Taking a Bullish Stance... on Human Progress

In This Episode

The last time Dan Ferris chatted with hedge-fund manager (and Stansberry Investor Hour fan favorite) Kevin Duffy, the bull market was swelling as young retail investors pursued heavily shorted “meme stocks.” Since then, Kevin says, “the mood has changed quite a bit.”

It’s a much darker period now… with a slumping market, roaring volatility, a hot war in Russia, a cold war in China, an uptick in inflation, and a snarled supply chain.

But despite how much the world and investors’ moods have changed in less than a year, the editor of The Coffee Can Portfolio remains steadfast in his newsletter’s investment philosophies: to be selective, contrarian, and patient.

In this week’s interview, Kevin – who has been in the game for more than 40 years, from buying his first stock at age 13 to shorting heavyweights in the housing and credit bubbles –shares his unique perspective on today’s investing atmosphere.

He and Dan discuss everything from the stocks, commodities, and inflation concerns that are shaping today’s financial environment to the cultural shifts caused by pandemic-accelerated digital revolution and Disney’s employee walkout.

Amid market regulation, “woke culture” leaking into the financial sector, and even the possibility of China positioning itself to be the “hero” of the Russia-Ukraine war… Kevin urges you to maintain optimism.

He recommends seeking opportunities within seemingly “uninvestable” stocks, treading with caution around companies that seem to push “government-fueled narratives,” and viewing booming trends like renewable energy and electric vehicles with a critical eye instead of jumping right in with the rest of the crowd.

Kevin admits we have a long way to go in achieving true freedom and sustained human progress. But as ever, he remains a long-term optimist…

[W]e have two impediments to human progress… One is bad ideas. The other is bad DNA.

We still have this DNA that’s about the crowd – herding, tribalism, contention… Your neighbor was a threat to you because resources were scarce. But now, social cooperation is bringing about more resources. So these impediments will go away over time.

The other is bad ideas. The ideas of socialism have to fail over time. But as they do, human beings will wake up and realize that they can do away with this and be a lot better off for it.

Featured Guests

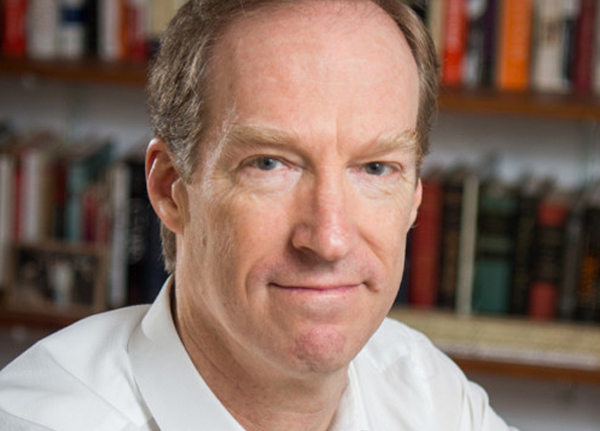

Kevin Duffy

Co-Founder of Bearing Asset Management

Kevin Duffy co-founded Bearing Asset Management in 2002 along with Bill Laggner. He and Laggner were vocal critics of the 2007 credit bubble, shorting many of its most aggressive players including Countrywide Financial, Fannie Mae, Citigroup, and Bear Stearns. Prior to Bearing, Duffy co-founded Houston-based Lighthouse Capital Management in 1988.

Episode Extras

Announcer: Broadcasting from the Investor Hour studios and all around the world, you’re listening to the Stansberry Investor Hour [music pays]. Tune in each Thursday on iTunes, Google Play, and everywhere you find podcasts for the latest episodes of the Stansberry Investor Hour. Sign up for the free show archive at InvestorHour.com. Here’s your host, Dan Ferris.

Dan Ferris: Hello and welcome to the Stansberry Investor Hour. I’m your host, Dan Ferris. I’m also the editor of Extreme Value published by Stansberry Research. Today, we’ll talk to Kevin Duffy. When Kevin and I get together, you never know what’s on tap, but it’ll be great I’m sure. In the mailbag today, just one lone question about the Hycroft mine and AMC Entertainment. And remember. You can call our listener feedback line: 800-381-2357. Tell us what’s on your mind and hear your voice on the show.

For my opening rant this week, one more time I will talk about AMC and the apes. That and more right now on the Stansberry Investor Hour. [Music stops] All right. Why do I want to talk about AMC and the apes again? I think there’s a point about this that deserves to be made. Maybe it’s obvious. Maybe [laughs] I’m the one who’s kind of behind the curve on this.

But just for a quick refresher before we get to that, AMC Entertainment is the movie theater company that recently invested – on March 25, they announced an investment in the Hycroft Mining Corporation… which their only asset is the Hycroft mine located in the Nevada desert near – it’s actually near where they have the Burning Man arts and music festival, and it’s not far from a little ghost town called Rhyolite which they’ve used for some films. They used it a lot in the ’80s and ’90s. So this gold mine out in the desert, it’s been shuttered… it’s been shut down since November – last November 2021 – and it is – they declared bankruptcy in 2015.

It operated in the 1980s and 1990s but it’s never been right over the past decade or so. It’s been an uneconomic resource. They haven’t been able to mine it profitably. They shut it down in November. The company’s stock – the company went public via SPAC in 2021. And the thing peaked at $16 and it was like 30 cents [laughs]. And then AMC announced an investment in it and it went up to, you know, well over $1.

And the point is here that AMC is investing in a gold mine. And that is totally inappropriate. And not only that but they’re investing in a shuttered gold mine which also – if you read all the filings and documents – doesn’t appear to have any reserves, right? Reserves, the definition of reserves, is the economically minable portion of a resource. I don’t doubt that there’s a massive gold and silver resource there, right?

Millions of ounces of gold… hundreds of millions of ounces of silver. But I do doubt that [laughs] it can be mined profitably. Because it hasn’t been in a long time. The Hycroft mine’s just burning cash… burned $110 million last year. So, AMC is out of its depth. They don’t know anything about mining. They invested in this horrible dog that’s never going to do anything.

And the same day, the Hycroft mine didn’t announce anywhere but they just quietly made this little filing that said, “Hey. In addition to this $56-million investment by these other investors, we’re also going to have an offering for $500 million worth of new shares.” And they recently announced they had raised up to $194 million. So the share count has exploded. It was $60 million before the announcement on March 250, and now it’s $194 million. It’ll go higher.

And, you know, it’s just a really shady-looking situation to me. However, [laughs] there’s something that needs to be said about these AMC shareholders who call themselves apes. And if you go on Twitter, they’re all over Twitter. If you just type “AMC” and search for them – or #AMC, and there are many AMC-related hashtags, or just $AMC for the ticker symbol on Twitter – you’ll see how enthusiastic these people are. You know, one of the hashtags is “APESnotLEAVING,” right?

They say they’re not leaving… they’re not selling their shares. And I’ve seen many of them post on Twitter and say, “I’m not leaving. I’m not selling.” Right? Now, if you just forget about the business for a second, AMC is a terrible business. The Hycroft business is a terrible investment. AMC’s burning cash, too. And they have almost $11 billion in debt and less than $2 billion in cash… about $1.6 billion now.

And they’re making investments in crappy gold mines instead of paying down debt and trying to fix their business… which the movie-theater business is in decline. It has been for over a decade. So here we are. And there’s all this fundamental stuff that tells you it’s a terrible [laughs] investment. But there are these shareholders who won’t go away. They won’t sell. And they’re constantly saying, “No matter what you do, don’t sell. I’m not selling. Not leaving. Apes not leaving.”

Again and again and again that’s the message. So if you ignore the fundamentals of the business, you have a group of shareholders that’s – in some ways, they’re exemplary. Doesn’t every company want shareholders who are never leaving? Yes [laughs]. Yes, they do. And in fact, some of the finest companies in the world have these shareholder constituencies that will not sell. I think Berkshire Hathaway trades a lot more than it used to, but it used to be one of those where people just didn’t sell their shares.

And there are a lot of people who still just aren’t selling. And a company like Constellation, the software company from Canada – not the alcoholic beverage company from the United States… Constellation, a software company from Canada, is a huge multibagger. I mean, if you just get a chart of it, it’s just like up many hundreds of times your original investment over the past decades.

And they just keep buying these software companies. and I saw a post on Twitter that was saying, “You know, this thing just hasn’t had a 10% drawdown in a long, long time.” Ten percent. And it’s a huge, hundred-plus bagger. That’s highly unusual. How many 35% drawdowns did Amazon have on the way up? You know, like 10 or something? I don’t know. A lot.

But one of the comments about Constellation was, “Well their shareholders just aren’t selling. It’s a solid shareholder constituency because they believed deeply in what this guy has done at this company. You know? It’s an amazing business. And I think to myself, “Well the fundamentals of Berkshire Hathaway and Constellation are incredible. They’re cash-gushers. They’re amazing businesses.” And AMC is a cash burner.

But then I think, “You know, that’s the fundamentals.” And over the long term, AMC’s apes will not defeat the fundamentals. They will not. But they have already prolonged the life of the company… without question. There is – without this huge short squeeze that took place in early 2021 that pushed up the shares of GameStop and AMC and other meme stocks, I’m certain that some of them would be bankrupt by now. Because they have too much debt and they’re losing money and they’re burning cash.

And the equity should be kind of worthless at this point. And you can see – it’s crazy but AMC bonds have sold off, right? The bondholders hate the Hycroft deal and they’ve sold [laughs]. And the bond prices are down. It’s just an insane, backward thing. So the point here is that it’s actually – there’s a term for this. It’s part of George Soros’s idea of reflexivity.

And part of the thing about reflexivity is, Soros said, “You know, company’s share prices respond to the fundamentals.” Right? A company’s fundamentals stay good. You know, their sales growth… they make good return on capital and it happens over a long period of time, and the share price goes up over a long period of time. And even in a short period of time, they give a good earnings report, the share price goes up, right?

So that’s normal. But then reflexivity says, “The share price action can affect the fundamentals.” Right? It can come back around and affect the fundamentals.” And that is exactly what’s happened with the meme stocks. These highly indebted, declining, distressed companies in declining industries have – they’ve got this shareholder consistency that ran their shares up 1,000%-plus.

And the company management’s widely – wisely decided to take advantage of it and issue lots of new shares and bolster the liquidity. So the share price action changed the fundamentals. And here [laughs] we are with these groups of shareholders that are acting like they own Berkshire Hathaway or Constellation or something and they’re not selling. It is bizarre how this has worked out. and there’s no telling – I don’t know. There’s no telling how long they can keep this up.

As we speak the share prices of the meme stocks – especially GameStop and AMC – have been strong recently. So, the businesses are declining… they’re distressed… they’re not going to make it. But who knows how long they can keep this up? What if AMC issues a whole bunch more shares and, instead of making these stupid investments, they start paying down their debt?

Well, that’ll keep them alive a lot longer. Won’t it? And Hycroft mine is one of them now. That thing was dead. If you look at a share price chart before all this stuff happened, Hycroft mine was going away. It was shuttered. Their public filing said, “We have no specific plans to figure any of this out. We don’t know what we’re doing. We don’t know how this is going to turn out.”

Which it’s a shuttered mine with no reserves. How do you think it’s going to turn out? And now, the share price was 29 or 30 cents or something, and now it’s like $1.70 or so. And they’ve issued like – they had like 60 million shares? Now they have 134 million [laughs]. So just like that, boom, 134 million shares. And of course, that means they’ve raised a bunch of cash.

So they’ve got new life in them too. The share price action is now changing their fundamentals. It is crazy. But my point is, “Yes. These are crappy companies and you should not invest in them.” But you’ll never hear me tell you to short them. Because you could be standing in front for a freight train. There could be another massive short squeeze on the way that pushes AMC from the $20s back up into the $70s. And Hycroft mine could be the same way. Although, that one’s getting heavily, heavily diluted.

So we’ll see. I just wanted to point this out. It’s an amazing – it’s something you should look at and study and understand exactly what’s going on. And I don’t think you should short it, but I don’t think you should buy it either. I think you should stay away from AMC, stay away from all the meme stocks. GameStop, AMC, Hycroft mine – all of it. Well, that’s all I have to say about that. So let’s go ahead now and talk with Kevin Duffy. Let’s do it right now [music plays and stops].

Last year when most investors were watching their stocks plummet, one Wall Street legend had an unfair advantage that was identifying winning stocks with massive upside. Like Riot Blockchain before it shot up 10,090% in less than 12 months… Digital Turbine before it shot up 789% in eight months… overstock.com before it shot up 1,050% in four months… and more.

Clients have paid as much as $5,000 per month to see this kind of research. But today, you can get a glimpse at his system – the “Power Gauge” – absolutely free. It’s a new way to see which small stocks could soon be rated a buy across Wall Street and shoot up by using a secret so powerful CNBC’s Jim Cramer once said even he doesn’t want to bet against it.

This Power Gauge comes from the legendary Marc Chaikin. Marc’s the creator of one of Wall Street’s more popular indicators, a system that appears on every Bloomberg terminal in the world, and is used by banks, hedge funds, and every major brokerage site. He spent 50 years on Wall Street… survived and thrived in nine bear markets… built three new indices for the Nasdaq where he once rang the opening bell.

But today, he has turned his back on Wall Street and wants to show you how this unfair advantage works. Right now, you can get a free in-depth look at how his Power Gauge system works… a way to type in any of 4,000 different tickers and see exactly where the stock is most likely to go next – and in any type of market. Simply go to www.trypowergauge.com for your free look. Again, that’s www.trypowergauge.com [music plays and stops].

It’s time for our interview. Today’s guest is Kevin Duffy. Kevin Duffy is principal of Bearing Asset Management, which he co-founded in 2002. The firm manages the Bearing Corp Fund, a contrarian macro-themed hedge fund with a flexible mandate. Prior to Bearing, Duffy co-founded Lighthouse Capital Management and served as director of research from 1988 to 1999.

He chronicled the excesses of the Japan and technology bubbles of the late 1980s and late 1990s, respectively. The firm was later sold to Fisher Investments. Duffy bought his first stock at the age of 13. He earned a B.S. in civil engineering from the Missouri University of Science and Technology and has a passion for financial history. Austrian economics and pithy quotes. He also publishes a bi-monthly investment letter called The Coffee Can Portfolio. Kevin Duffy, welcome back to the show. It’s nice to be with you again.

Kevin Duffy: Good to be with you too, Dan. Thanks for having me back on.

Dan Ferris: Yeah. You bet. So anybody who wants to can go to investorhour.com and look at your previous episode when we talked to you the first time. But I’d like to just kind of dive into the deep end because to say [laughs] the least a few things have happened since the last time we talked.

And what I’m most curious about with you, Kevin, is – I mean, you’re allocating capital… you write about what you like to own and what you like to buy in your newsletter, Coffee Can Portfolio. And I want to know. Has anything changed for you given you know, the Russian invasion, the uptick in inflation… have you changed anything that you’re actually doing with real capital?

Kevin Duffy: I think there are a lot of things that are definitely changing. We’re slowly starting to see opportunities in the growth area. So I think if we go back, you know – let’s say back to the peak in the meme stock madness of last year the economy was opening up and there was a lot of giddiness about the economy was going to do the best since the 1950s. And inflation was not really on the horizon. The vaccines were coming. The economy was reopening. All was good.

And then you had everybody kind of locked down and gambling in the stock market. and you had this crazy blowoff. Well, we’ve really come kind of full circle on that. And so, we’re starting to see – there’s been – even though the stock market, the S&P’s down 6% from its high… the Nasdaq 100 is down 12%. And we’ve kind of moved into this dark period with what’s going on in Russia… the hot war. We’ve got a Cold War in China. We’ve got supply chain issues, inflation – so there’s a lot more – the mood has changed quite a bit.

Yet there’s a complacency in terms of what’s going on, I think, in Russia and economically things are about as bad as they get. And yet, below the surface, there’s been tremendous damage. And so, you’re seeing – if you kind of look from the top down, it looks – it’s still – things are very negative. and yet, from the bottom up as a stock picker, I’m starting to get a lot more excited about what’s going on.

Dan Ferris: Yeah. You mentioned growth stocks, and I think one of the stats that kind of makes the rounds on Twitter in places – I think it’s something like more than 50% of the Nasdaq is down more than 50%… or even could be more than that, like 60% or 70% – but some huge amount. So it’s hard to believe that there’s not some kind of an opportunity there, right? That sounds like what you’re alluding to.

Kevin Duffy: Yeah. And there certainly is – and, I mean, what I do is I do screens… I look at a number of stocks on my radar. I’ve got different trends that I’m looking to and kind of boxes to check off. One of those is location independence… the Digital Revolution. So looking at a stock like Zoom. You know, which is right in the middle of that.

And during the lockdown, of course, that was a highflier. The stock got into the $400s. And it got recently down to, I think, under $100. Now, these stocks have rallied quite a bit over the last week-and-a-half or so. They’ve really bottomed. But a stock like that is actually starting to look kind of interesting right now.

So that’s an example. Jason Goepfert of SentimenTrader, he had some indicators on the damage in Chinese Internet stocks and the CSI Internet index that’s used in the KraneShares KWEB ETF… for a period of 17 days, there wasn’t a single stock in that index that was above its 200-day moving average. You know? So we’re definitely seeing some pockets that look interesting on the growth side.

Dan Ferris: I wonder if Alibaba is an interesting name to you. And I ask because, as you know, it’s an interesting name to Charlie Munger of all people. And I something yesterday where they’re buying back – what was it – $25 billion worth of stock… which you could say the same thing like about Microsoft and Apple and all these. But they buy back [laughs] near the highs… and Alibaba’s been creamed and they’re buying back, which I find that very interesting.

Kevin Duffy: Yeah. You know, I find it interesting too. I mean, Alibaba is – it’s like the “Amazon of China.” They are I think the main cloud provider and e-commerce company. And, you know, this stock is trading at I think 12 times – 13 times forward earnings. And if you just compare it to something like Microsoft that’s trading at 28 times forward earnings – and I would venture to say the prospects for Alibaba are greater than they are for Microsoft.

I think also the government has come out, and I think – you know, it’s kind of interesting what we got last year… not last year [laughs]… last week. Kind of felt like a year because a lot’s been compressed into a short period of time. But last week, JPMorgan came out and they double downgraded a bunch of these stocks, I think.

Dan Ferris: Yeah. I think they said they’re uninvestable. JPMorgan –

Kevin Duffy: Uninvestable. Right.

Dan Ferris: Like, is that a buy signal or what?

Kevin Duffy: That’s a good sign. As a contrarian when we hear “uninvestable” – I mean, we’ve heard that with Russia and we’ve heard it now with Chinese Internet stocks. That is definitely a good sign. So it is interesting how these stocks really bottomed at that time. And the government – you know, you almost feel like the government and China is sort of playing chess while everybody else is playing checkers, right? And so, they came out and they made some statements.

And it was kind of interesting. They’re basically supporting the stock market. They are essentially – they expect these regulatory moves against China to be over soon, and they’re now in dialogue with U.S. regulators regarding the ADRs as well. So that’s a lot of good news that has come out in a short period of time. I understand the stocks have run up a bit. But it’s starting to look pretty interesting.

Dan Ferris: Yeah. Run up a bit after getting absolutely obliterated.

Kevin Duffy: Yeah.

Dan Ferris: So probably more upside. I’m glad you mentioned Russia too. Because, like, Russia’s uninvestable. And now, the news on Russia [laughs] is that Putin’s going to require the, you know – his enemies are… I forget the phrase he used but going to require, “hostile states” – which certainly includes the United States – “to pay for oil in rubles.” You know? I mean, it’s like, “Two can play at this petrol dollar/ruble game.” I found that very interesting. And brilliant, of course.

Kevin Duffy: Yeah. The situation in Russia is – it seems to me like it’s kind of the – we’re getting the last gasp of the American empire that this whole policy of basically expanding NATO – that has had something to do with, you know… since, really, the Soviet Union crumbled and the Berlin Wall fell. You know, we didn’t just leave well enough alone.

We kind of kept poking the bear, and it sort of led to this. And here we plopped down in Afghanistan for 20 years and Iraq and what did we get out of it? It seems like we’re kind of at the end of this… and now this. So one of the things is the reserve currency. This is a wonderful position to have. And to have a reserve currency, you really need to be neutral.

And so, when the central bank basically seizes – I think – $600 billion of Russian assets, I think a lot of other countries around the world have got to be looking at this and saying, “Wait a minute. Do we really want to be owning government securities” – and which is a problem when you’re the government, U.S. government, and your debt has doubled in the last 10 years to $30 trillion and foreign central banks have really kept their holdings the same.

And so, you’ve got the Fed as basically having to buy up more and more of this debt. And it just seems to me like a lot of these things are really unsustainable. And it could be – it’s interesting we just talked about China. China could be in a good position here. They could come across as being a lot more neutral. They could be, you know – we’re trying to basically escalate the situation. We’re doing it with sanctions. And the Chinese are really trying to de-escalate the situation. So they can almost come across as heroes, and I think we look sort of bad on this.

Dan Ferris: Yeah. We had Kim Iskyan from Stansberry on the program recently. And he said the same thing. “Massive opportunity for China to” – he said, “It’s a massive opportunity for them to exercise soft power.” Right? And, boy, if they can negotiate through this mess that’d be major soft power. Also, I’m glad you brought up the reserve currency because that conversation was kind of kicked into gear by bitcoin… but given that bitcoin is so new, you know – it wasn’t too serious of a conversation in my opinion.

But when you can get $600 billion worth of foreign exchange just kind of [clapping sound] blacked out – like you said, in an instant – you know, other countries look at that and go, “Hmm. Would I rather own bitcoin and gold or something – you know, euros?” Anything else. “Or do I want to stay in Treasurys?” U.S. Treasurys, that is. And so, it seems to me like this is the moment, right?

And at Stansberry, we recently published that graph again where you have the – every 100 years, the reserve currency changes and we’re – whatever – 100-and-some-odd years into this one. Whatever you want to peg the date. You know? 1914, some people like… 1913. And lo and behold, this huge event is happening which directly – directly – puts pressure on the notion of the dollar as the reserve currency. You know? I feel like we’re being watched from above. You know? They’re trying to amp – the story got boring and they’re trying to make it more interesting.

Kevin Duffy: Well, and they’re hastening their own decline. I mean, I think we’re – the U.S. government is being kind of kept together with baling wire. It’s held together by stimulus checks, nuclear threats and gender pronouns. And all these things have sort of reached the point of absurdity.

Dan Ferris: Yep.

Kevin Duffy: And I think this can be a good thing. You know? I think long term, human progress has to follow a path of the expanding division of labor… it has to follow a path of free trade… it has to follow the path of decentralization and individuals interacting with each other… individual planning as opposed to top-down planning. And what we have here I think is really the last gasp of this government. And I’m not saying the U.S. government is going to collapse or anything overnight. But it’s sort of got to go into decline. And as it does, I think the private sector will expand and I think good things will come out of it. But it’s a messy process.

Dan Ferris: It is. I agree. You know? It’s beautiful, actually. Because the communists in various iterations over the past century or so, they sold their extreme top-down organization as great – literally as great leaps forward. But the great leaps forward are really these periods that look really chaotic, right? And that’s what you’re saying. I agree. It’s a good thing. It’s a good thing when things that don’t work cease to be and are then replaced by something that hopefully will work better. And it’s odd too. You know, this is a good time to be a stock picker depending on what you’re looking at. It’s an exciting time.

Kevin Duffy: Yeah. It really is. I think that is what kind of gets me excited right now, is you can focus on all the negatives – and I think to deal with that, you really have to look at the big picture. And if you look at the hockey stick of human prosperity and you look at what the impediments are, you know – human beings are incredibly resilient a d they will figure out a way. It’s like, you know – what was it? Jeff Goldblum in Jurassic Park? You know, “Nature finds a way.” Water runs downhill.

And we know what direction it takes, and it’s just a matter of getting the government out of the way. But right now, it’s a really interesting time as a stock picker because, over the last five years, we’ve had about $1 trillion flow out of U.S. equities out of active equities and into passive equities. And so, we’re getting this disparity, right? You look at – like for example – Nike versus Skechers. We own Skechers in the Coffee Can Portfolio and it’s the stock I mentioned on the first time I was your guest.

And these are similar companies… obviously, Nike is a lot bigger. It’s about seven times the size of Skechers. Skechers trades at 11 times forward earnings and Nike trades at 28 times forward earnings… 27 times. Something like that. Nike’s in the S&P 500 and Skechers is not. OK? And yet, when you look at these two companies you see Skechers, I think, is the number-three casual footwear brand in the world… it has a kind of a very slow-growing business that generates a lot of free cash flow in the U.S., but the action is really overseas.

It gets about 2/3 of its business from overseas, and most of that is in Asia. So they have a strong presence in Asia. So we were talking about China… talked about the Chinese middle-class. This is an opportunity to take advantage of that. And you look at stocks like this from the bottom up that are really interesting. You know, you also look at – I tend to look at risks as well.

And one of the risks here is that we have this Cold War going on in China and you have very visible companies like Nike that are also getting involved in – they sort of adopt these “woke” cultures. and I think this is a risk that investors aren’t really talked about that much. And I see that as a problem. I don’t see that as really being compatible with, let’s say, the Chinese consumer. I’m not sure that they relate to these things so much.

And Nike just reported a couple days ago, and their sales in China were actually down slightly. You know? And this is at a time when – I know Skechers is growing in China. I’m not sure what the rate is, because they don’t break it out. But you look at a company like Anta Sports – which I believe is the biggest sporting goods retailer in China – they’re growing at 20% a year. So what’s going on with Nike?

Dan Ferris: Yeah. You know, like, I sort of accept all kinds – you have to accept all kinds of things… especially the larger companies, right? And so, a little bit of woke language in some filings or whatever – we kind of accept it, right? But we saw something just in the past few days here that is making me really wonder about that. And I’m glad you brought it up.

And it’s this letter from Disney employees who would characterize themselves as conservative… painting a picture of working at Disney as being really an awful environment because they would say their progressive coworkers are just downright abusive they push their political agendas using company resources on company time, and they generally treat their conservative coworkers very poorly – according to this letter.

And I thought, “Well, that isn’t Walt’s and Mickey would not like that.” [Laughs] You know, “That’s not the Disney way.” It doesn’t seem to me. I mean they’re – it’s supposed to be the most welcoming place in the world, right? Families from kids to old people… everybody of every race, creed, color is supposed to feel very welcome there.

And to know that behind the scenes there is this, apparently – if we take this letter seriously – rather extreme level of tension. And the other thing we saw in the past couple days is that the Disney employees at the headquarters in California walked out in protest of some bill in Florida that they appeared to have completely misinterpreted. And it’s just like, “When do we get back to doing business and serving customers and not focusing on our own little political viewpoints?” It’s disturbing.

Kevin Duffy: Yeah. It really is. But I think as investors, I think this is an underappreciated risk. And I’ve got a good quote here by Nick Saban. And this is – to me, this is like mixing oil and water. And especially as these tech companies – they’re having to hire more and more people. And so, the quote here I want to read it because I think it really describes the challenge with maintaining this culture when you bring in this toxicity.

And the question was – this was on 60 Minutes in 2013. “Why are you so tough on people?” And he answered, “Well, I don’t know if that’s fair that I’m really tough on people. We create a standard for how we want to do things and everybody has got to buy into that standard or you really can’t have any team chemistry. You know, mediocre people don’t like high-achievers, and high-achievers don’t like mediocre people.”

And I think that really is the problem here that these companies are going to have more and more. I mean, I’ve talked to people who are software engineers at the big tech firms. And this used to be the Silicon Valley culture – used to be very libertarian back in the ’90s. And that’s changed.

And really, the inflection point I think might’ve been – what was it – the antitrust suit against Microsoft. You know, they have – like a lot of industries, they have been sort of corrupted by government in a sense. And it’s also this wokeness with a – obviously with the younger generation. You’re hiring younger – you know, you’re hiring younger people all the time. And so, it’s kind of insidious. It gets into these cultures.

Dan Ferris: Right. And you also – the nature of these enterprises has also created this weird quasi-governmental function of – or apparently. I don’t really think it is… but apparently. And I’m referring, of course, to Google and Twitter… Google especially with YouTube and the way they manage Search on the platform. And so, there’s this caution now about “Is Twitter a platform or a publisher or a media company? What is it?” And it’s hard for me to keep reminding myself somehow, because I don’t like it when Twitter censors people.

But it’s not really censorship because they own it, right? I mean, they own it. And if they don’t want – if they don’t want me on there for any reason, they have every right to kick me off. And yet, it feels very uncomfortable to know that this platform that reaches all around the world may be off limits to me because of a political view or something. It’s an odd world that we find ourselves in. Is it not?

Kevin Duffy: It really is. And it is certainly their right to do that. But the problem that these companies – and I think this is a risk. You know, the woke cultures are a risk. I think also – I see the government – I see this kind of inflection point with government. And you really, at this point – I think it’s important to have independence from government. And if you don’t, what ends up happening is you end up promoting all the different official narratives. You know, we’re cycling through these, right? Over and over again.

Dan Ferris: Yep.

Kevin Duffy: And at one point it’s COVID… we’re all – you know, we’ve got a war on COVID. Everybody is doing their part and then it moves to BLM. And now it’s, “We’re all going to – you know, we’re supporting Ukraine.” And look. I don’t condone anything that’s going on there. It’s horrible. But it’s always another narrative. And so, these businesses have – you kind of have to decide whether you want to try to stay neutral in all this and not tick off a big part of your consumer.

Dan Ferris: Yeah.

Kevin Duffy: Or if you’re going to promote the narratives. So we’ve seen this in professional sports, definitely… we’ve seen it in the MBA. You know, they’re constantly doing this and they’re alienating their customer. So I just see this as a , you know – it’s another risk out there that we want to be aware of.

And I would just rather find – I think if you look at companies that are not these big companies, they tend not to be in the S&P 500… they tend to be run by owner/operators who have a lot of skin in the game. So they’re sort of taking the long view. And they’re not harming their brands like I think these other companies – like a Nike – is tsking a risk. I think they’re taking a risk here.

Dan Ferris: Yeah. One of the companies I worry about with woke culture is Starbucks. We recommended it in the Extreme Value newsletter. I’ve talked about it now and then. And I noticed that once again [laughs], founder Howard Schultz is coming back. You know? He just – they can’t keep him away. He always needs to come back.

And I wonder – you know, I hope that things don’t go the wrong way with Starbucks. It’s a great business. You know? Obviously, the economics on a cup of coffee – a cup of Starbucks, expensive coffee, pretty wonderful. You know, and it’s a neighborhood gathering place and it’s got this wonderful recurring revenue. You know, faithful customer base. There’s a bunch of them in China.

And I’d hate to see that all go wrong. But let’s not talk about that anymore. I think we’ve covered wokeness. One thing I was curious to discuss with you, Kevin, is we’ve seen a lot of like commodity-based businesses and energy-related businesses just scream in the past year as the prices of things have gone up. Do you or do you not invest in commodity-related businesses? I don’t remember.

Kevin Duffy: Yes. So that is one of the themes. And part of the reason for that theme – we’ve had it in the Coffee Can Portfolio since day one… is, we’ve had this long period of underinvestment in commodities. And I think part of that is – I hate to bring up wokeness again, but it is this ESG under basically divestment of fossil fuels.

Dan Ferris: Right.

Kevin Duffy: And so this is basically a kind of detachment from reality. And what I like to do is have – when I look at human progress, I want to be long human progress. I want to have those as tailwinds. And I look at a lot of what’s going on right now in terms of government intervention as impediments to human progress. So I don’t really believe in, let’s say, front-running whatever the government is pushing. You know, whatever the flavor of the week happens to be.

So right now they’re pushing – let’s say – electric vehicles. And that’s something I would just avoid just for that matter of fact. Because I think what it’s doing is, it’s impoverishing people. You know, it’s making automobiles more expensive to the average person… it’s squeezing the middle class… it’s making it more difficult on poor people. And so I just don’t – I want to be aligned with things that are improving others’ conditions.

And so, that’s a pretty good line right there. You know, so what’s going on with commodities is, we just had this – you know, we continue to have this underinvestment. And I think it’s interesting right now that you have – the cure for high prices is high prices. We’re certainly getting high prices right now. And so, we’re going to probably get some demand destruction. We’re probably going to head into a recession. But what we’re not seeing is really a significant pickup in supply.

And I think that’s because of ESG, and hopefully that’s another pin that eventually pricks this bubble… in terms of I think people are so detached from reality right now that they – you know, we need maybe a good recession, a good wake-up call, to have them maybe question their ideology. The problem is that ideology is pretty sticky. It doesn’t [laughs] just go away overnight. And people are blinded by ideology. You know? They will just hold onto it through thick and thin.

Dan Ferris: Whether it works or not has nothing to do with it. It just feels good to repeat it. But yeah.

Kevin Duffy: Yeah.

Dan Ferris: Yeah. You know, it’s funny. I don’t want to push a conspiracy theory, but if you were trying to hurt the middle-class attacking the cheapest, most abundant transportation fuel on the planet would be a good way to do it. And unfortunately when you attack fossil fuels, that is exactly what you’re doing. You know, now we get – you know, you could probably go on the Internet right now and find 10 pictures of gas prices over $4, $5, $6, $7 all over the country. I mean, you and I can afford it, right? We’re not hurting. But, you know –

Kevin Duffy: Well, you can. I can’t. [Laughs] I used to be a short seller, “Dan.

Dan Ferris: That’s right. You’re a short seller, I’m in the newsletter business [laughs]. So yeah… you can’t afford it and I can. That’s funny. But yeah. So there’s opportunity there. And I saw something else recently. Someone said, “You know, people who are attacking fossil fuels, they’re actually harming” – you know, if they want to push renewable’s, the way to do that is not to attack fossil fuels. You know? The way to do it is to actually make renewable’s competitive – genuinely competitive – with them. And that’s really hard to do. You know?

Kevin Duffy: Mm-hmm.

Dan Ferris: If they did – and I have no – and I’m going to guess that you don’t… I don’t care. If somebody wants to generate electricity in a certain way and they buy land and they build windmills and that’s what they want to do and they want to sell their electricity on the market, I have no problem with that. You know? I also have no problem if they want to operate a cold plant.

But of course, I don’t want them to foul up the neighborhood, right? You can operate these things responsibly and cleanly. So it goes without saying. But just having it pushed on us and knowing that it doesn’t really compete without subsidies – which is to say it doesn’t really compete… that’s where I draw the line.

Kevin Duffy: Yeah. And look at what happened in Texas a couple of years ago with the freeze and… you know, what people think of Texas as this free market, electricity market, and it really isn’t. I have a friend. His name is Rob Bradley. And he founded the Institute for Energy Research. And I talked to him – he lives in Texas. And he’s a guy you ought to have on. He’s a really sort of a cornucopian when it comes to resources. And who was – what was the big bet? There was a big bet about –

Dan Ferris: Ehrlich and Simon?

Kevin Duffy: –Higher and lower – what was it?

Dan Ferris: The big bet, Ehrlich and Simon? Paul Ehrlich?

Kevin Duffy: Paul – yeah. Yeah.

Dan Ferris: Yep.

Kevin Duffy: Exactly. Yeah. So I learned a lot from him. But I remember talking to him about this. And what people forget about Texas is that they are really leading the charge in terms of wind power and solar power. I mean, if there’s any place where wind makes sense, it’s in Texas. So they were very reliant on these sources of energy… and when they weren’t available, that they had serious problems. And the problem is that these risks that you introduce into the system, they have – you know, they’re huge tail risks. So you have the loss of life, the destruction to – the economic destruction was just massive during all of this.

Dan Ferris: Now, when I think about conversations about energy and whether it should be regulated or not regulated, I’ve always gone for the latter. But I remember Munger and Buffett, maybe 10 years ago at one of the Berkshire meetings, got into a discussion about this. and they made a compelling argument that deregulating the market – which I don’t think actually happened [laughs] in California is the problem. Right? It didn’t actually happen.

But their contention was that deregulating the market created a situation where there was no incentive to create excess capacity and that electricity generation – if it’s going to work right and now create a lot of problems… it’s kind of like insurance. It works best when there’s plenty of excess capacity. And there was excess capacity when they had the regulated return and all the rest of it on the utilities. But then, they sort of changed things and then there were supply problems.

And of course, I would say that it’s not truly regulated. But they were – they talked for about 15 minutes, as I recall, about this… 15 or 20 minutes. And I thought – I walked away thinking, “Gosh. That was fairly compelling and I’m a free-markets guy all day long.” But how do we – my question, then, is – for myself and any free-market guy – are they right? It feels right to me that electricity generation is something where having excess capacity is what is going to work well.

And how does a free market incentivize that? It seems like it incentivizes it to keep the supply kind of tight. Do I have this wrong? Help me out here. Because I know you’re a free-markets guy… you think through these things. You tend to think through these things better than I do, so I wanted to run this buy you and see what you have for me, if anything.

Kevin Duffy: Oh, my gosh [laughs]. You know, I have gotten into – I did get into the California so-called deregulation. The problem is, it is complex. And I’m really the wrong person to ask that question. You know, the right person is a guy like Rob Bradley. This guy has written a book on it. He studied the history of it.

And I just know that whenever I hear a simple narrative, “This was caused by deregulation” – well, you know that that’s probably not quite correct and it just requires a little digging, and you realize, “This has nothing to do with – this is very convoluted. It is really interfering in the free market.” And you realize that the problems that got created are not free-market problems. They’re definitely caused by interventions in the market. So I think that might be a good starting point. I definitely have faith in the market’s ability to be able to handle these things. But it’s complex.

Dan Ferris: OK. We’re going to do that. I’m going to – I want to get Rob Bradley on here. I want to get him on here and talk about energy because this is one of those topics, Kevin. Isn’t it? Whenever we talk about deregulation or government or anything, it’s like roads, right? The first thing everyone, “Who will build the roads? You know, we wouldn’t have this great interstate highway system.” You know? And so, it’s an ideal topic, I think, to talk about regulation versus not. And thank you. We’re going to get him on here. That’s good. All right. So we’ve –

Kevin Duffy: Well, and if you want to – if you want to talk roads, Walter Block is the guy to have.

Dan Ferris: OK.

Kevin Duffy: He’s written a book on it.

Dan Ferris: Yeah. He’s a huge libertarian name. We should get him on too. But we’ve actually been going at it for a little while here, and it’s time for the big final question. I don’t know if you remember what it – oh, but you listen to the podcast, so you probably know what it is. But I’ll repeat it anyway. For every guest, every topic, the final question is the same. And it is simply, “If you could leave our listeners with one thought today, what would it be?”

Kevin Duffy: Well, again, I had all this time to prepare and I really don’t have anything prepared [laughs].

Dan Ferris: It’s a hard question. I do admit that it’s a hard question.

Kevin Duffy: Yeah. Like, “How do we take everything that we’ve talked about and wrap it into a little bit of a bow?” And –

Dan Ferris: You don’t have to do that. You –

Kevin Duffy: I guess I’ll just say…

Dan Ferris: Any single thought. Whatever’s on your mind.

Kevin Duffy: Yeah. You know, what’s getting in the way – this idea of human progress. What’s getting in the way of it… because you wonder, “Why is it that we’re still having – we haven’t been able to figure this out. It shouldn’t be that difficult.” That, really, freedom and free markets and the expanding division of labor and not going to war and trading with each other, social cooperation, the spontaneous order… you know, the driver of human progress is the entrepreneur.

And here we have people putting guillotines in front of one of the most successful entrepreneur’s homes in Washington, D.C. Like, something is wrong with this picture. But I’m a long-term optimist, and I think that we just have two impediments to human progress… One is bad ideas. The other is bad DNA. We still have this DNA that’s about the crowd – herding was very important to survival and tribalism and contention when we lived in this Malthusian world… which was a zero-sum world.

You know, contention – well, your neighbor was basically a threat to you because resources were scarce. But now, we have social cooperation… is bringing about more resources. And so, these impediments will go away over time. And yeah. The other is bad ideas. And, you know, the ideas of socialism, they have to fail. You know, they have to fail over time. But as they do, I think human beings will wake up and they’ll realize that they can do away with this and they’re going to be a lot better off for it.

Dan Ferris: All right. There’s a lot in there. That’s a good final thought… well, to give our listeners a lot to think about, and I’ll probably get a few e-mails. And maybe they’ll address some of this and I’ll shoot you an e-mail and you can respond. But thanks for being here. I enjoy your Twitter feed. I encourage anybody who’s listening, if you’re on Twitter, it’s KevinDuffy1929. Correct?

Kevin Duffy: Right. That’s not the year I was born.

Dan Ferris: Not the year he was born [laughs]. And where else can we find you?

Kevin Duffy: You can find my – on my website, thecoffeecanportfolio.com.

Dan Ferris: Great.

Kevin Duffy: It’s all you need to know.

Dan Ferris: All right. CoffeeCanPortfolio.com. All right, Kevin. Thanks a lot, man. I love talking with you and I like the way you think, and I’m really glad you could come back and talk with us again.

Kevin Duffy: Thanks… enjoyed it.

Dan Ferris: All right [music plays and stops]. As you can tell, I love talking with my friend Kevin Duffy. We see the world in similar ways and he always has some really good ideas about investing. And I think noticing that the growth stocks have gotten really battered down and that you should go prospecting in there is one of them. I heard some other people I respect say the same thing. And they have to be right [laughs].

It was stocks with more than half the Nasdaq down more than 50, 60% or whatever it is. There has to be a deal or two in there somewhere. So that’s probably like one of the better ideas. And then the idea of a structural kind of longer-term bull market – in commodities and energy specifically, due to underinvestment for whatever reason – is another one that I think is a great idea. Because right now, with prices having run up so much, the tendency is to want to take profits off the table… which you can do to a degree, right? Because it’s very cyclical short term and long term.

[Music plays and stops] Gold just passed $2,000 an ounce, setting the stage for a historic, new bull run. Multiple billionaire investors are loading up on gold, including hedge fund founder Ray Dalio and real estate mogul Sam Zell… meaning now is the time to own gold. One precious metals expert is stepping forward with a big prediction… he believes we could see gold reach as high as $3,000 by the end of the year – possibly higher. Find out why and get instant access to his number-one gold investment for 2022.

It’s not bullion, an ETF, or a mining stock. In the past, folks using this same gold strategy could’ve been able to make nearly 50 times their initial investment. Considering how quickly the price of gold has been moving, you don’t want to waste any time missing out on the gains he believes are in store for this investment. To get a copy of his new free report with all the details, simply to go www.goldmania2022.com. Again, that’s www.goldmania2022.com for a free copy of his new report.

[Music plays and stops] In the mailbag each week, you and I have an honest conversation about investing or whatever is on your mind. Send questions, comments, and politely worded criticisms to feedback@investorhour. I read as many e-mails as time allows and I respond to as many as possible. You can also call our listener feedback line, 800-381-2357. Tell us what’s on your mind and hear your voice on the show. I’ve got one e-mail this week, [laughs] folks.

There were a couple others but, you know, I thought this was the one that really needed to be responded to. And guess what’s the topic? The topic is AMC and Hycroft. And Alan W. writes in and says, “Hello, Dan. I always enjoy the Investor Hour podcast and don’t often send questions, but I’m really curious why Eric Sprott bought into the Hycroft deal with AMC. While the AMC strategy appears strange at best, it is hard to rationalize the interest that Sprott has in this deal.

Because he specializes in mining and special metals, etc., it’d be interesting to know what he sees in this because I doubt he often puts his money into a losing investment. Keep up the great discussions and regards. Alan W.” Alan, actually, I’m sure Eric has lost more money than you and I and everyone we know is ever going to make… and yet, he still made a ton of it. He’s known for taking large, risky bets.

And some of them win and a lot of them lose, and he in the end has become a wealthy man. My point is, this is appropriate for him because it’s a big, risky bet. But for him – I think he’s a billionaire. I think he’s been a billionaire for some time and he’s got tons of money, and this is probably one of 100 or more of these investments that he has. You know? So it’s probably not nearly as important to him as it is to AMC.

So I won’t guess at his motivations. I just have an idea about the type of investor he is, and it doesn’t surprise me at all that he’s here. It surprises me a lot [laughs] that AMC is here. One thing also, Alan. Understand Eric Sprott is an individual. He is not involved with the day-to-day operations of the company Sprott. OK? And there was another question in the mailbag to that effect… and, indeed, it is correct. You know, Sprott Inc is separate from Eric Sprott. And this investment is completely separate from Sprott Inc.

So, you know, I still think it’s a terrible investment for AMC, even – look. Even if this turns out well for AMC – even if they don’t lose money, break even or make money – that backward-looking process of saying, “Well, it turned out well, so it must’ve been a good decision” – we talked about that with Annie Duke here on the show. It’s called resulting… it’s a bad decision-making metric. It’s not how you decide what was a good decision. A good [laughs] decision for a movie theater company run by a career hospitality executive – right? He worked for Vail Resorts, Hyatt Hotels, United Airlines, and another company – I’m sorry that I don’t remember.

But all hospitality industry, and now he’s at AMC Entertainment. It’s a good fit, right? But gold mining is not a good fit. And unfortunately, he said that he’s going to look for more of these transformative deals. Well, I guess he wants to transform AMC into a steaming pot – an even smellier steaming pile of crap because [laughs] that’s all you’re going to do with these transformative deals like Hycroft.

But that’s the answer, Alan. You know, Eric probably does – I don’t know his track record. But with that style of investing, you do often lose money. I know another guy who was probably the greatest mining investor I’ve ever heard of in my life, and he told me. He said, “You know, I’ll have a portfolio of 100 stocks or more and, you know, five or six of them will literally be responsible for all the gains. You know, and a lot of them just go away and go to zero.”

So I think that’s how it works with these little mining companies. So yeah. Good question, Alan. I’m glad you gave me the opportunity separate Eric from Sprott Inc and to characterize my view of Eric. I haven’t spoken to him about this. I have met him. I spoke to him years ago. But I didn’t think it was actually appropriate to talk to him about this. You know? It really isn’t. It’s about AMC. It’s not about him.

All right. Thank you, Alan. That’s another mailbag and that’s another episodes of the Stansberry Investor Hour. I hope you enjoyed it as much as I did. We provide a transcript for every episode. We really do. Just go to www.investorhour.com, click on the episode you want, Scroll all the way down, click on the word “transcript,” and enjoy. If you liked this episode and know anybody else who might like it, tell them to check it out on their podcast app or at investorhour.com.

Do me a favor. Subscribe to the show on iTunes, Google Play, or wherever you listen to podcasts. and while you’re there, help us grow with a rate and a review. Follow us on Facebook and Instagram – our handle is @InvestorHour. On Twitter, our handle is @Investor_Hour. If you have a guest you want me to interview, drop me a note: [email protected] or call the listener feedback line, 800-381-2357. Tell us what’s on your mind and hear your voice on the show. Till next week. I’m Dan Ferris. Thanks for listening.

Announcer: Thank you for listening to this episode of the Stansberry Investor Hour. To access today’s notes and receive notice of upcoming episodes, go to investorhour.com and enter your e-mail. Have a question for Dan? Send him an e-mail: [email protected]. This broadcast is for entertainment purposes only and should not be considered personalized investment advice. Trading stocks and all other financial instruments involves risks. You should not make any investment decision based solely on what you hear. Stansberry Investor Hour is produced by Stansberry Research and is copyrighted by the Stansberry Radio Network.

Get the Investor Hour podcast delivered to your inbox

Subscribe for FREE. Get the Stansberry Investor Hour podcast delivered straight to your inbox.