Why It’s Better to Be Smart Than Lucky at Investing

In This Episode

Some familiar names are making big moves this week, as Dan discusses Microsoft’s latest plunge into AI, Alibaba’s declaration of intent to become the go-to online marketplace for U.S. B2B activity, and even shares the best – and free – source to get the sharpest analysis on Tesla he’s ever seen.

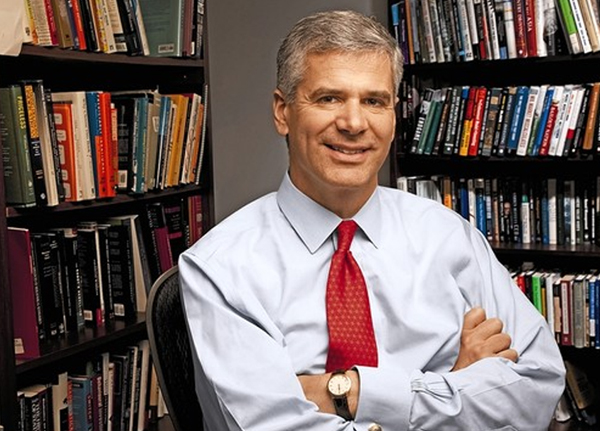

Dan then gets to this week’s podcast guest, Michael Mauboussin, the Director of Research at Blue Mountain Capital Management.

Before that, Michael headed global financial strategies at Credit Suisse, and was chief investment strategist at Legg Mason Capital Management. He is the author of three books, including More Than You Know: Finding Financial Wisdom in Unconventional Places. Michael has been an adjunct professor of finance at Columbia Business School since 1993, and received the Dean’s Award for teaching excellence in 2009 and 2016.

Michael has some extremely eye-opening insights for anyone who sees investing as a form of gambling. If you’d rather be lucky than smart when it comes to the markets – this interview is for you.

Featured Guests

Michael Mauboussin

Director of Research at BlueMountain Capital Management

Michael J. Mauboussin is Director of Research at BlueMountain Capital Management. Prior to joining BlueMountain, he was Head of Global Financial Strategies at Credit Suisse and Chief Investment Strategist at Legg Mason Capital Management.

Episode Extras

NOTES & LINKS

- You can learn more about Dan’s Extreme Value service and get the details on a special market situation he’s closely monitoring by clicking here.

- To check out Michael’s book, click here.

SHOW HIGHLIGHTS

3:07: Dan opens this episode with a break from his usual practice of telling listeners what he thinks, or what he’s doing. “Today I’m going to tell you what to do.”

8:52: Dan lists the investing benefits of keeping a decision journal. “You can record your actual state of mind, there’s no fantasizing about it later on.”

10:32: We have a lot of research services at Stansberry – but there’s only one, Dan says, that he knows will be right for 99% of people – maybe even 100%.

16:18: Dan makes sense of Microsoft’s billion-dollar foray into AI announced this week. “$1 billion could become tens of billions of dollars in value at some point.”

17:54: To anyone curious enough about Tesla to gain access to Whitney Tilson’s frequent analysis on the company, Dan explains how anyone sending an email to [email protected] can get placed on the mailing list.

23:32: Dan introduces this week’s podcast guest, Michael Mauboussin, the Director of Research at Blue Mountain Capital Management. Before that, he headed global financial strategies at Credit Suisse, and was chief investment strategist at Legg Mason Capital Management. He is also the author of three books, including More Than You Know: Finding Financial Wisdom in Unconventional Places. Michael has been an adjunct professor of finance at Columbia Business School since 1993, and received the Dean’s Award for teaching excellence in 2009 and 2016.

30:33: Dan asks Michael about a quote by game theorist Richard Epstein in the intro of his book, The Success Equation: “There is no way to ensure you’ll succeed if you participate in an activity that combines skill and luck.” Michael explains why luck feels so important to investors.

34:26: In this environment where everyone has all the information they need to make investing decisions – plus a lot more – Michael explains how the net effect is to make investing seem much more random and luck-driven than it really is.

42:21: Michael explains how understanding base rates – how data points have behaved in similar situations before – and mean reversion can make sense out of the chaos individual investors initially perceive.

46:49: Unlike conventional wisdom, Michael says active management does tend to generate superior returns to passive funds – but there’s a caveat that makes most active management impractical.

51:54: Could brain-damaged people really make better investors? Michael goes into a shocking, and controversial, study.

1:13:35: Dan reads a mailbag question from Eric J., who asks if Annie Duke will be re-appearing on the podcast soon.

Transcript

Voiceover: Broadcasting from Baltimore, Maryland, and all around the world, you’re listening to the Stansberry Investor Hour. Tune in each Thursday on iTunes for the latest episodes of the Stansberry Investor Hour.

Sign up for the free show archive at investorhour.com. Here is your host, Dan Ferris.

Dan Ferris: Hello, and welcome everyone to another episode of the Stansberry Investor Hour. I’m your host, Dan Ferris. I’m also the Editor of Extreme Value. That’s a value-investing service published by Stansberry Research.

We have a really cool show, an awesome guest today. Let’s get to it all, right now. Okay, this rant is going to be short. Now, you remember last week I talked about training, and what it means to be a trained investor – versus being like a trained musician or a trained doctor – and we talked about, for example, you might remember I talked about Ben Graham, right? The father of value investing.

He wrote a mammoth book called Security Analysis, and another book called The Intelligent Investor, that you really ought to read... and he was Warren Buffet’s mentor, et cetera, et cetera.

You know Ben Graham, right? And he said he had different advice for the trained securities analyst versus the untrained security buyer, and it’s funny that he distinguished the trained guy as the analyst and the untrained guy as the buyer, because I know people.

You know, they hear things at cocktail parties and they just hit "buy" on their computer, rather than really analyzing, but to the trained analyst... anything could conceivably be cheap enough for the trained analyst to buy, or expensive and ugly enough for the trained analyst to short.

But Graham said the untrained security buyer should just never put money into a low-grade enterprise on any terms. In other words, stay away from bad businesses and bad securities, you know? Risky ones, right?

Stay with the high-quality stuff, which is good advice, but this week, I was thinking you might have left last week’s rant thinking, "Okay, training? What are you talking about? I have a job, and a spouse and kids, and a life and a house, and stuff. I don’t have time for training. You know, I can’t take off four years and go to school to be a trained security analyst."

And yet, you’ve got to train your brain to do this. There’s discipline. It really is like playing instrument to be an investor – you've got to do it every day.

So, there’s got to be some discipline that you practice every day, and I’m afraid the natural discipline we practice is no discipline at all – which is like watching the news and getting scared every 10 minutes because of the President’s tweeting. Or some, you know, other thing happening in the world, and we just tend to be a little reactionary, and there’s no discipline.

So, what I’m going to do today is something I never do. I always give suggestions – things you ought to do – or just tell you what I think "this is what I do, this is what I think."

Today, I’m going to tell you what to do. I’m not – this is absolutely what to do, and I’m not even going to explain it much. I’m just going to tell you to do this. That’s why the rant’s going to be a little shorter.

Okay, there’s six things that I want to tell you what to do, to help you practice a better, daily discipline as an investor... and just practice more discipline in general, not even daily.

The first thing I want you to do, is read a piece that’s free of charge on the Internet called Avoid News by a guy named Rolf Dobelli. He has a couple of good books out, too, but you don’t need those. You need the piece called Avoid News. Read it. Read it slowly and carefully. Think about it. Practice. Try to practice it as much as possible.

In our interview with our guest Tim Price recently, in last couple episodes, and he mentioned specifically the piece, Avoid News. And we talked about the prospect of how much news you might be able to avoid... and I think it’s quite a bit. I think you could be a lot more selective about what you take in from the Wall Street Journal and, you know, TV news, you know – Fox Business or Bloomberg News, or whatever your kind of financial thing you watch on TV. That’s the first thing to do: Avoid news.

Second (we’ve talked about before), which is: You must master the skill of saving money. We have a – we did a rant on that a while back and I just – you know, there’s no way to replace this skill with anything else. If you don’t have the skill of regularly saving money, it’s going to be a challenge for you to have any kind of discipline as an investor.

The third thing I want you to do: I’ve said this a bunch of times but I feel like I still haven’t made the point enough. You must, must, must read The Most Important Thing by Howard Marks. If you want to know what training is – this training that I keep talking about from last week and this week – it’s all the stuff in that book.

And remember, I said there’s 18 "Most Important Things." Right... last week we talked about the younger – they’re trained but they’re younger resident physicians at the local hospital, versus the Chief Resident who I spoke to.

And the younger physicians are obsessed with the tourniquet time – the amount of time it takes to do a procedure in surgery almost to the exclusion of other things, you know, which doesn’t make me feel very good as a potential patient.

But the Chief Resident was like, you know, "certainly you don’t want to keep the patient under any longer than is absolutely necessary, but you don’t want to rush through it."

You want a good outcome for the patient, and that should drive all your decision-making – not beating your friend, you know, 10 seconds on tourniquet times.

Right, so experience plus training, you know, really, really means something, and it’s more subtle. That Chief Resident’s view is a more subtle, nuanced, complex view. There’s more to it than one variable, and that is what you learn by reading The Most Important Thing by Howard Marks. I’m not kidding: Keep that book at arm’s length. Read it regularly.

Also, read Chapter 20 of The Intelligent Investor regularly. I have an alert on my phone every month "read Chapter 20" because I’ll tell you something: These things are like jumping out of an airplane – parachute or not, it’s an unnatural act.

Okay, so doing these things, recognizing risk, controlling risk, investing with a margin of safety, which is Chapter 20 of The Intelligent Investor, they’re unnatural acts.

Being a good investor, being a – how normal does Warren Buffet seem to you? How normal do any of these people seem to you? Well, they’re not. These are unnatural acts that they’re engaged in, and you must train your mind to do them. You’re not going to come out of the womb naturally just having good investment discipline, and I’m telling you, do this stuff, and it will go a long way to helping you get it.

Number four, our guest today is an awesome guy. Part of the reason I’m doing a shorter rant is because we wanted to spend plenty of time with him, and he recommended to me that we should keep a decision journal.

And you know something? As soon as he told me that, I started doing it right away, and I’ve been doing it for a couple of weeks, and we’ll talk to him about it a little bit today.

Keep a decision journal. All your decisions as an investor, I just go into it daily. I open up daily and, you know, put – I just have a Microsoft Word file and I just put the date on there, and write down all the decisions and stuff related to investing decisions for the day.

Most days, there’s no decision. It’s just, you know, a lot of times I write what I’m not going to do, what I’m not going to react to. Decision journal – very good. You can record your actual state of mind, instead of fantasizing about it later on.

Okay, that’s number four. The fifth thing, the last thing – look, I know that 99% of the people, in the sound of my voice, are not professional investors with lots of investment discipline.

So you know, if you buy a stock and because you read something by me or somebody else, and we have a lot of conviction about it, and you know, I say, "Well, I don’t care if the thing falls 50%."

I’m not going to recommend selling it, you know, because I have a high conviction, and maybe that doesn’t fit your personality – and I think it doesn’t fit a lot of people’s personalities – because most people, what will happen is they’ll say, "Yeah, I’ll hold through a 60% drawdown. You know, I’ll hold through a 60% bear market in the S&P 500. I got what it takes."

Yeah, and then the day comes when that thing is down 60%, and you sell out in a panic, and take a catastrophic loss. It’s horrible. So – well, as a Stansberry editor, you know, Stansberry’s done a great job of using trailing stops to help people avoid these catastrophic losses.

To me, that’s the main value of it. The main value is that yes, sure, it will take you out of positions sometimes that are going to go up after you stop out. But a lot of times, it’ll take you out before the thing – you know, if your trailing stop is 25%, you’ll take a 25% loss, and the thing will go down 40, 50, 60, whatever, and you won’t take any of that extra loss.

So over time, I think it is a form of discipline, and if you ever don’t need it, you’ll be the one who will make that decision. You’ll know one day when you don’t need to do that, if you ever don’t need to do it – and some people, you know, they don’t use it on 100% of their portfolio.

Thing number five that I’m telling you to do here is actually go to TradeStops.com because, look, TradeStops, we have a lot of different products at Stansberry, but TradeStops is the only one that I can say is probably going to be right for, like, 99% of our readers, at least – maybe even 100%.

Because professionals, you know, we’ve learned that from the statistics, the professionals aren’t any better than the rest of us. They can’t beat the market most of the time either.

So, they should probably be using trailing-stop discipline, and that will keep you out of a lot of the trouble than people who don’t have good discipline, get themselves into.

So, five things: Read Avoid News by Rolf Dobelli, so you can train yourself not to just take in everything the news media throws at you. You can select what you want to go into your brain.

Learn the discipline of saving money. That’s number two. Number three is, for God’s sake, read Howard Marks. It’s so easy. Just buy the darned book. Keep it at arm’s length and read it... and read Chapter 20 of the Intelligent Investor. Just do this for God’s sake.

Decision journal, keep a decision journal. Yes, sit down at your computer and type out what you did exactly. Record your state of mind and the decision you’ve made – how many shares you bought, what it was, why you bought it, and your state of mind.

You know: "I’m really excited about this... I’m leery about this... I don’t know if this is going to work or not." Whatever. Why did you put, you know, x amount of dollars into it? Why not more? Why not less? Record every aspect of the decision, and later on, when you’re questioning it, go back and look and see what – you know – why you did what you did, so that you don’t lie to yourself about it, because people do that. We’re only human. This stuff – we have to do this stuff because human beings are like this.

And the fifth thing is, for God’s sakes, go to TradeStops.com. Okay, use TradeStops. You know, it’ll save you from having to actually have discipline. It’ll impose discipline on you.

Right, it’ll be your mom and your dad, and it’ll say – it’ll give you an alert that you can set up and go "uh, you’re stopped out, you need to sell." It won’t sell for you – they can’t get in that deeply into your account – but you get the message. Okay, just do this stuff for God’s sake. All right? Okay, enough said. Moving on.

All right. Let’s talk about what’s new in the world, and the first thing that caught my eye this morning is that Microsoft is investing a billion dollars in an artificial intelligence project with OpenAI, which is the company co-founded by Elon Musk – Elon Musk and three other guys. And I don’t know the extent of Musk’s involvement in OpenAI, but I would imagine he’s assembled a team of really smart people, because he tends to be able to do that.

So, the deal is that Microsoft and Musk’s company, OpenAI, they announced this partnership to build what they’re calling AGI – "Artificial General Intelligence" software, I assume – to tackle more complex tasks than what traditional AI – we’re already talking about such a thing as "traditional AI" [laughter.]. That’s weird.

So, Microsoft is going to invest a billion dollars in OpenAI as part of this project, and OpenAI is going to use Microsoft as its exclusive cloud provider.

Okay, so Microsoft gets the cloud business from an OpenAI – they put a billion into OpenAI, and first of all, they said they’re going to solve more complex problems. But they only named – like all the stuff I read, they said "OpenAI – Microsoft’s vision for artificial general intelligence to work with people to help solve currently intractable, multidisciplinary problems including global challenges such as climate change, more personalized healthcare and education" – which I know that healthcare and education are kind of pet concerns of Bill Gates

I know he’s put money – his philanthropic organization has put money into the Gates – "Bill and Melinda Gates Foundation," I think it’s called, has put money into education. And he’s been very frank about, you know, mistakes that he’s made, things that work things that don’t work – more personalized healthcare, climate change, you know, I don’t know, maybe I’ve lived on the left coast too long. I just – I hear "climate change"... I’m like "oh boy." You know, because it’s such a heavily, heavily politicized subject and you hear about somebody putting a billion dollars to work.

It’s like "oh geez, what are they going to do?" But overall, look: Microsoft’s an incredible company. You know, it’s been a multi-multibagger – I sold it way too soon in Extreme Value.

It gushes free cash flow. A billion dollars is not a lot of money. You know, they pay off all their debts – all of their debts which are like, $73 billion I think, and then still have close to $60 billion in cash left over.

Okay, so a billion is not a lot of money. Plus, like just last quarter, they generated $11 billion in free cash flow. So, billions and billions come out of this thing every year, and a billion-dollar investment at this point in their history is not a huge thing.

However, isn’t it cool though? That in that business, a billion-dollar – you know, a billion-dollar investment can become tens of billions worth of business value at some point.

It’s really cool... It’s optionality. It buys some optionality, and so you know, you could get – you could wind up with a really great outcome from a relatively small investment, and it’s – the press release isn’t telling us much.

So, who knows? Who knows how this is going to turn out? But if you’re a Microsoft shareholder, you like investing. I don’t even believe I’m saying this – a billion dollars, a relatively small investment compared to the overall value and cash generation ability of the business – in order to potentially create a huge, huge outcome.

So, that’s great. So, you know, speaking of Elon Musk involved in this OpenAI thing with Microsoft, I want you to – I was telling you what to do when I started the program today. I want to tell you what else to do. Here’s another thing I’m going to tell you to do:

I want you to follow – if you’re interested in Tesla at all, okay. If you’re interested in Tesla at all, I want you to follow Whitney Tilson’s Tesla e-mails. He really covers this thing very well.

Now he’s short, but Whitney’s a really good guy and he’ll publish people’s bullish viewpoints in his e-mails, and they’re very detailed. Whitney just works, and works, and works. He puts out so much material, he’s like a machine.

So, I highly recommend you follow him, and to do that, you have to send a blank e-mail to [email protected], and I’ll put this link on the page for this episode on investorhour.com, but let me just spell it out for you: T-S-L-A-S-U-B-S-C-R-I-B-E at M-A-I-L-E-R dot K-A-S-E C-A-P-I-T-A-L dot com. Okay, [email protected], and that’ll get you Whitney Tilson’s Tesla e-mails.

So, if you’re interested in the company at all – maybe you’re short, maybe you’re long, maybe you don’t care – and you just find it very entertaining, I would encourage you to follow them. And also, Whitney’s a really good thinker and investor, and it pays to just see how his mind is working on this problem of, you know, what’s the outcome going to be for Tesla. Okay, do that.

Next thing that caught my eye today, before we move on to our interview here, is that Alibaba says – Alibaba, the Chinese e-commerce giant, they want to be like the go-to online marketplace for U.S. based businesses to do business with each other, like B2B, and they said, you know, they’re launching.

They have big plans for U.S. market. They’re launching new capabilities for U.S. businesses on Alibaba.com, and they’re kicking off in Brooklyn, New York with a national tour. And they’re going to recruit U.S. small business to sell on their platform.

Okay, and the reason this caught my eye is like, um, capitalism works, right? But people think it’s broken when companies like Amazon and Facebook, and Google just come in and dominate their market and wipe out all competition.

I mean, Amazon is a brutal competitor. You know, they’re not like all concerned about making a profit [laughter], and when you can afford that luxury, you know you really have a big advantage over your competitors who have to answer to investors.

So, you know I think things are maturing in the online space and you know, there are people who aren’t going away. Walmart’s not going away, you know – other people aren’t going away.

Now there are – they make a small percentage of online sales. Amazon is still the dominator, you know, and I don’t – I don’t shop at Walmart online. I shop at Amazon online just like everybody else, but I like seeing competition, and I hope Alibaba is capable of competing with Amazon.

And then I hope sometime after that, someone else is capable of competing with Amazon and Alibaba because all of that will be good for you and me. All of that will be good for customers, and believe me, Amazon’s been great for customers.

They suck all the margin out and you know, they shop around for the best price. You know, it’s part of what they do. I always get these updates in my cart. I have a giant – I have 230 books in my "Save for later" in my cart, and so I get a list, every day, of prices that were adjusted.

Some were adjusted upward, but a lot of them are adjusted downward because they look around the web for the best price. So, they’ve done us some good and that’s why we’re all using it.

It’s superconvenient. We can’t resist and, I think you know, Alibaba is like a Chinese version of that, and we’ll see if they can kind of make a dent in Amazon. I hope they can. That’ll be good for us. All right, that’s the news for today.

We have a wonderful interview today, but first, let’s hear a quick word from our sponsor.

[Commercial: “10 years ago, we created the Atlas 400 to surround ourselves with the best and smartest people in the world, and to experience all the best things life has to offer. The purpose of the Atlas 400 is simple: Extraordinary people in extraordinary places doing extraordinary things. How do we achieve this? Eight to 10 times a year, we host amazing adventures around the world. These trips get people out of their daily routines – out of their comfort zones – and place them in a faraway land with a group of like-minded people. That’s the way to build friendships, to make lasting relationships.

It’s easy to open up when you’ve spent the day in a race car with someone, or zip lined across Patagonia with them. It’s different from your typical, business conference interaction. Imagine yourself in the company of over 100 of the world’s most-accomplished people, traveling the world, enjoying new friendships, having new adventures, discovering enormous, new opportunities – perhaps seeing your life and yourself in a whole, new way.

We believe "business first" is the wrong way to go about life. Focus on your relationships, and opportunities will inevitably spring from those relationships. I hope you take advantage of this opportunity to change your life. If you’re interested in learning more about membership in the Atlas 400, go to www.TheAtlas400.com/signup. That’s www.TheAtlas400.com/signup, partner code: STANSBERRY.”]

Dan Ferris: Okay, everybody. It’s time for our interview. I’m really excited about this one. Today, our guest is Michael Mauboussin. He’s one of my favorite people in the whole financial world.

Michael J. Mauboussin is director of research at BlueMountain Capital Management. Prior to joining BlueMountain, he was head of global financial strategies at Credit Suisse, and chief investment strategist at Legg Mason Capital Management.

He is also the author of three books, including More Than You Know: Finding Financial Wisdom in Unconventional Places, named in the 100 best business books of all time by 800-CEO-READ.

Michael has been an adjunct professor of finance at Columbia Business School since 1993, and received a Dean’s Award for Teaching Excellence in 2009 and 2016.

He is also chairman of the board of trustees at the Santa Fe Institute, a leading center for multidisciplinary research in complex systems theory. Michael Mauboussin, welcome to the program, sir.

Mike Mauboussin: Thank you, Dan, and that was a very gracious introduction. Appreciate it.

Dan Ferris: Well, we specialize in very long gracious introductions around here. So, I usually start by asking folks in your line of work when they first got interested in finance, but you kind of did the world a service by telling us about when you got hired at Drexel Burnham Lambert, in your book about success, The Success Equation.

So, I guess what I want to know is was there something in your youth that pre-saged your career in any way that you know, sort of foreshadowed what you’ve become today?

Mike Mauboussin: I would say most definitely not. So, I actually had no idea really what I wanted to do when I got out of school. As I may have mentioned in that book, I was a government major, you know, basically a liberal arts guy.

I studied economics as a minor but wasn’t really – I didn’t really study any business formally. Growing up, I was mostly into sports and athletics, and probably devoted too much of my time to playing sports – versus hitting the books – and you can see throughout all my work, that I still am a big sports fan.

But I do think that having a liberal-arts background for me, at least set me up in a certain way that was useful... which was when I came onto Wall Street it was – and I think it still is – to some degree.

But it was sort of replete with old wives’ tales and rules of thumb, and this is how we do things. And I did have an inclination to try to understand things from first principles.

So, even pretty early on, I spent some time trying to understand why people came up with these rules of thumbs, you know, where those things stood out – stood up – and where they stood out and didn’t make any sense.

So, that’s the first thing, and the second thing I’ll say is that I have always been just sort of, as a kid, pretty comfortable with numbers. Even though I did study government in college, my high school guidance counselor really wanted me to apply to – and I actually did – a bunch of engineering schools.

He really thought I should be an engineer, so I’ve always been comfortable with numbers, and I think that’s also very complimentary when you go into – into finance in particular, and I ended up being an analyst. Some comfort and numeracy, I think, is a huge asset.

Dan Ferris: It’s interesting to me that you have wound up in finance, because as I have – I have your books kind of piled on my desk here, and as I look through them, certainly there’s lots of stuff about finance.

I mean it’s very clear what this person does for a living, but it seems to me that you’re evolving into someone who started out thinking about making good decisions in finance, and now it’s just about helping anybody make a better decision. Is that fair to say?

Mike Mauboussin: Yeah, I think it is, and I would just go back and say – and you mentioned in the introduction – I started teaching at Columbia Business School in 1993. And I think part of that was the evolution of that, which was when you say – well, you know, you teach and I teach security analysis, which is basically how to analyze a company or analyze a stock, and you know there’s certain techniques that we – you know, we teach about how to do valuation exercises, how to do a competitive strategy analysis, and so forth.

But as I got into that – so I’ll make two comments. First, is you know when I was approached about teaching that course, my first reaction was: "This should be pretty easy, right? Because all I have to do is sort of – and I was an analyst, right?"

So, all I have to do is sort of watch myself and make a bunch of – make a bunch of slides and present on it., but the first thing it does is forces introspection.

So, you know, if you have to communicate what you do all day to someone else effectively and clearly, and compellingly, I think it really prompts you to think about what you’re doing, and whether you’re doing things the right way.

The second thing that came up pretty quickly was – in my mind, as I studied investors, and especially great investors – it became, I think, quite clear that what distinguished the very best from the average was not their analytical skills.

Let’s just say that the analytical skills – or you know, understanding accounting and those kinds of things – those become ante for the game, but really what distinguished them was their decision-making.

And in particular, decision-making in very stressful situations. Right when markets zoom to extremes, it’s very difficult to not be carried to those extremes emotionally as well.

And so that got me very interested in just understanding how we think about decision-making. Now it’s interesting: When I went to college in the mid-1980s, there was not a lot – I mean there were psychology courses, obviously – but there was not a lot on decision-making.

And you know, obviously Kahneman and Tversky did a lot of their wonderful work in the 1970s and early 80s, but it really hadn’t permeated a lot of mainstream academia – and certainly hadn’t made its way into, like, the business curriculum or finance curriculum.

So, I think that I was also, you know – so that whole area has been a burgeoning area for probably a quarter century now, and so, was able to sort of latch onto some of that stuff in the earlier days.

So, I think it’s a combination of those things, and then once you start to build this toolkit of thinking about the world in terms of probability – thinking about the role of luck and outcomes. Whether again, it’s your favorite baseball team, or your career or something else, it starts to open up the opportunity to think about – or introduce – a lot of really-valuable mental models that expand way beyond your day job into every aspect of your life.

And you know, at the end of the day, a lot of what we do is the quality of our decisions, plus – plus or minus – the role of luck, and so the only thing you can really control is your decision-making. So, I think it benefits all of us to start to get as good as we can at doing it.

Dan Ferris: Yeah, and in that vein, I hope you won’t mind – I just want to read a little bit from The Success Equation, and it’s at the end of the introduction right before Chapter One – and you’re quoting a fellow named Richard Epstein, who is a physicist trained – or a game theorist trained in physics. And he notes that there is no way to assure that you’ll succeed, if you participate in an activity that combines skill and luck.

But he does say it is gratifying to rationalize that we would rather lose intelligently than win ignorantly, and Michael, as soon as I read that, I thought of these people who say "I’d rather be lucky than smart," but I’ll never say that again.

Mike Mauboussin: [Laughter.] Well, that’s good.

Dan Ferris: Because yeah, it’s a lack of – when you say "I’d rather be lucky than smart," isn’t it a lack of appreciation for process versus outcome, which is a major theme of your work? Don’t you think?

Mike Mauboussin: For sure, and I think that it’s interesting... that aphorism. There are a lot of aphorisms around luck and that’s just one them. That one’s always – that one candidly has always baffled me. I’ve never really understood it, and I think it’s probably not a good way to go through life, right? Obviously.

And you know, one of the ways to think about process, or skill and luck, is to think a lot about what’s in your control and what’s not in your control. And to do all that you can to improve your likelihood of favorite outcomes based on what’s in your control – and a lot of that is skill and that’s effort – and then become, you know, almost philosophical about the luck component.

So, this idea that "I’d rather be lucky than smart"... I’ve never understood why anybody would ever adhere to that point of view [laughter.] Now when you’re lucky – and we all get lucky from time to time – something good happens. You know, you should be grateful for it, but recognize that it was not – had nothing to do with you, and that next time around, you shouldn’t expect it again.

Dan Ferris: Bute I have to tell you, that idea of "we would rather lose intelligently than win ignorantly," – you know, it’s not exactly like a big encouragement. It’s not exactly like "let’s go and do these activities where luck is involved."

I don’t get a great feeling that I really want to have luck being a big factor in my life – once I read that – and yet, here we are in finance, right? I mean, and luck is involved.

Mike Mauboussin: Right. I will say, though, it’s interesting that you know – like my friend, Andy Duke, who wrote a great book called Thinking and Bets and, you know, someone who is trained as a cognitive psychologist and understands a lot of these topics, you know, but poker players, they – you can’t be an elite poker player without understanding that intimately, right? And they have to deal with it intimately.

Now the way they offset that is: They increase the sample size. So, they just play a lot of games, spend a lot of time at the table, and they can have some confidence that their skill will shine through at the end of the day.

But in any short stretch, obviously you know, it can be luck that dominates what's going on. And you know, the world of finance is also tricky because I think that you know it’s this concept we call the "paradox of skill," which is the reason the market feels like luck is so important is – not because the participants and market are not smart or dedicated (and we’d say "skillful") – it’s because there’s a mechanism here called "prices" or "asset prices," and the fact that everybody’s so hardworking and skillful, and thoughtful, means that most of the information – most of the time – gets reflected in prices.

So, prices tend to be a fairly reasonable estimate of value, and as a consequence, it appears like things are close to random – or luck plays a bigger role. So, it’s the paradox skill set – is when activities of both skill and luck contribute to outcomes, it could be the case that as skill increases, luck becomes more important.

And the key distinction there is between, you know, just absolute level of skill, which has clearly been – every domain you could look at has been rising, and relative skills. So, I think the key insight is investing – the relative skill has gone down because pricing has become, by and large, more efficient.

Now there’s a continuum of efficiency in different asset prices and so forth, but that’s the basic principle. So, investing feels much more random... even though skill is much higher than it’s ever been. So, that’s a hard thing for people to sort of get their heads wrapped around.

Mike Mauboussin: Right. I read an abstract of a paper recently, that pointed out that the more skillful investment managers become, the more incentive investors have, to buy index funds because there’s – right? The prices are pushed up and arbitraged out.

And I have to tell you, Michael, I owe you kind of a debt of gratitude, because I know we said you wrote three books in the introduction, but there was another book called Expectations Investing that was you and a fellow named Alfred Rappaport. Which really helped me and changed – it gave me exactly what I was looking for, because I was struggling as a value investor, trying to use discounted cashflow in a smart way – but it’s all based on prediction.

Right? I have to predict the cashflows in the future. I have to predict the revenues and predict the margins, and the taxes, and all the rest of it, and I thought, "Well, I don’t know the future."

And then you came along with this book, and flipped that on its head. And we do that now: We do price-implied expectations analysis in the newsletter I write called Extreme Value.

So, thank you, Michael Mauboussin, and that’s a great way to think about asset prices, I think.

Mike Mauboussin: And I’ll say – I mean, that goes back to – you mentioned sort of the path into finance, and I mentioned this, you know, walking into Wall Street and feeling like a big, cacophonous symphony, and the story is that one of my training-program mates gave me a copy of Rappaport’s 1986 book called Creating Shareholder Value, and he gave it to me for a very different – there was actually a chapter toward the back of the book.

So, he gave it – so his motivation to give it to me had nothing to do, really, with the core of the concepts, but I read that book and it was like, really, a light bulb going off for me. And it was clearly a professional epiphany, and Chapter Seven of that original book was called Stock Market Signals to Managers.

The audience was corporate executives, and the argument was: "Hey, corporate executive, you’re stocked at $50 a share. If you make investments that earn above the cost of capital, that may be insufficient for your stock to do well."

You have to do better than what the market thinks. So, as a consequence, you have to understand what the market thinks, and so I was like – you know, that was an amazing point for me to say like, "Oh, we can reverse engineer what’s priced-in, and understand where that bar is set, and then think about whether the company is likely to achieve – or not achieve – that set of expectations.

So to me, that was immediately – went right into my analytical tool bag, and I got to meet Rappaport for the first time in the early 1990s. It was a thrill for me to meet him and, by the way, we still work closely together on projects. He’s now 87 and doing great.

And then in the late 1990s, he said, "You know, we should probably try to take these ideas that we’ve been following back and forth, and really apply them formally for investors." And so, that was the birth of expectations investing.

Now I’ll say the timing of that book could not have been – I don’t know if it could have been worse. It actually came out September 10, 2001 – so a day before a national tragedy, in the middle of a three-year bear market.

Right when we signed the book contract, it was a roaring bull market and then, in the middle of a bear market – but I think that those principles have really stood the test of time. I think this idea that, as you said – I mean, you go reverse engineer expectations. It takes a lot of the onus off of you making all these pinpoint precision forecasts, and just allows you to understand, basically, the over-under – and that’s a lot more tractable problem for most people to try to think about.

And you know, you can incorporate that with some other ideas like "base rates" and so forth, and you have a really robust way of thinking about probabilistically whether particular investments are likely to pay off.

Dan Ferris: I’m glad you mentioned base rates. I feel like that’s one of the most important things – well, I keep saying this. I feel like I’m talking to Howard Marks. You know, he wrote this book, The Most Important Thing.

It’s got 18 "Most Important Things," and Michael Mauboussin is the guy with, like,100 "Most Important Things," but base rates is definitely one of your most important concepts. Do you agree with that? I mean, that’s really one of your big ones.

Mike Mauboussin: I do, and by the way, these are – this is – you know I wish I could take claim to any of these ideas. None of them are mine, but base rates is an idea that I learned about primarily through Danny Kahneman. And you know, it’s this idea that when we solve problems, we usually use what he calls "the inside view," which is you know, "we gather information, we combine it with our own experience."

We combine it with our own views of the world, and then we forecast – and in finance, that’s the common way to do things. If I said to you, "You know, Dan, what do you think? You know, go analyze IBM or something, you know?" You do what most people do.

You read a bunch of stuff about it, you build a model on it, and so forth. The outside view, or this application of base rates, basically says "let me think about this problem in the instance of larger reference class."

You know, let me ask what other people – what happened to other people when they were in the situation before – and it’s a very, very unnatural way to think about the world for a couple of reasons...

First is: You have to leave aside your own views of things and leave aside your own experience – and we tend to place a lot of weight on our own subjective views of the world.

And second is: You have to find and appeal to the base rate, and usually, base rates are not at your fingertips. It’s unlikely. In the world of finance, we have a lot of information about corporate performance but really, you know, if I said to you, you know, "What is the distribution of growth rates or revenues for a five-billion-dollar company?" You know, you’re not going to have that number at your fingertips – or that range at your fingertips.

So, I think the – you know, the argument that Kahneman made. And Kahneman and Tversky – even back in the 1970s – was the thoughtful integration of the inside and the outside views.

So, your own views, along with base rates, is a very, very powerful way to think about many things in life, and by the way, the first time I met Danny Kahneman – which was a real thrill for me and that was 2005 and I – he gave a little presentation.

And the term that he used was this concept called "discipline intuition," and the argument was that you should always start with the base rates, and then introduce your own views of things.

And – but you know, not the other way around. It shouldn’t be your own intuition, and then introduce the base rates, because then you’ll be more biased – and I’ve always found that to be very, very powerful.

So, I think the idea of base rates – and by the way, the application to finance is extraordinary – not just in thinking about the likelihood of corporate performance, but there’s actually another whole set of keys here that are really fascinating which is: Understanding base rates really gives you extraordinary insight into regression toward the mean, and if you talk to any investor (certainly any value investor) they’ll –

Dan Ferris: Michael, I’m going to interrupt you because I’ve been a bad host. Let’s tell our listener what base rates are, and then talk about mean reversion.

Mike Mauboussin: Oh yeah, so that’s my – that was my fault, yeah.

Dan Ferris: So, base rate will basically say you’re going to look at the performance that’s happened in the past for a particular thing. So, as I said like, you know, ask what happened when other people are in the situation before.

Let’s give a concrete example: So, let’s say you’re looking at a company with – I’ll make this up – with $10 billion of revenues, and you want to know what is the likely growth rate of this company going forward.

Right? So, and let’s say – we’ll say five-year growth rate. So, the base rate would say: "Let’s look at every company that was started – that started with $10 billion of revenues – and let’s look at the distribution of those growth rates."

You know how – what percent grew at 25%, what percent grew at 20%, 15%, and what percent shrunk, and so forth. So, you have – you can imagine almost like a bell-shaped distribution of growth rates for those companies.

So, a base rate is essentially a record of what’s happened in the past, and another example would be mergers and acquisitions. Company A buys Company B. You know, in those kinds of deals, what percent of the time does Company A’s stock go up, what percent of the time does it go down, by how much and so forth.

Right? So, it’s basically looking at history to understand or get a sense of what might happen in the future.

Dan Ferris: Okay, great, and then you were about to talk about regression to the mean as being –?

Mike Mauboussin: Right, so this is a – it’s a really powerful way to understand regression to the mean because, you know, when you go into the math of all these things, you start to understand that some – when there’s a lot of skill in the system, there’s a lot of so-called persistence.

What happened before is likely to happen again. You know, you and I run a sprint against Usain Bolt – it doesn’t matter what your former track record is. He’s going to win those races every single time, and there’s no regression. There’s no change.

By contrast, if it’s an all-luck activity, there’s a ton of regression toward the mean. In fact, if you win the lottery last – yesterday, there’s no reason to believe you’ll win tomorrow.

And so as a consequence, understanding where things fall in the luck-skill continuum – and base rates help us understand those things, allow us to understand the rate of regression toward the mean. Not just that it happens, which it does, but the rate at which it’s going to happen.

So, it’s a very – it’s a very, very powerful mental model, and then she said like the most important thing. If you had asked me if I could teleport myself back to my younger-analyst self, and I could give one mental model, it would be the base-rate idea. I think it’s the most powerful idea that is underutilized in the financial community.

Dan Ferris: Yeah, so talking about regression to the mean, like we could think about, you know, the market return as being the mean. And if we do think about that, like we know that most funds, you know, don’t perform as well as the market, and probably most individual investors, if we look at the DALBAR study.

So, we’re mostly – most people are doing worse than mere luck, right? In the stock market. And it seems like most people have no business being in the stock market because they can’t even seem to revert to that basic, mean-of-the-market return.

Mike Mauboussin: Right. Well I’d say – so first of all, I would just say first of all, that for most investors who, you know, are certainly not inclined or don’t have the time or energy to try to either analyze these companies and buy stocks themselves, or identify managers who they think could do it effectively – those people should index.

Right? And I think that – that’s obviously – that message is out. Huge amounts of flows have gone into index funds and ETFs, and for the most part, that makes a lot of sense.

Now just to take a pause – for a moment, just to state the obvious: That can’t go on forever. Right? So, active managers do two, really-important things for the world.

First is, they promote price discovery, which is a fancy way of saying they gather the information that’s relevant, and they make it reflected in prices, right? And that’s – so essentially, they make prices efficient and that’s a really important activity. That’s societally very valuable. Okay, so that’s a big deal, and the debate we have to have is what percent of all money run has to be active for that function to be provided, and that’s – you can talk about that a bunch of different ways, but that – the active management’s not going away.

And then the second thing is, that active managers provide liquidity, and liquidity is a very – you know this idea of liquidity just means you can translate it. For example, stock into cash or cash into a stock with very little cost or little friction.

And liquidity is important, especially at certain points in the cycle. So, active managers do provide vital roles. I do think that if you look at active managers in general, they tend to do a little bit better than the stock market overall – but that is offset by the fees that they charge, right? So, they come out probably pre-fee a little bit better, and then post-fee – a little bit worse. So yeah, most individuals probably should be indexing.

Now, the interesting question that I think we’re facing now in markets are these open questions. And I’m not sure I know the answers personally, but the fact that people are moving so much money into index funds and ETFs – does that create distortions?

And the distortions that would probably come to your mind are – one would be valuation distortions, right? Because every – you’re just buying a basket of securities – you’re paying no attention to the fundamentals. And you know there was early evidence, for instance, that one of the ways we could try to isolate that effect is stocks that would go in and out of indices.

Right, so S&P 500 as a certain number of companies – and takes a certain number of companies out – does that affect the valuation of those businesses?

I think the early evidence was that – that did affect them. I think there’s less of that now, but that’s an interesting one. The second is are there greater correlations?

Right, because one of the benefits of diversification is you buy companies at different exposures – and if they’re not correlated with one another, you get the benefits of diversification.

But if you’re dealing with baskets or indexes, the question is: "Is correlation – do correlations rise?" In which the benefits of diversification become less pronounced.

And the third one is – again, goes back to the same thing – it’s this idea of liquidity, right? "Does it affect liquidity, the fact that most people have this money locked up in these things and there’s less to trade out there?"

By the way, all these things I think are – people have talked a lot about them. I think that they’re even more pronounced in a bond market than they are in the stock market. But I think there’s a very active, ongoing research on all these topics, and I think that – I don’t know all the full answers on those things.

So yeah, my advice to people would be that they should probably – they probably should index if they’re not interested. But the fact is that there are still opportunities for people – for active managers by definition. And I’ll just do one slightly academic thing: There was a really famous paper written in 1980 called The Impossibility of Informationally Efficient Markets. It’s Sandy Grossman and Joe Stiglitz, and the argument is pretty straightforward.

They say markets can’t be perfectly efficient, and the reason is that there is a cost to gathering information and reflecting it in prices... and so long as there is a cost to doing that, there should be a benefit in the form of excess returns.

So Lasse Pedersen, another finance professor, has got this clever term. He says markets are "efficiently inefficient." Right, there has to be enough inefficiency to encourage active managers to go out and try to find those inefficiencies, and take advantage of them, but they can’t – there can’t be a lot of $20 bills or $100 bills lying on the sidewalk.

So it’s a really interesting set of questions. So the punch line is though – and the active management world is not going to go away but for most people – and by the way the other thing is indexers are free-riders.

Right, they are free-riding off the active managers, in terms of price discovery and I have no – I have no problem with free-riding, but I think we should be clear about what it is, and call it out for what it is.

Dan Ferris: So, let’s come at this another way with another study that you discuss – and I’m sorry, I can’t even remember which book. I have – like all your books and I get them confused sometimes [laughter] but it’s the one with the brain-damaged subjects and the normal subjects.

Tell us about that – and I have a very specific question about that – but tell us about that.

Mike Mauboussin: Yeah, and I think that study mostly related to loss aversion. So, the set-up is: You take a group of people who are – who have brain damage, and the key is that they have a very specific type of brain damage. So, they’re often stroke victims. So, they can do mathematical calculations very well. They have normal IQs and so forth, but the part of their brain that’s damaged is – that relates to emotion. So, they’re emotionally sort of flatlined – they don’t really feel fear, or greed, or anger. They just don’t have a lot of emotional pulse, and then you compare them to people who are normal – so people off the street. And the way this experiment was set up is: You were endowed with $20.

So everybody’s got $20 up front, and then you played a game where the researcher would flip a coin, and if you called it right or it came up tails – whatever it is – you would get $2.50, and if you called it wrong, you would lose your – okay.

So you hand your dollar over to the researcher and then they flip the coin: $2.50 if you got it right, and you lose your dollar if you get it wrong. Now each round of the game, you could do one of two things...

You could either hand your dollar over, and then have the coin flip, or you could just keep it and just go to the next round, right? So there, you were guaranteed to keep your dollar.

Right, so that’s the set-up and you know, you don’t have to do a lot of math to understand that you should hand your money over to the research, right? Because it’s a $1.25 expected value, right? 50% times $2.50 versus losing your dollar.

Right, so you should hand your money over to the researcher, and the goal of the experiment is to have the most money at the end, right? So it turns out they do this experiment, and the brain-damaged people end up with 13% more money than the normal people – which by the way, in 20 rounds of the game, is actually a pretty big margin of difference.

And the key, when they sort of unpacked it, was that the brain-damaged people played many more rounds than the normal people did, and in particular, they played twice as many rounds after having lost.

So I think the psychology of what’s going on here is that you’re a normal person – and by the way, the first few rounds of the game, everyone got that they should hand their money over, so they all do this.

But you’re a normal person and you lose two or three times in a row, and you start to say, "You know what? I’m seeing my bankroll go down, this doesn’t feel good, right?"

You say, "Maybe I’ll just sit out a couple rounds. I’ll keep those dollars. I’ll put them back in, and then I’ll play when I feel better, right?" And so you think about the stock market environment that, when people suffer losses, they will willingly turn down obviously-net-present-value-positive investments. That’s the basic moral of the story.

So you think about the first quarter of 2009, right? We’d been through a horrible fall of 2008, the markets are down sharply. Most every who’s involved has lost money. We don’t really know where the bottom’s going to be on all of this stuff.

Mathematically, you’d say, S&P is at 670, earnings power is, probably you know, $70 or $80. You know the math of whether – and risk premium went through the roof.

The math of whether the market was compelling was pretty straightforward, although you just suffered through a horrible period, and most people felt that they should not get involved with the market, right? Or even pull their money out of the stock market.

Right, so the brain-damaged people not suffering from that same set of inhibitions basically says "I just get that it’s good NPV, so I’m going to – "net present value" – so I’m just going to basically go for it.

So that’s that study, and the moral of the story is not to say that you should be emotionally flatlined throughout your life, but to say more. That understand that your emotional state will affect your assessment of an investment opportunity, and in this case we had one that was overtly, mathematically, straightforwardly positive, and people still chose not to play because they were – they were stung by recent losses.

So what was the question you were going to ask, Dan? You got something specific on that?

Dan Ferris: Well actually, maybe it’s not a question. I just – it struck me.

Mike Mauboussin: [Laughter.] Or comment.

Dan Ferris: It struck me. Yeah "comment," sorry. So it just struck me as really, really – the salient feature of that whole story is people with – you know brain damage, people without the emotional engagement of so-called normal people bet twice as often after a loss, and that really – it’s one of the things that tells me, like okay, you say most people should index and when I say most people shouldn’t be in the stock market, I think I’m effectively saying that.

I’m saying that they shouldn’t be actively managing their own account, buying and selling individual securities, for that reason, because if you’re – if you’re just a regular, normal human being, like being a normal human being has kind of set you up for failure, it seems like, in the stock market, which is a little crazy because everybody’s in it [laughter.]

Mike Mauboussin: Right, and you mentioned before briefly, this DALBAR study, and I’m not sure DALBAR’s the best of this but there does appear to be a gap in returns, and just take one little step back.

You know, it’s an interesting – and I think Jack Bogle, the great Jack Bogle talked for a bit about this. So it turns out that if you look at the average, you know, you look at the stock market does some rate of return over time, look at the average active mutual fund does a shade below that, mostly because of fees, but if you look at the average individual investor, they do substantially worse.

They do something like 60% of the market’s returns and this is – people call it the investor gap, right which is – the reason is they tend to buy high and sell low.

They do the opposite of what they’re supposed to do, and one of the points I always like to make is that these numbers vacillate over time, and I think actually they’ve improved over time but you know historically, folks like Jack Bogle suggested that number could be as high as 100 – and DALBAR numbers are higher but I think with a good methodology, something like 120 basis points per year.

Now in a world where you know, a reasonable, nominal return for the stock market is probably – I don’t know, seven, eight percent, whatever the number would be, 120 basis points, 1.2 percentage points is a lot.

Right, and so this is not a sort of a – we obviously say gave it through the lens of an experiment but this is not – this is real life because when you lose 120 basis points per year, compound that over 10, 20, 30 years, that’s a substantial differential, and terminal wealth is a consequence of that.

So you know, avoiding some of these mistakes can be, especially when you consider the role of compounding can make a huge difference in people’s outcomes and their lives.

Dan Ferris: Yeah, so you have a really good technique for helping people kind of get over some of this called a decision journal. What is that?

Mike Mauboussin: So I mentioned when I talked to Kahneman the first time, you know, he mentioned this discipline intuition. I also that day asked him for the one bit of advice he would give to a manager, an investor and he said – you know, without like hesitating he said you should have just a journal of your decisions.

And so the argument is that when you make a consequential decision, you should write down what you expect to happen, why you expect to happen. You should also note how you feel, physically and emotionally about the decision.

And then if possible you should – when you talk about your expectation, you should express those things in probabilities, not words, like I think there’s a good chance that XYZ will do that but rather in probability, the actual numbers.

And the argument is that this allows you to give yourself honest and accurate feedback on your decisions. Right, so what happens is you make a decision, and whether it turns out well or turns out poorly, and whether it’s well for the – good for the right reasons or good for the wrong reasons, or bad for the right reasons, or bad for the wrong reasons, you tend to make up a story that puts yourself in a good light.

I mean you tend to – you justify things that turn out badly or whatever it is, and so when you’ve written it down – and by the way, typically, there are two things that come into play.

One is called hindsight bias, is you think you knew what was going to happen with a greater probability than you actually did, and you haven’t written it down, so you can’t prove that one way or another, and the other is this concept called creeping determinism, which is you start to think you knew what was going to happen whether – I mean you thought to what was going to happen is inevitable in some way.

So the journal allows you to keep track of your forecasts, keep track of your thoughts, and to give yourself honest feedback, and I think one of the things that has been demonstrated in psychology and a lot of other fields is that timely and accurate feedback is what allows you to get better at what you’re doing.

So timely and accurate feedback for forecasting allows you to become a better forecaster, and there’s a lot of good evidence to support that.

So I think the journal is that, is a way of being – it’s not overly – it’s not expensive, it’s not time-consuming but you need discipline, right? To just make sure you’re jotting down what you think is going to happen, why, how you feel, and what the probabilities are, so that you can keep track and have a means to give yourself accurate, timely feedback.

Dan Ferris: That is such a great suggestion. It’s such a simple thing that I’m betting most people within the sound of our voices won’t do it, but it’s one of those things that it’s so powerful and so simple that people hear you say yeah, just keep a decision journal, and it’ll have this great effect on your decision-making.

And they say really that – you know, people want something sexier but in this case, that’s it. All you have to do is keep that journal and you’ll see your thinking slapping you in the face.

Mike Mauboussin: Yeah, a lot of this stuff for decision-making, to improve decision-making is actually pretty – pretty straightforward, maybe even slightly boring stuff.

And I’ll also say that – just to be more concrete about this is that, you know a lot of the – a lot of – some of these techniques were developed, for example in scoring systems for probabilistic estimates and so forth. They were developed, for example, for meteorologists, right, so people forecasting the weather.

And the one thing we – and this has also happened in medicine and so forth – and what we’ve seen consistently is when people get that feedback, they get better – and this is something we can quantify. They get better at it.

So if you say "I want to get better at what I’m doing in probabilistic forecasting," this is just – it’s just a very straightforward technique – but it has been – it’s got – it’s tried-and-true in terms of a performance enhancement.

Dan Ferris: Speaking of medicine, how do you feel about checklists?

Mike Mauboussin: Huge fan of checklists, by the way, and Atul Gawande wrote The Checklist Manifesto. I know you're based in Baltimore. A lot of this is based on work that came out of Johns Hopkins.

So now, I will just say my practical experience with checklists in investment organizations is that they’re not always super-easy to implement, and I think part of the reason is that investment professionals often feel as much as anything as if they’re artisans.

Right, they’re sort of – there’s a bit of judgment... a lot of judgment that goes into what they do. So, I have found that where checklists tend to be most effective is on almost the technical aspects of how you do analysis.

So let me be a little bit more concrete. You know, I think if you developed a checklist for how to estimate the cost of capital, a checklist for how to calculate return on invested capital, a checklist for how to think about a company’s potential, sustainable, competitive advantage.

Those are areas that – they’re almost subcomponents to a broader investment thesis, where you want to make sure that in an organization you have consistency. You have rigor – it’s being done properly – and so that when two analysts are talking about a company whose return on capital being 15%, they mean precisely the same thing.

So I think checklists are incredibly powerful. Now look, in other domains, you know, aviation, medicine, incredible value in checklists, and once again, probably not – notwithstanding their evident power, still probably underutilized and still, we get more upside from these things.

But yeah, so I’m a big – I’m a big checklist fan. By the way, Atul Gawande... essentially everything that guy has done, the guy is just terrific. I find his – all his work – really, really fascinating.

By the way, I listened to a podcast with him a while back, and he mentioned something that – I actually went and tracked it down. It was a paper that influenced him, and it was written in the 1970s about medical mistakes, basically.

And they said – they basically said that there are two, basically reasons or mistakes, right? One is just ignorance. We don’t know how to do a certain surgery, or we don’t know how this – how to treat this particular disease.

And obviously, there’s a lot of R&D in all that, trying to reduce that ignorance gap, and I figure some of that stuff, we can talk about in the world of finance as well, but the second was – and probably more significant was people just don’t do what they know they’re supposed to do. Right, so it’s not – it’s not that they’re ignorant of it, like the checklist for the doctors, right, they know that they’re supposed to do these things.

It’s just they don’t always do them as faithfully, and as accurately, and as timely as they should. So, that’s where there’s a lot of up-side in performance – whether it’s medicine or investing or other fields – just by doing what we know you’re supposed to do more effectively. So, I think checklists are incredibly powerful.

Dan Ferris: Yeah, I’m glad you mentioned that study because I was going to bring it up because we were talking about how boring and straightforward some of these things are, and the things – you know that second thing where you don’t do what you’re supposed to do in medicine, you know. It’s just like all the basic, little things that you do in preparation for surgery, for example, you know, wash your hands a certain number of times a certain way – it’s all boring and simple but it’s extraordinarily powerful.

And I have to tell you, this has been a challenge for me in my life. You know, there are things I know that are good for me, but I think, "Oh, you know, is it that big of a deal? It doesn’t seem like it, you know, and it’s just not sexy enough. We need to figure out how to make this stuff sexy, man."

Mike Mauboussin: Yeah, so I don’t know if – and I don’t know if it’ll ever become sexy but I do think that there’s a lot of interesting work on – and I think the medicine folks, the doctors, are doing some of this which is – and it’s an interesting thing, even Dan just – and your sort of personal observation which is can you reshape or change your environment to some degree that allows you to reduce the cost of doing the things you’re supposed to do?

Right, so even in – and it’s a great example with the doctors and putting in intravenous tubes, which is a lot of where this work came from.

You know, they found that the doctors knew exactly what they were supposed to do, as you said – you know, the protocols for washing your hands and cleaning the area, and the patient, and so on, and so forth.

What they also found though is that a lot of the materials they needed – or where they had to walk – were all over the place, and so they said "you know, we put all the essential things we need on a particular cart that allows the physician to do these things." So, they create an environment where these things are right at the fingertips of the physician, and he or she can do these things like very – you know, sort of in a very structured and ordered way.

That helps a lot, so that’s what I would always say is are there – just thinking about ways to shift or manipulate your environment in such a way that allows you to – reduces your cost to implement these kinds of things.

And I think that’s a lot – I mean there’s a lot to be done with that kind of stuff, and that’s also very simple – not very sexy – but very effective.

Dan Ferris: Right. It reminds me of the study you talked about in your book Think Twice with people buying wine. The situational awareness of when the French music was playing in the grocery store – they bought more French wine.

When the German music was playing in the same grocery store, they bought more German wine and less French wine, and it’s almost like we have to learn how to manipulate our own environment.

We’re kind of – it’s this sort of recursive thing. We’re looking back on ourselves and looking at our environment and saying "how can I shape this thing around me to influence me back, you know, on me?" You see what I’m saying?

Mike Mauboussin: Yeah, definitely. I mean that’s – and that’s the thing. So yeah, you just want to set yourself up. I mean there are lots of little examples but you want to set yourself , and there are trivial things.

You know, if you want to follow a particular type of diet that prevents you from eating carbs or whatever it is, you just get rid of the carbs. You just make them so they’re not available anywhere in your environment, and that helps.

Right, because it’s not at your fingertips. So, there are little techniques like that, that anybody can employ that they can be very helpful.

Dan Ferris: All right. Well, Michael, we’re actually at the end of our time. We’ve actually gone a little over, but you’re Michael Mauboussin, so I reserve the right to go over time with you.

I wonder if I could ask you if there was one thing that you could just leave our listeners with, what might that be?

Mike Mauboussin: Well, I think that, when I think about investing – well, really anything in life, but I think about investing and I think about the quality of the investors who I admire the most – it almost always comes back to curiosity.

And I think Dan, you exhibit a lot of this as well, right? Which is just trying to understand how things work, understand different points of view, understand what people in different fields do, and how they’re effective or not effective.

I think it’s just this idea of curiosity, and if you’re curious about things, what that often leads you to do is to read... and again, reading outside of your field, and to try to understand whether there are lessons from other disciplines, mental models from other disciplines that may make you more effective at what you do.

Now I think there is a downside to some of this curiosity which is, you may – you know, you may read an article or a book or something that may not have any relevance to your day job now.

So, there may be some intellectual cul-de-sacs but eventually I just think that this accumulation of sort of mental models can be incredibly powerful.

So, to me the one thing I would leave with people is if you have a spark of curiosity, feed that as much as you can and build on it.

Dan Ferris: Excellent, thank you so much. I have to tell you, Michael, it’s been a real pleasure to talk with you. I’ve wanted to talk with you for some time, and I hope that you’ll come back and talk with us some time again.

Mike Mauboussin: We’d love to. Thanks, Dan. Pleasure’s been mine.

Dan Ferris: Okay, thank you very much, bye-bye. Okay, it’s time for the mailbag, folks. This is a fun time for me because this is where you and I get to interact. So, whatever is on your mind, I want to hear from you.

This is a really important part of the show for me. I read every single e-mail: concerns, questions, comments, politely worded criticisms. Send it all to [email protected] and I guarantee you, I promise you I will read it. I mean I even read the Russian spam e-mails, okay, and the gratuitous requests for – I get all these e-mails that I did not solicit from people who want to be on the show and sell their products.

So I read all of them, even the garbage. So, I will definitely be interested in reading your good stuff. Let's get on with it. I’ve got three of them today.

The first one is from Peter G., a long-time, very thoughtful, intelligent correspondent. Peter G. says, "Hi Dan, I’ve been reading your Digest essays for the past week, and I have just one question: What about Steve’s melt-up thesis? What you say, and I’m not saying you’re incorrect, directly contradicts Steve’s thesis with regard to a buying frenzy before the fall – before the fall of the market, not the fall of the year – or maybe he does mean the fall of the year."

I haven’t been following exactly what Steve’s saying up to the minute, but in other words, Steve has this melt-up thesis. He says the stock market’s going to melt-up before it falls and I’ve been – in my Digest essays in the past week, or so here – I’ve been kind of bearish... real bearish.

I’ve been telling people to be worried about debt markets, and overpriced equities and stuff. So, he says I directly contradict Steve. Actually, what I’ve said – and I said this in public a couple of times in a couple different places.

What I’ve said is that a melt-up would not surprise me at all and Steve, we’re doing something a little bit different. Steve has a melt-up script. He says you know, there’s a script, and in a script by its nature, it tells you what happens next, you know, exactly what happens next.

And Steve says well, know, next comes the melt-up, and for me when I see a melt-up, that’s going to confirm to me that we’re in Crazyville and that the crash – the 50 to 60% crash in the S&P 500 that I expect in the next few years is coming, but you’ll notice I’ve said in the next few years.

I don’t know if it’s 2019, 2020, or 2024. I really don’t know. I just know that when things have gotten like this in the past, they’ve been followed by really terrible returns from that moment for the next several years like when you – which is another way of saying if you buy at the peak when valuations are really stretched, you’re not going to make any money for a long time on that investment.

And I think that’s where we are now, and the market tends to correct those things by punishing the valuation the other direction – making them way too cheap. In other words, making stock prices fall and bond prices too – some of this junky debt that I’ve been referring to in these digest essays that Peter G. is talking about.

So, that’s my comment. I don’t think I directly contradict. I’m just talking more about the end of the – this looking like the end of the cycle and at some point, it’s really going to fall apart.

Steve says "yes, at some point it will fall apart," but before that happens, we usually get this huge melt-up and he doesn’t think we’ve seen that yet.

So, that’s it. That’s the difference. I think it’s substantial enough that I’m not maybe directly contradicting but I can definitely see how you interpret it that way.

And you know, Steve can be wrong, I can be wrong. Steve’s got a good track record with this stuff. I have a decent track record with staying, "Holy hell, this is – there’s a lot of risk out there right now."

One time in my entire career, I said it’s a good idea to buy put options: October 1, 2018 before the market lost 19% in three months, and you know I got crazy concerned, April 2008 and said the crisis was going to get really bad, banks were going to fail, dogs and cats living together, mass hysteria, and it happened.

Okay, next on the mailbag, number two, this is from Eric J. Eric J. says, "Dear Dan, thanks for having Annie Duke on the Investor Hour. She was FANTASTIC (in all caps). Her interview and the one previous interview in second-level thinking has influenced me to think differently. I really find this educational and enlightening. I would love to hear Annie again in the future."

I’m not sure which interview he’s talking about on second-level thinking. I think we might have talked about that with Tim Price. Yeah, I’d love to hear Annie again in the future.