How to Identify the Best Mining and Exploration Companies

In This Episode

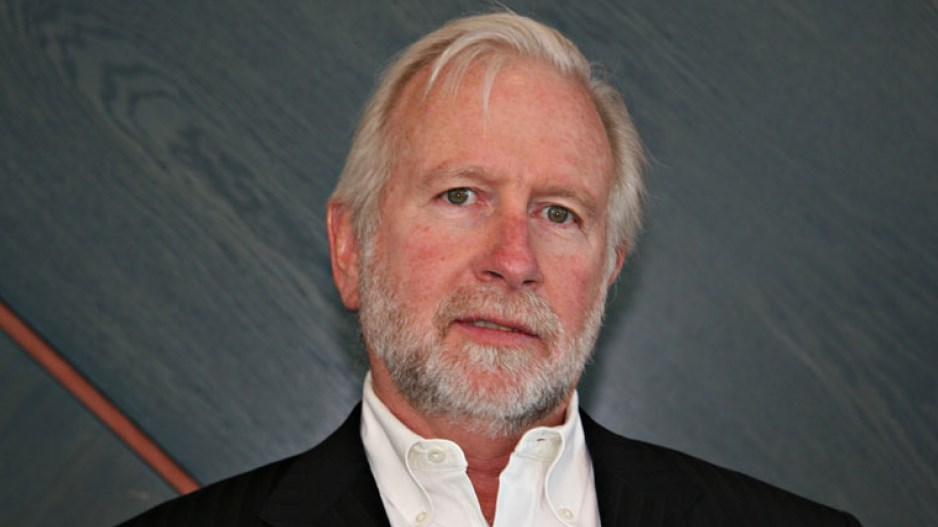

On this week's Stansberry Investor Hour, Dan and Corey welcome Brent Cook back to the show. Brent is an economic geologist, as well as the founder and senior adviser of newsletter company Exploration Insights. With more than 30 years of experience in property economics and geology evaluations – spanning 60-plus countries – Brent has seen it all. He is one of the most credible, successful, and knowledgeable mining-stock investors in the world. If you invest in mining stocks, this episode is an absolute must-listen experience.

Brent kicks off the show by discussing what's happening at Yellowstone and what he learned from attending Rick Rule's mining conference. Brent warns investors to beware of mining and exploration companies that are picking up old, "dead" projects and redrilling holes, purely to bump up their share price and raise capital. After, Brent details a bit about his career history and how he ended up in geology. Speaking about why it's so difficult finding good companies in the industry, he notes...

Probably over half the companies listed – junior exploration companies listed – are working on projects that don't really stand a chance of providing a significant increase in the share price. And that's usually because... there are so few high-quality projects or deposits out there to be found.

Next, Brent discusses what investors should look for when trying to find a mining company worth buying. This includes the narrative of the broader economy, the risk profile, and knowing what kinds of results you want to see from the company in terms of drill results. As he explains, folks should seek high-margin companies with good management teams and with deposits in friendly jurisdictions. He lists off several regions and countries that he believes look promising today, plus some complications he has faced in the past...

In Colombia, I remember going to a project that on paper sounded good, but the deposit went under a beautiful white church. So that's not going to happen. It gets down to specifics of the location, but certainly the jurisdiction. Are you in the right country? Are you in the right province or state within that country where the politics are such that you can build a mine?

Finally, Brent names a copper-mining company that he's interested in today. It has water rights, no environmental liabilities, and a project that looks auspicious. He also shares a gold-mining company he likes that's developing a very high-grade deposit in Australia. Brent then explains the difference between mining and extracting gold and copper, and he makes a bullish case for the red metal...

We definitely do not have enough [copper] deposits on the horizon to come into production to fill what I think we're going to need. In general, it takes 10 to 20 years, from discovery to production.

Featured Guests

Brent Cook

Founder of Exploration Insights

Brent Cook founded Exploration Insights in 2008 and has since transitioned into the role of senior adviser. As a seasoned geologist, Brent's knowledge spans all areas of the mining business, from the conceptual stage to detailed technical and financial modeling related to mine development and production.

Transcript

Dan Ferris: Hello, and welcome to the Stansberry Investor Hour. I am Dan Ferris. I'm the editor of Extreme Value and The Ferris Report, both published by Stansberry Research.

Corey McLaughlin: And I'm Corey McLaughlin, editor of the Stansberry Daily Digest. Today, we interview economic geologist, Brent Cook.

Dan Ferris: Brent is also the co-editor and founder of Exploration Insight, an exploration mining-focused newsletter. He's also, I found out, a great beach volleyball player. Let's talk with him right now to find out more about exploration mining and beach volleyball and whatever else is on his mind. Let's talk with Brent Cook.

Let's do it right now. All right, Brent. Welcome back to the show. It's good to see you again, as always.

Brent Cook: Hey. Thank you. Good to be back.

Dan Ferris: So, we ran into each other at Rick Rule's event, and that's sort of why we're here, but before we talk about that event, or what you might've learned, or what you're doing now, we need to cover the matter of the – let's see. I don't even know if I can pronounce this correctly – the phreatic? Was it a phreatic eruption that you –

Brent Cook: Oh, right.

Dan Ferris: – wrote about on July 23 in the Yellowstone National Park, at the Biscuit Basin? Quite an eruption. People are running to get out of the way of it, but you made a point. This is important to me because when Yellowstone finally blows, I'm toast.

It's right down the road, so when that super-cone, or caldera, or whatever they call it, blows, there will be no more Dan, but you said, well, most likely phreatic with no magma. If there's magma involved, look out. So, what are we talking about here? I need to –

Brent Cook: OK. OK, so there's what's called a hotspot that has been moving across from Oregon, across Idaho, the Snake River Plain and all that, and as the continent moves, the hotspot stays the same, and you keep getting volcanoes along that. Yellowstone is the most recent. It's about 700,000 years ago.

That thing blew big, blew big, and it would've wiped out all the way over to North Dakota, South Dakota, Wyoming. That would've been destroyed. I think you're actually lucky, because you're upwind. You might be all right, but what I'm talking about with the phreatic eruption is as these hot springs move water though, they slowly close the vein or fracture with silica, and once that gets tight enough, the pressure below builds, and they erupt. That's the phreatic eruption, and that's OK, but if there's magma actually injecting in there, that probably means you're going to have – you've got trouble.

Dan Ferris: Yeah.

Brent Cook: So, you're good.

Dan Ferris: OK, upwind. Good to know. You see this? This is why we need scientific people on the show.

Corey McLaughlin: It's the downwind people that need to be concerned, Dan. Yeah.

Dan Ferris: Yeah, that's right.

Brent Cook: You don't want to be North Dakota or South Dakota.

Dan Ferris: All right. So, all our Dakotas –

Brent Cook: You know many of them, actually.

Dan Ferris: Yeah, that's right. The Dakota-based listeners will take note. Well, I'm glad we straightened that out. So, besides that, before we get to serious business, I noticed on your Twitter profile – I never noticed this before – it's a beach volleyball. Are you like, a competitive beach volleyball player?

Brent Cook: I play it at least two or three times a week. I'm past my spiking and blocking stage, but it's a great game on the beach.

Dan Ferris: Yeah.

Brent Cook: Perfect. It gets hot. You jump in the water. You can drink a beer and you play with friends. It's a good sport.

Dan Ferris: Sounds like a California thing.

Brent Cook: I actually play it in Utah just as much.

Dan Ferris: Oh, OK. All right. Good to know. All right, so, not going to die in a fireball, play a lot of beach volleyball. Got it. So, let's talk about what did you get out of Rick Rule's event this year, because a guy like you is going to get a lot more out of it than a guy like me.

I'm not a geologist. I'm not a scientist. I wander up and down the aisles, talk to people a little bit, but the geology, I know some basics, and I rely on those basics and people like you to sort of fill in the cracks. Did you come away from that with any, like, really big takeaways this year?

Brent Cook: I wouldn't say big takeaways, but it was a really good show because it was a very select group of exploration and some mining companies. And so just sitting there and meeting with them all, talking with them at their booths or at the bar, you pick up a lot of stuff that you don't get otherwise, rumors, and who's doing what, and what they're thinking, progress on different companies' programs, that sort of thing. So, I got a lot out of that. The macroeconomic stuff, that's always interesting to me.

I don't really delve into that a lot, but that's always interesting as well, to see it through the presentations by some very smart people who follow that, including yourself. So, that's good to do as well. In terms of picking new companies, there's things I own, and it was good to catch up, and there's a few I put more time into, investigated, but I don't think there's one company new that I actually bought.

Dan Ferris: So, what you're telling me speaks to one of the great lessons of investing or speculating in exploration mining, which is if you don't know the people pretty well, and like, have real contact with the people, you don't know anything, and you probably have no business putting money to work, correct?

Brent Cook: Yeah. I think that's certainly how, especially in the early-stage stuff where it's all about the next set of results, drill holes or whatever, once you get into a large mining company, you can look at the financials and their mining costs and that sort of thing.

Dan Ferris: Yeah.

Brent Cook: But early stuff, it really helps to kind of know the people and know the project and know the expectations.

Dan Ferris: Yeah, and frankly, Brent, to like – you just – I hate to put it this way, but it's true. If I'm being too harsh, let me know. Like, you've got to go to Vancouver and meet everybody and figure out who the crooks are. You just do, right?

I mean, come on. You're a nice guy, so if you don't want to pile onto that, I'm not going to. I don't want to make you uncomfortable, but that's just my take on it. Maybe you can state that in a more judicious manner, but that's what it looks like to me.

Brent Cook: I'll try. There are certainly, probably over half of the companies listed, junior might be in exploration companies listed are working on projects that don't really stand a chance of providing a significant increase in the share price. And that's usually because there's – well, it is because there are so few high quality projects or deposits out there to be found, but you don't really know if you've got one or not until you do the work, or as I say, the other half of the companies up there are picking up old, tired projects that have been drilled before and sort of redrilling the best drill hole in the hopes of bumping up their stock and raising money and that sort of thing. That's really what you've got to watch for, is the old, dead projects that are being recirculated.

Dan Ferris: Yeah, like I say, it's sort of like there's people who really are the real, genuine article with – and some of them have great, multidecade track records of creating value in exploration, and then there are geologists looking for paychecks, and you do have to figure out – and promoters and various types of people.

Brent Cook: Yep.

Dan Ferris: And you have to figure out which ones are which.

Brent Cook: Yep, it's –

Dan Ferris: Is it impossible to do if you're not a geologist?

Brent Cook: No, not really. I think what you really need, if you're not in the industry or that sort of thing, is there are people out there you can rely on. The brokers at Sprott in Carlsbad, they're all solid people. The analysts at Sprott – and I'm not pushing Sprott. I'm just saying I know them well.

Dan Ferris: Yep, me too.

Brent Cook: And there are other analysts out there, newsletter writers. There are some good ones out there that actually know what they're doing, and as the gold price increases, you see a bunch of guys you've never heard of that were previously pushing crypto or lithium, and now they're pushing gold and copper, and then they know as much about that as they did about crypto, so don't listen to them.

Dan Ferris: Right. Yeah, that happens with the companies too, doesn't it? In a real gold mania, a gold company will all of a sudden be a crypto and vice versa, right? We saw that with –

Brent Cook: Yep. Yeah, you've seen that over and over and over.

Dan Ferris: Yeah. It's kind of a dead giveaway there –

Brent Cook: Yeah.

Dan Ferris: – when one of the crypto companies becomes a gold company.

Brent Cook: Yep.

Dan Ferris: OK. And another thing I wanted to ask you about was, I don't know much about your early career, and I note that when we look at your Twitter profile, and just – I've known you for a long time. You're an economic geologist. You're focused, as it says on your ExplorationInsights.com website, like, turning rocks into money. You're specifically like, it's this combination of investor and geologist, and that's how you spent many years. What did you do before that? Did you start out that way, like fresh out of school, or what did you do?

Brent Cook: I came out of Utah State University and went straight into uranium exploration, then jumped across, ended up in the Pacific Northwest, then Australia, New Zealand, Papua New Guinea, Indonesia. Worked over there, then came across work in the Caribbean and Brazil and the western U.S., and I'll tell you a quick story. I was down in Brazil, working on a s*** project with a corrupt bunch of people, and I was out there. It was a lousy project.

It was a bunch of garden piers, which are the local miners. They were all drunks. There were some really – let's call them old hookers – out at this camp, and then I'm standing there in the rain. It's horrible, and these guys fly in, in their helicopter, with their investors, take them around, show them how great everything is, and piss off to Manaus and have a great night there, and I'm still standing there.

So, I went to the Prospectors & Developers in Toronto that year, first time I'd been, and bumped into a good friend, Borden Putnam, who was then running a fund out of San Francisco, and cruised around with him and realized – that's when I thought, "Oh, this," saw the money side of it. He introduced me to Rick Rule in '97, and that's where I learned the money side of things, is working as his analyst for three or four years, then I went independent again, but that's what got me into the turning rocks into money. So, I learned the geology, and then I learned the money, and now, hopefully, I'm good at both.

Dan Ferris: Right.

Corey McLaughlin: What did you have to learn, the first couple of things you had to learn when you joined with Rick, learning about the money end of it to – I think some listeners would be interested.

Dan Ferris: I would, too.

Brent Cook: All right, so what he did, he – you know Rick, he's cheap as hell.

Dan Ferris: Yep.

Brent Cook: What he said was, "I'm not gonna pay you much. We're only gonna give you $200,000 to invest how you want with interest and something above LIBOR, I think it was, and that was mine to do what I want with. If I lost it all, it was his loss as well, so the first year and a half, I was down $90,000 on that investment, and that's where I learned the money side of things, is it's not just about the geology. It's about the people, the timing, the share structure. All that stuff plays into it, the jurisdictions, so that was a really good lesson. I ended up working back to my $200,000-plus, and did well ever since, but that was the start, losing $90,000 [snaps fingers] like that.

Dan Ferris: Yeah. Everybody pays their tuition, don't they, especially in exploration mining.

Brent Cook: Yes.

Dan Ferris: Everybody pays their tuition, Brent. Nobody gets away with that without doing that.

Brent Cook: Yep.

Dan Ferris: I've mostly paid tuition in exploration mining. I've mostly not made money. That's cool. I met Rick a year or so later, so yeah.

Brent Cook: Yeah.

Dan Ferris: And he was the first person I met outside of just the regular newsletter crowd. He was the first real investor that I met, and at the time, he was – we were talking about water companies, which he's one of the few people that even cares about companies that own water rights, and we went – I went out there and visited utilities and water rightsholders, and it was interesting. It was a great education.

Brent Cook: Yeah.

Dan Ferris: He's been something of a mentor to me at times over the years. Like, he's my guy. He's my guy that I go to if I start getting interested in some little mining stock or other, and years ago, I was much more interested in them. He's very generous with his time, and I just sit down and say, "Can I trust this guy?"

"Nope." "Can I trust this guy?" "Yeah, he's a good guy." "Can I trust this guy?" "Nope. Nope. No." There's a lot of no's on that list. So, he's been really great.

Brent Cook: Yeah. Yep, agree.

Dan Ferris: So, you left there and just went out on your own. Is that when you started doing Exploration Insights, when you left Rick?

Brent Cook: Actually, I got hired away by a fund out of Texas. That lasted two weeks.

Dan Ferris: Two weeks?

Brent Cook: Yeah. I'm glad it ended, but most of the stuff he had was crap, and I told him it was crap, and he didn't take to that, so that was over. And then I consulted to a number of mining firms and started writing something I called The (Sometimes on Friday) Sheet, which was free. I'd just write my notes. Have a few drinks Friday night and write something up.

Dan Ferris: That's great.

Brent Cook: And that rolled into the newsletter that I bought from Paul van Eeden, who I'd worked with a bunch, and that was Exploration Insights.

Dan Ferris: Great guy. Yeah, great guy.

Brent Cook: Yeah, very, very smart guy. He bailed at the right time, in 2008.

Dan Ferris: Yeah.

Brent Cook: Another lesson, and yeah, and then I got that going, did it for eight or nine years, and met some fellow named Joe Mazumdar, who was one of the most – worked for the brokerage firms in Canada, but he was the most honest, smartest analyst I'd come across, and slowly convinced him that the newsletter business was not all scams. And so, he took it over, and he's been writing Exploration Insights since, and I'm kind of on there as a – I guess you'd call it senior advisor. We worked together a lot, but it's his letter now, and it's – in my view, it is the best newsletter or anything coming out of any analyst that I've seen.

Dan Ferris: Yeah. I can't argue with that. I'm not here to sell your newsletter, but you're here because we're really careful, or, I'm really careful about who I talk to in the mining world, like, in a public forum like this, and it really is the real deal. It's one of the places you go.

Like, with John Doody, you go there to find out if a major mining company is really making money and really has – is really a decent deal. And you go to you guys to find out if an exploration stock is even worth thinking about, let alone putting actual money into. So, yeah. Makes sense to me, and Joe's a geo, or no?

Brent Cook: Yeah, he's a geologist, but he's got a master's in mineral economics, and he got his degree in Canada somewhere, then he went to Australia, got another one, then he went to the School of Mining and got the economics degree. He's worked for major mining companies and brokerage firms, and now he's on his own.

Dan Ferris: All right, so, honest Canadian broker/geologist, all in one place, like how often does that happen? I got nothing against Canadians. I love them. Some of my very best friends are Canadian.

Corey McLaughlin: Yeah, I love Canadians. Yeah.

Dan Ferris: That's right.

Corey McLaughlin: Yeah.

Dan Ferris: But well, I know the Altius guys and the Sprott people. I have nothing against Canada whatsoever. I love Canada, in fact. I've been there many times. I think I've been to almost – well, not every province, no. I think I'm two provinces shy of the total, but love Canada, love the people in... Let's not misrepresent my viewpoint, but like I said, you go to Vancouver, and it's – let's just say it's a rough crowd, and even –

Brent Cook: A lot of characters, a lot of interesting characters in this industry. That, to me, makes it really fun.

Dan Ferris: Yeah, a lot of characters is a good way, is a nice way to put that. So, Brent, let's provide our listeners with a little service here. Let's give them some bullet points. Let's give them Brent Cook's bullet points.

If you're going to get into these stocks by all means – read stuff by people like you, but you've got to... You have to have a framework of your own. Where should they start? What are the two, three, five, however many bullet points that folks should sort of concentrate on and focus their energy on if they're going to look at exploration mining stocks?

Brent Cook: Yeah, I think one is, what's your narrative? What do you think is going to be happening in the big picture in terms of the global economy and that sort of thing, and how that plays on copper and gold and silver. If your narrative is that it's going to be positive, then you're in the right space. Then I think you need to think about your risk profile. How much money do you want to put at risk? You know you can buy BHP or Newmont and lower your risk, or you can take – head to the gambling tables and buy some $24 million market cap junior explorer –

Dan Ferris: Right.

Brent Cook: – where your chances of a 10x are much, much better. So, that's kind of the big picture, I think, and then it comes down to finding a company or a number of companies. In theory, we have 20 companies, max, in the portfolio. I think that's all you can follow on a full-time basis.

I think if, as an individual, lower that to 10. Most people, I'm afraid – because we tell investors tend to hear, like me or somebody on the stage, recommend some stock and buy it, and then they forget why they buy it. They don't know how to follow the news, and 80% of the time, eventually, these companies go broke because it's... Your odds of discovery are very low, so once you pick a company, follow it in detail.

Know what your expectations are. Know what success looks like in terms of drill results, and make sure what you're looking for, what they're looking for, if they're successful, matters. I think too many companies are out there, looking for something that, even if they're successful, the share dilution, raising money, even the market cap may increase, the share price doesn't. So, you need to find – latch on to something that's going to be important enough for a major mining company to buy it.

And I'll give you a good example, one that just happened this week, is Filo Mining, a great group of people. London Mining – Lundin Mining, they started off in the high 80s, put together a concept. The stock was like $1.50 or something getting out of the gate. It was just bought by BHP for $34, more or less.

So, that's the sort of thing, but as it progressed, they had a concept. The drilling, the surface work seemed to look good. The geophysics I did looked good. The drilling hit some amazing drill holes, and that just continually got better. I mean, that's a good example.

Dan Ferris: So, where did the stock – they were bought out at $34? Where did it move from? Like, was it a penny stock at one point?

Brent Cook: My recollection, I haven't looked, but I think it started life at about a $1 or $1.50.

Dan Ferris: OK.

Brent Cook: Canadian.

Dan Ferris: Nice move.

Brent Cook: A very nice move.

Dan Ferris: Yeah.

Brent Cook: It was a very nice move. That makes up for a lot of mistakes.

Dan Ferris: Yeah. Yeah, that's right. You only need one of those to make up for a bunch of mistakes, which is another nice thing. I remember Rick telling me he had 100 and some odd stocks in one of his partnerships that he did, and it was like – he said, "Six of them made all the returns," and it was like, a 50% kegger for 10 years or something insane. It's interesting. It's an interesting strategy, just to hold a little bit as a kind of almost like, an option on huge success.

Brent Cook: Yeah, and I think I've made good money on stocks that eventually failed, again, because as the news comes in, all right, it's looking all right, right? And then, hang on, there's a fatal flaw, be it metallurgy or whatever. If you can catch that, you can still make good money before the rest of the market doesn't.

Dan Ferris: Yeah.

Brent Cook: You can get two, three, four-baggers that way when the stock goes back down to – below what you bought it for.

Dan Ferris: Yeah, you're reminding me –

Brent Cook: You just have to watch.

Dan Ferris: You're reminding me of Doug Casey. Like, he said, "I made all my money on a fraud, a flake-out, and a psychotic break," and there were three stocks, and the CEO had a psychotic break and he sold, and he made tons of money on that, and then, I think he owned Bre-X before it collapsed. That was the fraud, and then there – I forget what the – the flake was some stock that he owned in some Australian brokerage they forgot about for five years or something, and the guy called them up, and said, "What do you want me to do with this?" And he had made millions of dollars and forgot about it.

Yeah. Good stuff. So, all right. So, what do we got? What did we say here? Was that one or two bullet points? We wanted something that a big –

Brent Cook: There's a lot.

Dan Ferris: Yeah, that was. We wanted something that a big mining company would be very interested in, so you want – in other words, and this is something that some various folks, including Rick, have taught. No small mines. No small deposits. That's not a good idea, is it?

Brent Cook: Right.

Dan Ferris: Because the economics just don't work.

Brent Cook: Nope.

Dan Ferris: OK, so you want big deposits, and you want good grades and good metallurgy, and all the rest of it, but big. Big is an important one, and an easy one to determine.

Brent Cook: Yeah, I would say high margin as well.

Dan Ferris: So, high margin exploration mining companies don't have revenues. What do you mean, "high margin?"

Brent Cook: Well, the deposit they're looking for, they're drilling out, has a high margin. I can show you deposits in Nevada that average 0.4 grams of gold per ton that make – have really good margins, and I can show you one in Nevada that was 10 grams per ton that lost money and went broke. So, it's not just grade. It's how much you make off what you're mining.

Dan Ferris: OK.

Brent Cook: So, that's – it's a variety of deposits and stuff, so –

Dan Ferris: All right.

Brent Cook: – grade is important, but it's not everything.

Dan Ferris: All right. Now, OK. That is super interesting, 0.4 versus 10. What's the difference? How do you assess the potential for margin in the mining operation?

Brent Cook: OK, so the 0.4 is a large, at-surface, open pit deposit, gold deposit, that has been weathered over a few million years. And so, the gold that used to be tied up in pyrite in the molecular structure of the pyrite grain, it has turned to rust, and when it turned to rust, oxidized. The gold is released, so it's free. All they have to do is drop cyanide on that, and the gold comes out.

It's a really cheap operation to do that, whereas the 10 gram-per-ton deposit was in a vein that was maybe half a meter wide. So, your mining cost underground, the mining width was at least a meter, so your ten-gram resource was diluted by half, so it drops to five grams. And then it was really bad rock, so a bunch of stuff would fall in, and they kept having troubles with that. And so, the 10 grams per ton on the resource report ended up being something like three in the end, and they lost money.

Dan Ferris: OK, so a good little tangent here is that there's a big difference between owning a deposit that looks great, and making money in mining, and mining is a business. Like, every investor, every knowledgeable person I know says, "Just stick to the royalties and the prospect generation, these little amounts of capital that produce good results, and stay away from the mining business because it's a fricking nightmare." The water and [inaudible] and all the rest of it.

Brent Cook: Yeah, that's not my advice, but OK. Gamble a bit. Have some fun.

Dan Ferris: Right. OK. Yeah, if you're not having fun, man, by all means, do something else. All right, so I'm looking for bullet points here, Brent. I'm going to keep badgering you here.

Brent Cook: OK.

Dan Ferris: We got the difference between a deposit that can really be mined well, and a large enough one to attract a major. Does anything else come to mind? We've determined that that's one of them, right, good people.

Brent Cook: Yeah, good people, jurisdiction.

Dan Ferris: Jurisdiction.

Brent Cook: And by that, I don't just mean a country. I mean, specifically where you're at in that country. For instance take the U.S.

Dan Ferris: Did you take the geology you're talking about, like the productiveness of the terrain?

Brent Cook: No. No, actually, the politics and government and that sort of thing.

Dan Ferris: Yeah.

Corey Laughlin: Yeah.

Brent Cook: Yeah, the jurisdiction.

Dan Ferris: OK.

Brent Cook: For instance, take the U.S. Nevada, good. California, not so good.

Dan Ferris: Yeah.

Brent Cook: Utah, good. Oregon, not so good, right?

Dan Ferris: Yeah.

Brent Cook: Same thing in Argentina, until recently at least. San Juan Province was good. Mendoza was bad.

Dan Ferris: Gotcha.

Brent Cook: And even in Colombia, I remember going to a project that on paper sounded good, but the deposit went under a beautiful, white church.

Dan Ferris: Oh.

Brent Cook: So, that's not going to happen.

Dan Ferris: No.

Brent Cook: It gets down to the specifics of the location, but certainly the jurisdiction. Are you in the right country and you're in the right province or state within that country where the politics are such that you can build a mine?

Dan Ferris: All right.

Brent Cook: That's important, so jurisdiction and location within that country.

Dan Ferris: Yeah, that's a –

Corey McLaughlin: That was one of the questions I had for you, was like, are there any jurisdictions and/or just, geography locations that, either in the United States or globally that are under the radar at this point?

Brent Cook: I think Scandinavia is still under the radar. Great infrastructure. Your laws are good. They allow mining, and it's permittable. I think Scandinavia is good.

I think Argentina has recently improved with the new government. I think Bolivia is actually getting better than it used to be. On the other hand, Mexico's gone down the list in terms of where I'd want to be now, unless you've got a real high grade, underground vein deposit. Australia's generally good. Yeah, those are the places –

Dan Ferris: What about Morocco?

Brent Cook: Morocco, it appears to be pretty good. There's a couple of companies over there now that are doing quite well.

Dan Ferris: Yeah. Yep. Yeah. I did a little talk with Benoit from Aya Gold & Silver at the event there in Florida, and I kept coming back. I was like, "Really? Morocco?" I almost didn't believe it –

Brent Cook: Yeah.

Dan Ferris: – because I thought, "Well, why haven't we heard about this before?" And it really stumped me because he doesn't have a lot of competition over there right now, and I thought, "Well, if it's that great, why isn't everyone?"

In the good jurisdictions, what do you always hear? "Well, we got this great deposit, and Newmont's right next door," or, "BHP's right next door," or something like that. Nobody's next door in Morocco, and I just couldn't believe it, right? And he said, "Dan, people are talking about being next door to us." So, that's –

Brent Cook: That's right.

Dan Ferris: Yeah.

Brent Cook: It takes time to get into that, to work that culture, because it's not a western culture.

Dan Ferris: Yes.

Brent Cook: So, you need the right people in the right place. The other company there is Royal Road, turning up some really interesting stuff as well. They're in Saudi Arabia, another country that is on the uptick.

Dan Ferris: Right, and apparently – I don't want to harp on Aya, but apparently the deposit there is pretty, pretty spectacular, according to them, which –

Brent Cook: It's a good deposit.

Dan Ferris: Yeah.

Brent Cook: Very good deposit.

Dan Ferris: So, who knew? If you tell me about greenstone belt, or like, Labrador Trough, or some of these places I've been to in Canada, I just – every geologist is saying, "Oh, yeah, yeah. They're huge. Highly – lots of resource there."

But nobody's ever said, "Dan, you've got to get over to the Anti-Atlas side in Morocco. It's the place to be if you're looking for silver or gold." It's nice to learn that stuff –

Brent Cook: Yeah.

Dan Ferris: – and that's the kind of stuff you learn by just banging around the conferences and going to places like Vancouver and meeting lots of people like you and Rick and everybody, that there's no substitute for it. There's no substitute. So, Brent, I'm going to hit you up here. If the answer is you'd rather not, hey, it's totally cool, but is there a current name that you really like, a company that you'll kind of talk about? You don't have to pound the table, and our subscribers, they're – or our listeners to the podcast, they're adults. They know that if they put money into something, it's on them, not you. So, you got a name for me?

Brent Cook: Yeah. I think copper's a good place to be –

Dan Ferris: Yeah.

Brent Cook: – longer term.

Dan Ferris: Yep.

Brent Cook: You know, the shortages coming, all that sort of thing, in the electrification of the world. I like a company called Arizona Sonoran Copper, Vancouver-listed. They've got a deposit in Arizona on private land, so you don't have to deal with the federal government for the most part. It's an old deposit that's being – they've expanded it, so the environmental liabilities are virtually nil.

They've secured the water rights. The town next to them is keen to get that thing built, and they are up-dip of Robert Friedland's Ivanhoe Electric's Santa Cruz Deposit. That company's got a billion-dollar U.S. valuation. Arizona Sonoran is about $100 million, so I think there's room there for improvement, if you will.

Dan Ferris: OK. Brent? Brent, tell our listeners what up-dip means.

Brent Cook: Oh, sorry. So, the Santa Cruz deposit is pretty deep and sits like this, and then their deposit sits up higher at surface.

Dan Ferris: I see.

Brent Cook: So, logically, Ivanhoe Electric should take that out as well.

Dan Ferris: Right.

Brent Cook: That's logically. We'll see what happens, but that would make for a much more efficient operation, and they could start at surface as well. Another one I like is Mawson Gold, Canadian-listed. They've got a deposit in – or are developing a deposit in Victoria, South Australia that is very high grade.

It shows good continuity, and it's like a deposit next door that – who owns that now – Agnico owns – that was bought for a big bunch of money. That's where Eric Sprott made a ton of money, whereas he owned Fosterville, which was bought and bought again. So, that's a really interesting deposit as well. I think it's going to develop into a nice, high-grade system.

Dan Ferris: It sounds –

Brent Cook: Those are the two I can –

Dan Ferris: OK, so this speaks to a point that we made before, you know? It's about people with nice deposits saying, you know, "Ivanhoe's right next door," or, "Agnico's right next door," something like that.

It sounds like an enterprising investor could run around just looking for that. Like, they don't have to look for somebody who's out, alone, away from anybody else. They can just go around, look at the big deposits, and see who's in the neighborhood, see who, you know. Is that a reasonable idea for an enterprising individual investor?

Brent Cook: Not necessarily. I can show you.

Dan Ferris: Yeah.

Brent Cook: We just talked about that deposit in Australia, a nice, high-grade deposit next to a nice, you know, developing, high-grade deposit. Then there's a fault, and east of that fault, there's bugger all because it's gone. It's been faulted off, so people do have claims over there, but their odds of success are like, not very good at all.

Dan Ferris: Right.

Brent Cook: So, it does help to know the geology. I remember when I was working at Papua New Guinea, there was a big discovery here, which is 30 million ounces, and all these other companies picked up ground on the islands around it. And they would draw a line between that deposit and their property, saying, "This is on trend," but you know, they're going east, west, north, south from there, so it really didn't work that way.

Dan Ferris: OK, so that answers... Just it speaks to the utter complication there. You know, it's hard to make a general rule, isn't it? It's hard to make these bullet points I'm asking for.

Brent Cook: It is.

Dan Ferris: They're hard fought and won, aren't they?

Brent Cook: Yeah, and I think you mentioned it there.

Dan Ferris: Yeah, because each deposit – there are categories of types of deposits, right? And people can learn to look for those, but just because you found one of those doesn't mean success, right? Each one has its own idiosyncrasies, does it not?

Brent Cook: Yes. It takes a very unique set of circumstances, geologic circumstances to form an economic deposit. I'm on ballpark for every really good porphyry copper deposit. There's probably 50 that are just not – don't have the grade. Now, that might be too big. Let's call it 20 –

Dan Ferris: OK.

Brent Cook: – 20 that don't work.

Dan Ferris: OK.

Brent Cook: And that's just the odds. Otherwise, gold doesn't sell for what, $2,400 an ounce because it's easy to find. I mean, there's billions of ounces of gold in seawater, but it's not economic.

Dan Ferris: Right. Boy, if they ever figure that one out, the gold price might be in trouble.

Brent Cook: Yeah, I'm not worried.

Dan Ferris: Yeah, me either.

Corey McLaughlin: Hey, Brent? You mentioned copper before, obviously with the macroeconomic forces behind it now, and probably for a while, but I've always been curious. How is mining copper different or similar to mining gold or anything else, that – what are the unique things about finding and mining copper?

Brent Cook: Well, let's see. An economic copper deposit will average in the order of 0.5%-plus, depending on a lot of stuff, copper, 0.5% copper, whereas gold, you're looking at half a gram gold per ton. So, right off the bat, there's a huge difference in concentration, and then the mining method could be the same, but again, you've got to mine a lot more ore to make money on copper than you do with gold, just because of those concentrations. And then coming down to extracting it from the rock, sometimes it's similar in that if you – like a porphyry copper deposit, you float the metal off – by float, they agitate it, and it sticks to bubbles, and they float that off, and you get gold and copper together, and then you extract it together. So, in some respects – I'm not sure I'm getting to your question.

Corey McLaughlin: Yeah. No, you are.

Brent Cook: OK. It can be similar, and it can be a whole lot different, depending on the type of deposit.

Corey McLaughlin: Yeah, I was just curious because I've always heard about some sort of relationship between gold and copper, but you know, I'm like, a newb. I know little about this, but you know, I've always heard there's some relationship, and I just wonder, like, with these gold companies that, you know, know what they're doing with gold, and then obviously, there's this whole – in the mainstream, there's all these narratives about copper. I just wonder how easy it is to – for, like, those sorts of same people to make the transition over to copper.

Brent Cook: It's actually not that hard if you're looking at large, again, porphyry copper deposits, and a porphyry copper deposit is basically a magma that's cooled into a granitic-type rock, and at the very top of the – as it's cooling, the ore, the copper, and the water – silica and all the metals, they don't get incorporated into the crystal structure of the granite, the quartz grains and stuff. It's kind of like scum on top of a deposit, or on top of kind of a bowl of soup, or a pot of stew, or something. The scum on top is the good stuff, and mining, you know, that's where it occurs, and it's generally big, and so that's where the deposits are formed. It's not that hard for a gold company to come in and figure that out and mine that, extract it.

Corey McLaughlin: Yeah.

Brent Cook: I don't know if that made any sense at all.

Dan Ferris: No, it does.

Corey McLaughlin: Yep.

Dan Ferris: It reminds me of something that a geo – Neil Adshead told me. We were in Labrador Trough, and he explained to me, he said, "You know, you can mine gold in various places," because as you say, you know, it's $2,000 an ounce, right? So, you can mine it, and sort of if you can make bars or whatever, maybe you could even take them out by helicopter or something, is what he suggested –

Brent Cook: Yep.

Dan Ferris: – versus needing the infrastructure to... You've got to find iron and ore in the right place, because you have to scoop it out, and you know, it's price per ton. You've got to scoop it out of the Earth in massive quantities and have a railroad and a seaport and all this other stuff nearby. So, it's a different sort of a proposition, and I would expect copper, the dynamic that you touched on earlier sounds similar to me, between copper versus gold.

Brent Cook: Yeah, exactly.

Dan Ferris: Yeah.

Brent Cook: Yeah. That's exactly right.

Dan Ferris: Yeah. All right, so, that's a consideration too for budding exploration mining investors, or any exploration mining investor for that matter.

Corey McLaughlin: Yep.

Dan Ferris: All right, good to know. Speaking of copper, and you said this earlier. One of the things you've got to do is form a view about this, and you touched on something that I think is really important, and Robert Friedland has touched on this too. He and others have made these comments, like one guy said, "We're going to need eight new Escondida Mines," Escondida, the largest copper mine in the world in Chile.

"We're going need eight of these in the next eight years," one guy said, or you know, by 2035 or something, and they don't exist, and I was talking with someone recently, and I said, "You know, we hear these narratives. It reminds me of when I was a kid," I said, you know, "and people said, 'Boy, I'll tell you, one day a billion people in China are going to buy a refrigerator and then the metals prices are going to sure move,'" and in the early 2000s, that finally happened, 40 years later, after someone told me.

So, I just wonder, I'm buying this narrative, like electrification, we don't even need the green-energy transition, do we? We just need electrification. There's a billion people that don't have reliable electricity in this world, and you get them reliable electricity, and we really do need those mines. So, do you, Brent Cook, make projections on copper prices, or do you simply look at the situation, get volition, not worry about the price?

Brent Cook: Probably mostly the latter.

Dan Ferris: Yeah.

Brent Cook: I think, in terms of how much copper we're mining and producing right now, we're burning through one Bingham copper mine a year, and Bingham copper mine is that big mine outside of Salt Lake City. So, in theory, we need to replace that every year, and we're definitely not doing that. But I think the idea that we need eight Escondidas in the next 10 years is not really accurate either, because what does happen, as the price goes up – of copper goes up, mining companies can start mining lower grade.

And a good example of that is a big deposit in Chile, the El Abra, which has been operating for a long time. It's a big mine, and the owner is going to put another $7 billion into expanding that deposit production. So, there's a deposit that's going to start filling that gap. So, I think we've got to count in these other deposits that are just going to expand their resources, but nonetheless, we definitely do not have enough deposits on the horizon to come into production to fill what I think we're going to need.

Dan Ferris: Right, so –

Brent Cook: In general, it takes –

Dan Ferris: Yes.

Brent Cook: Yeah, in general, it takes 10 to 20 years from discovery to production. The whole drilling it out, the studies, the technological studies, the permitting, all that, it takes a long time to go through that process.

Dan Ferris: Yeah, so that's a good point. The way I sort of frame it in my mind is that people talk about shortages in these things and higher prices. Higher prices bring metal out of the fricking woodwork. I mean, they just do, right? But you've just sort of put the rubber on the road for that idea, haven't you, because you explained, the capital investment is available and in this one case of the mine, El Abra, the resource is available.

It just needs the capital, and at maybe current prices, they're telling us, "Yeah, it's worth it. We're going for it." I'm glad you made this point. It's very important for, you know, hyper kind of copper bowls, but the basic thesis is sound. We want to emphasize that.

Brent Cook: I believe so.

Dan Ferris: Yeah. All right, Brent. It's time for our final question, which is the same for every guest no matter what the topic, and if you've already said it, by all means, feel free to repeat it, and the question is really simple. If you could leave our listeners with one thought today, what would you like it to be?

Brent Cook: Jesus.

Dan Ferris: Take your time.

Brent Cook: Yeah, OK. Yeah. Enjoy life. That's what we're here for.

Dan Ferris: There you go. We're getting more and more answers like that. Over the past several months, more and more people are saying, "Does it have to be about investing?"

And they're saying, "Enjoy yourself. Look around. Get in touch with your – touch grass. Spend time with your family. You only live once." All these kind of things because, let's face it, all this money stuff that we talk about, you can really get wrapped up in it, can't you? You can kind of get obsessive, and it's really unhealthy, isn't it?

Brent Cook: Yeah. I know a lot of really rich people whose lives are controlled by their money, rather than vice versa. That doesn't sound like fun to me.

Dan Ferris: Yeah, what's the point of being rich at that point?

Brent Cook: Exactly.

Dan Ferris: I thought rich was about peace of mind. All right. Listen, Brent, I don't talk to you nearly enough. I need to remedy that. Maybe we'll do it partly by getting you back on the show a little more often than every couple of years here, so thanks for being here. Really enjoyed it. Thank you.

Brent Cook: Yeah, well, thanks for the invitation. I enjoyed it, too, and I look forward to bumping into you at the next show.

Dan Ferris: Yeah. There's one in September, I think, in what, Colorado or someplace? Are you going?

Brent Cook: Beaver Creek, yeah.

Dan Ferris: Yeah, right.

Brent Cook: I'll be there. That is the best junior mining show around.

Dan Ferris: OK, good to know. Maybe I need to register with that. I'd like to run into you there. All right. Thanks a lot, Brent.

Brent Cook: Yep. All right. See you.

Dan Ferris: Bye-bye.

Corey McLaughlin: Thanks.

Dan Ferris: It's interesting, isn't it, that talking to a geologist in an investment context, it's like visiting the moon or something. I mean, it's just completely different. It almost has nothing to do with investing in any other context that we discuss on the show, like, nothing.

Corey McLaughlin: In a way, yes. Visiting the moon, I feel like there's a pun in there, a mining pun somehow.

Dan Ferris: There is.

Corey McLaughlin: OK.

Dan Ferris: There is a mining pun there. I couldn't quite make it, so I just said, "Visiting the moon."

Corey McLaughlin: All right, yeah. [inaudible] It's somewhere there.

Dan Ferris: Yep.

Corey McLaughlin: Yeah, no. It was, like I said – you and him know a ton more about this whole area than I do, and so it's just fascinating for me to listen and learn a little bit about gold mining, copper, what all goes into it, and what his expertise in, if you're interested in these things, what you'd need to actually look at.

Dan Ferris: I'll tell you what, Corey, and this is for our listeners, too. If you ever get the chance, maybe a good way to do this – knowing me helps. I could maybe help you with it, but go to a mining conference, talk to everybody, let them know that you know, you know, Rick Rule, and you're from Stansberry and all that. And sooner or later, somebody's going to invite you to go visit one of these deposits, and it is an education for which there is absolutely, positively zero substitute.

I got out of a helicopter in Newfoundland once, and all the guys walked over, 10 feet from the helicopter – the rotors are still spinning. He turns the engine off, it keeps spinning, and they picked up rocks off the ground. He said, "Look at that, Dan. You see that? That's visible gold." And our friend, Matt Badiali, a former Stansberry guy, he has never seen visible gold. The geologist has never seen visible – it's not something everybody gets to see.

Corey McLaughlin: Right.

Dan Ferris: Because mostly it's in just the tiniest – it's really tiny, and you have to do a lot of processing to concentrate it into a gold bar or something, but – and I have that, actually, here on my desk.

Corey McLaughlin: Oh, nice.

Dan Ferris: The gold is like, it's impossible to see. I forget even where it is. I have to look at the rock for like, five minutes to remember where the damn gold is, so – but it's in there somewhere.

Corey McLaughlin: Yep.

Dan Ferris: Matt can find it, if he were here, so yeah. It's not like anything else, and being there and being on the ground, literally, is – people talk about on-the-ground research. Yeah, this requires literally on and in the ground. If you can go down, totally.

Corey McLaughlin: Yeah, no. It's science, yeah. I have some family in Colorado. I've been in some of these smaller towns where there used to be mines, and they're trying to revitalize them. It didn't quite work out, but yeah.

Dan Ferris: Yeah.

Corey McLaughlin: And I see that, and to me, the copper angle is interesting because it's not always found right where the gold mines are, necessarily. It can be, but right, there's like – like, Arizona, right, that he mentioned, it's not something that comes to mind, I think, for a lot of uneducated people like myself about where you're mining these sorts of things, or where mining, you know, activity is happening.

Dan Ferris: Yeah.

Corey McLaughlin: So, yeah.

Dan Ferris: Yeah. Yeah. Arizona is a good copper district. That's right. There's nothing like, you know, going to these places, and there's nothing like talking to a guy like Brent Cook.

I'm telling you, like, the combination – I joked about it, but I'm deadly serious. The combination of like, honest geologist in mining stocks, like, all together, honest and a geologist in mining stocks, somebody who's going to help you not get ripped off? Look, it's just a fact of life that it's all too rare, and when you find one, you're like, "Oh."

Talk about finding gold. That's gold. So you've got to know the right people and go to the right places. It's not like picking stocks and looking at data on your computer. There's plenty of that, too, but that is not sufficient.

Corey McLaughlin: No.

Dan Ferris: You must know the people. If you're going to be a really good mining investor, you must travel. You must get on the ground to the actual sites and learn how to know what's going on there, and probably a good way to get to that is to start going to mining conferences. And I'm going to see if my schedule allows me to go to Beaver Creek, and if it does, I should really go, because I know a lot of people who work in mining.

Corey McLaughlin: I've been to Beaver Creek before. I've been there. Not that conference, but I've been there.

Dan Ferris: Oh.

Corey McLaughlin: Yes. Good.

Dan Ferris: Right.

Corey McLaughlin: Family that worked out there for a little bit, yep.

Dan Ferris: OK.

Corey McLaughlin: I could tell you where to go.

Dan Ferris: I mean, do you recommend a trip to Beaver Creek?

Corey McLaughlin: Yeah, to like, anywhere.

Dan Ferris: OK, all right. Good. All right, so double recommendation. I'll have to look into it, but great fun talking to Brent, you know?

I've known him for many years now, and there's just – like I said, there's a handful of people in the world like him. If you're a mining investor, you have to know about him, and you have to know what he says about stocks that you might own in that sector. All right, so that's another interview, and that is another episode of The Stansberry Investor Hour. I hope you enjoyed it as much as we really, truly did.

We do provide a transcript for every episode. Just go to www.investorhour.com. Click on the episode you want. Scroll all the way down. Click on the word, "Transcript," and enjoy.

If you like this episode and know anybody else who might like it, tell them to check it out on their podcast app or at investorhour.com, please, and also do me a favor. Subscribe to the show on iTunes, Google Play, or wherever you listen to podcasts, and while you're there, help us grow with a rate and a review. Follow us on Facebook and Instagram. Our handle is @investorhour.

On Twitter, our handle is @investor_hour. Have a guest you want us to interview? Drop us a note at [email protected], or call our listener feedback line, 800-381-2357. Tell us what's on your mind and hear your voice on the show. For my cohost, Corey McLaughlin, till next week, I am Dan Ferris. Thanks for listening.

Announcer: Thank you for listening to this episode of The Stansberry Investor Hour. To access today's notes and receive notice of upcoming episodes, go to investorhour.com, and enter your e-mail. Have a question for Dan? Send him an e-mail, [email protected].

This broadcast is for entertainment purposes only and should not be considered personalized investment advice. Trading stocks and all other financial instruments involves risk. You should not make any investment decision based solely on what you hear. Stansberry Investor Hour is produced by Stansberry Research and is copyrighted by the Stansberry Radio Network.

Opinions expressed on this program are solely those of the contributor and do not necessarily reflect the opinions of Stansberry Research, its parent company, or affiliates. You should not treat any opinion expressed on this program as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Neither Stansberry Research nor its parent company or affiliates warrant the completeness or accuracy of the information expressed on its program, and it should not be relied upon as such. Stansberry Research, its affiliates and subsidiaries, are not under any obligation to update or correct any information provided on the program.

The statements and opinions expressed on this program are subject to change without notice. No part of the contributor's compensation from Stansberry Research is related to the specific opinions they express. Past performance is not indicative of future results. Stansberry Research does not guarantee any specific outcome or profit.

You should be aware of the real risk of loss in following any strategy or investment discussed on this program. Strategies or investments discussed may fluctuate in price or value. Investors may get back less than invested. Investments or strategies mentioned on this program may not be suitable for you.

This material does not take into account your particular investment objectives, financial situation, or needs, and is not intended as a recommendation that is appropriate for you. You must make an independent decision regarding investments or strategies mentioned on this program. Before acting on information on the program, you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from your own financial or investment advisor.

[End of Audio]

Get the Investor Hour podcast delivered to your inbox

Subscribe for FREE. Get the Stansberry Investor Hour podcast delivered straight to your inbox.