the articles about people. I'm pretty sure it was Marcellus because I want to say that I just remember the folks in the east, they just kind of didn't get it. They thought, well hey, I'm rich. I've got oil on my land, and now I can finally – now they're learning how to drill it, and I can sell it, and I can get rich. And they didn't know that that meant an army of trucks and giant equipment on their property just basically ruining it. I mean, we had a pool put in in our little back yard, and they ruined the entire yard. So I remember articles about this, and that's kind of what it reminds me of. I understand the landowners, but you know, especially in Texas, you'd think they'd get it, right.

Cactus Schroeder: The good thing about the horizontal wells is they're drilling three miles underneath the ground, so the physical portion of land that they're on is not too obtrusive, whereas when I'm drilling vertical wells, I make a well, I'm putting a pumping unit on it, and it's a little bit – I'm more in the way than these others. And usually those big trucks and big equipment and drilling rigs, they're only there for a month or two, and then they're gone. So it's not too terribly bad, but if you're not used to it, it can be a problem, and people have to understand what's going to be involved. Like I've got a friend of mine that has a ranch. In fact, I was there at dinner last night, and he has all these wind turbines. And he gets paid, I think, $80,000 or $100,000 a year for his wind turbines. And so – but I find them just God awful. I would not do that at all, however, if I had a pumping unit in my yard, or even if I had some solar panels somewhere, to me, it's not as ugly as those giant wind turbines. However, everybody's different. It doesn't bother him. He's perfectly happy to put that money in his pocket and put up with the wind turbines. So everybody looks at it a little differently.

Dan Ferris: Yeah, it's a tradeoff. It's definitely a tradeoff. You've got to make a decision. All right, I think we are at about the time when we need to ask our final question, which is the same question for every guest, no matter what the topic, even if it's a non-financial topic, exact same question. And if you've already stated what you would like your answer to be, by all means, feel free to repeat it. That's fine. And the question is real simple. If you could leave our listeners with a single thought today, what would it be?

Cactus Schroeder: I think [inaudible] is one of the most important industries, the energy industry, whether it's oil, gas, wind, electrical, or whatever. You use it every day of your life, and you need to understand a little bit more about it. And I think not only is it a good investment, particularly at this time, but it's also a hedge against if oil prices go to $200 a barrel, or if natural gas prices go to $10. If you own some of this stock, it's a hedge against what's going to happen to you as these prices fluctuate. And that's – I'm proud of the business that I'm in. I've always done as much as I could environmentally to make the surface appealing and not damage it, and so I have no problem with it, although some people think that if you're buying into oil and gas, you're killing the environment, and that's just not the case.

Dan Ferris: So taking care of the environment is an energy-intensive task.

Cactus Schroeder: True.

Dan Ferris: All right, Cactus, it's always a pleasure to talk with you. Thanks for taking time out and coming to talk with us today.

Cactus Schroeder: No problem, Dan. Great to see you. Corey, take care. Hope to see you guys soon.

Corey McLaughlin: Thank you.

Dan Ferris: Yeah, we'll see you soon.

Announcer: Opinions expressed on this program are solely those of the contributor and do not necessarily reflect the opinions of Stansberry Research, its parent company, or affiliates.

Get the Investor Hour podcast delivered to your inbox

Subscribe for FREE. Get the Stansberry Investor Hour podcast delivered straight to your inbox.