Key Takeaways from the Annual Stansberry Conference

In This Episode

We decided to do something special for podcast listeners this week…

Instead of a standard one-on-one interview like we typically have on the Investor Hour, we’re letting you listen in on an extremely exclusive conversation with some of the world’s most brilliant economic and political commenters.

This is your invitation to listen in to the American Economic Panel Discussion at the Annual Stansberry Conference in Las Vegas.

Typically, it costs several thousand dollars to attend this event in-person.

But today, you’re getting a slice of the experience 100% free of charge.

The panel is hosted by Buck Sexton, along with some of the most influential and outspoken guests, such as Dr. Ron Paul, Trish Regan, John Tamny, Grant Williams, and our very own Dan Ferris…

The panel does a deep dive into many of the most pressing questions on many American’s minds, like…

How bad do you see inflation getting?

What kind of political costs could the Biden Administration pay from rising inflation?

What are the implications of the Federal Reserve creating some other version of a Central Bank Digital Currency?

And if you could speak to the current administration and give them some policy advice, what would it be?

And they don’t sugarcoat things.

The panel gives you the straight facts about the real problems facing our government and the Federal Reserve…

While at the same time, giving listeners tons of practical advice to help ensure you’re prepared for whatever’s next.

If you’re worried about the direction our country is headed, this is a conversation you CANNOT afford to miss…

Also, if you’re interested in hearing more about the Stansberry Conference, including over 60 of the highest conviction investment ideas from our editors, you still have the chance to watch the whole thing at 2021livestream.com…

Featured Guests

Buck Sexton

Buck Sexton is host of the nationally syndicated radio program, "The Buck Sexton Show," heard on over 100 stations across the country.

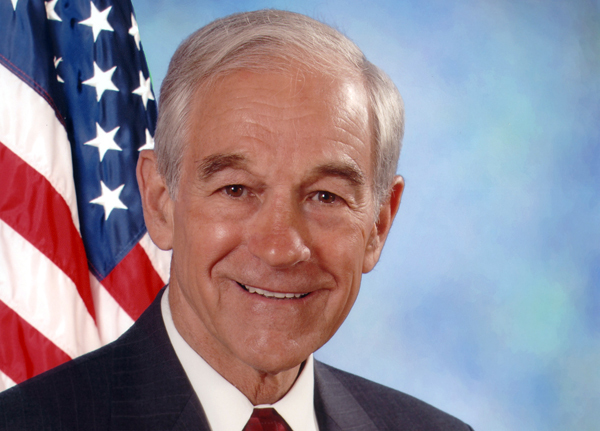

Dr. Ron Paul

Former U.S. Representative

Ron Paul is an American author, physician, and former politician. He was the U.S. Representative for Texas' 14th and 22nd congressional districts. He represented the 22nd congressional district from 1976 to 1977 and from 1979 to 1985, and then represented the 14th congressional district, which included Galveston, from 1997 to 2013. On three occasions, he sought the presidency of the United States: as the Libertarian Party nominee in 1988 and as a candidate in the Republican primaries of 2008 and 2012. Paul is a critic of the federal government's fiscal policies, especially the existence of the Federal Reserve and the tax policy, as well as the military-industrial complex, and the War on Drugs. Paul has also been a vocal critic of mass surveillance policies such as the USA PATRIOT Act and the NSA surveillance programs. Paul was the first chairman of the conservative PAC Citizens for a Sound Economy and has been characterized as the "intellectual godfather" of the Tea Party movement.

A native of the Pittsburgh suburb of Green Tree, Pennsylvania, Paul is a graduate of Gettysburg College and the Duke University School of Medicine, where he earned his medical degree. He served as a flight surgeon in the U.S. Air Force from 1963 to 1968. He worked as an obstetrician-gynecologist from the 1960s to the 1980s. He became the first Representative in history to serve concurrently with a son or daughter in the Senate when his son, Rand Paul, was elected to the U.S. Senate from Kentucky in 2010.

Paul is a Senior Fellow of the Mises Institute, and has been an active writer, publishing on the topics of political and economic theory, as well as publicizing the ideas of economists of the Austrian School such as Murray Rothbard and Ludwig von Mises during his political campaigns. Paul has written many books on Austrian economics and classical liberal philosophy, beginning with The Case for Gold (1982) and including A Foreign Policy of Freedom (2007), Pillars of Prosperity (2008), The Revolution: A Manifesto (2008), End the Fed (2009) and Liberty Defined (2011).

On July 12, 2011, Paul announced that he would forgo seeking another term in Congress in order to focus on his presidential bid. On May 14, 2012, Paul announced that he would not be competing in any other presidential primaries but that he would still compete for delegates in states where the primary elections have already been held. At the 2012 Republican National Convention, Paul received 190 delegate votes. In January 2013, Paul retired from Congress but still remains active on college campuses, giving speeches promoting his libertarian vision. Paul received one electoral vote from a Texas faithless elector in the 2016 presidential election, making him the oldest person to receive an electoral vote, as well as the second registered Libertarian Presidential candidate in history to receive an Electoral College vote after John Hospers.

Grant Williams

co-founder, Real Vision TV

Grant Williams is Author of Things That Make You Go Hmmm... and Co-Founder of Real Vision Group. He has more than 30 years in finance, during which time he held senior positions at a number of investment banks and brokers in London, Tokyo, New York, Sydney, and Singapore.

John Tamny

Author of Popular Economics

Tamny is the author of Popular Economics: What the Rolling Stones, Downton Abbey, LeBron James Can Teach You About Economics (April. 2015), Who Needs the Fed? What Taylor Swift, Uber, and Robots Tell Us About Money, Credit, and Why we Should Abolish America's Central Bank (May, 2016). Tamny's third book, The End of Work, was released in May of 2018. In it, he chronicles the amazing evolution of abundant work that rewards more and more unique skills and singular forms of intelligence. The "end of work" is near, precisely because the jobs of today and tomorrow increasingly don't feel like work.

Trish Regan

Award Winning Journalist, Host of American Consequences

Trish Regan is one of America's brightest and most recognized conservative thought leaders. As an award-winning journalist, television anchor, opinion columnist, and author, Trish brings specific insight into the issues facing the world economy and American businesses today.

Trish is host of Trish Intel - a daily program dedicated to economic and political truth. She is also a columnist for several publications, including the fast-growing, new online digital venture American Consequences. An outspoken advocate for the First Amendment, Trish stresses the importance of intellectual diversity and the ability for all voices to be heard.

Throughout her career, Trish has interviewed numerous heads of state, including multiple U.S. presidents, vice presidents, fortune 500 CEOs, and other institutional, charitable, and government leaders.

Episode Extras

1:44 – “There was a really cool chart I saw maybe a week or so ago… it showed United Kingdom data on labor stoppages – like strikes and walkouts and things – versus inflation. And it said the two correlated really well going back to the middle of the 19th Century…”

7:28 – “I think that the government really loves what it was able to do, the power it was able to get – the next thing they’ll do this with – they ran the drill with COVID and they’ll run the same playbook with climate change. They’re going to pretend it’s an emergency, which it’s not. Nothing like it. And they’ll run the same playbook.”

18:50 – Dan raves about the Stansberry Conference out in Las Vegas… “There were 27 picks for the audience, some of which you just won’t get any other way than by watching the presentation. And that doesn’t even include Matt McCall’s incredible lineup of 38 different companies that he mentioned during his presentation!” You can hear them all at 2021livestream.com…

20:53 – In lieu of a one-on-one interview, this week we’re treating you to a replay of the American Economic Panel Discussion at the Annual Stansberry Conference in Las Vegas. The panel is hosted by Buck Sexton, along with special guests Dr. Ron Paul, Trish Regan, John Tamny, Grant Williams, and Dan Ferris…

24:59 – Buck spoke with conference attendees all week, and the one big thing on all their minds was inflation. So, Buck kicks things off by asking the panel to share their thoughts on how bad things could get, starting with Dr. Ron Paul…

27:00 – “If you’re concerned about inflation, which everyone is getting concerned about, what you have to do is talk about, when are we going to audit the Fed? And when are we going to get rid of the Fed to solve the problem of inflation?” – Dr. Ron Paul

30:11 – “If inflation sticks, the Federal Reserve will have to raise interest rates, and everything – and I mean everything – from stock prices to bond prices, to real estate, to private equity is now utterly dependent on rates staying low forever…” – Grant Williams

32:24 – “Our standard of living as Americans is constantly decreasing and being depleted by this inflation. I mean it’s really pretty remarkable because it takes so much more money now to live than it did years ago…” – Trish Regan

34:25 – “This is where I disagree with Dr. Paul. Inflation is not an increase in the money supply…” – John Tamny

37:58 – “Inflation is a complicated topic and the Fed’s relationship with inflation is a complicated topic. The Fed prints a dollar of currency, they go into the market, they buy a dollar of income-producing securities. That act, in itself, is fundamentally deflating…” – Dan Ferris

42:02 – “We are seeing, for the first time in 40 years, wage prices – even if it’s nominal, and Trish’s point is absolutely correct, these aren’t real wages – but they will have to go up to keep up with real wage prices…” – Grant Williams

43:17 – “People take this quite personally, and they do want to blame someone. And they probably don’t blame Jerome Powell maybe as much as some of us do. But they turn around and say, who are the leaders in charge? And that’s Biden and I think he will pay a political cost for this, for sure.” – Trish Regan

47:20 – “This Biden guy, he’s caused a lot of trouble… but I’ll tell you what, if you look at statistics of the last 30, 40 years, Republicans are no angels when it comes to cutting back on spending. We don’t have a free market!” – Dr. Ron Paul

50:42 – Buck asks the panel about the implications of FedCoin, or some other sort of Central Bank Digital Currency…

51:15 – “It creates an enormous problem… What it gives the government is enormous powers in terms of taxation, primarily… They can start dropping money into the accounts of people they’re politically aligned with, for example. They can tax those who you aren’t politically aligned with them…” – Grant Williams

58:21 – “I’m troubled by this. I think it’s very much a class warfare thing. I don’t think it’s going to get them anywhere, but they’re going to continue to perpetuate this because they want to look like they’re sticking it to someone…” – Trish Regan on a possible wealth tax

1:02:35 – “Whether you’re in gold or crypto, or whatever, you don’t want the government interfering!” – Dr. Ron Paul

1:10:50 – “Right now, it’s real easy to bash China… But what’s the purpose? We spend a lot more on military than they do. And we print all the money and they take all our fiat money and they buy all our stuff. They save up their money and buy up a lot of competition…” – Dr. Ron Paul

1:10:50 – “It cannot be stressed enough that to visit China today, as an American, is to feel like you’re a very welcome person. You feel more at home than the average person. Everywhere you look is a McDonalds, Burger King, KFC, Apple store, Nike store. Everything over there is American. The Chinese people, say what you will about Xi, are conducting a love affair, and it’s a passionate one with all things America.” – John Tamny

1:17:00 – “We’re all speculating about an unknowable future, so the one thing I would implore all of you to do is to pay attention and to not take things that you read at face value. Understand the problems facing the government and the problems facing the Federal Reserve… they’re very, very real.” – Grant Williams

1:21:18 – “I talk about gold, and I talk about crypto, but that’s not the issue, you want freedom of choice. And because our country hasn’t provided that freedom of choice, that’s what we need to get back to. And that is not complex. That debate has been going on for several thousands of years…” – Dr. Ron Paul

1:21:46 – “My biggest concern, and I feel this in a very acute way, in a way that I never have in my entire reporting career. I feel like our freedom is very much under threat…” – Trish Regan

1:23:55 – “Go forward optimistic, let’s never forget that a bad day in the United States is an amazing day anywhere else…” – John Tamny

1:25:08 – “I like the theme of free speech. It’s under attack, it’s been completely perverted, right? Because now, speech is violence. And violence is seen as an acceptable means of squelching the allegedly violent speech. It’s been flipped completely upside-down…” – Dan Ferris

1:28:27 –We’ve got some great questions on the mailbag this week… One listener asks Dan about the one time he sold gold… Then he has a follow up question about what the Biden administration is doing to the oil and gas industry… And another asks Dan about the Evolution Gaming company (EVVTY) that was mentioned on a previous episode… Listen to Dan’s response to this and more on this week’s episode.

Transcript

Buck Sexton: Well, hello everybody.

Crowd: Hello.

Buck Sexton: This is gonna be very exciting, I assure you. Welcome to our great American panel, full of great Americans. Actually, I thought a fun way to do this might be just really quickly, almost like they do the icebreakers at summer camp or something. We're gonna go down the line. Just please introduce yourself briefly. Go ahead. You first, sir.

Dan Ferris: Hi, I'm Dan Ferris. Who doesn't know who I am here for God's sake. This guy doesn't know. Hello, sir. I'm Dan Ferris. I've worked for Stansberry longer than anyone but Porter. Okay. I'm the editor of Extreme Value and the host of the Stansberry Investor Hour podcast, www.investorhour.com.

Crowd: Yeah.

Buck Sexton: There we go. Sir.

John Tamny: Most of you don't know who I am. I'm John Tamny, editor of RealClearMarkets, Vice President of FreedomWorks. My latest book that all of you should buy several copies of is When Politicians Panicked.

Trish Regan: Hey, everyone. It's good to be back with you. I met a lot of you a couple of years ago. My first time at the Stansberry Alliance Conference. I'm Trish Regan. I am now the publisher. I've joined the Stansberry family of American Consequences and host of the Trish Regan Show as well as the American Consequences podcast. It's really good to be back with all of you. And I look forward to an interesting panel tonight.

Ron Paul: I'm Ron Paul. I spent a few years in Congress. And then I got smart. But since that time, and prior to that time, I spent a lot of my energies and desires to do one thing, promote the cause of Liberty, believing that will find the solutions for most of our problems. And now I'm currently involved on a daily basis with Ron Paul Liberty Report along with Daniel McAdams, which is a livestream program at 11:00 Central Time.

And we go over current events. And also I have a homeschooling program. And this was modest in nature and I started after I left Congress in 2013. And it's been steady, but I would wonder whether you were surprised or not, what happened to the growth of that company or the curriculum in this past year. It's more than doubled. People are looking for something different than what you're getting from the government schools. Thank you.

Grant Williams: I'm Grant Williams. I'm the author of Things That Make You Go Hmmm and the host of the Grant Williams podcast. I think I'm on the wrong panel because I'm English. Was there a great Britain panel? I'm not sure. I think I'm like the Jeremy Irons of all the American movies. _____, you get to throw fruit at, if you don't like some of the answers up here. So I'll put in a –

Dan Ferris: We broke up with you a few years back, didn't we?

Grant Williams: Yeah, I think so.

Buck Sexton: And really briefly, my name is Buck Sexton. I actually sat on a panel with Dr. Paul five years ago at my first Stansberry conference. So I've been coming for a while. I now co-host the Clay Travis and Buck Sexton Show which is in the spot. Thank you. Formerly the time slot of the great and the one only Rush Limbo. So it is now the the biggest, still the biggest radio show in the country.

So let's have a conversation now, shall we? Thank you all for introducing yourselves. Everyone knows you. But just in case figure we'd give folks a refresher. Dr. Paul, we're gonna go to you first. Because every person, I did a quick poll, non-scientific of course, beforehand of what questions or what topics with people, just speaking to some of the folks here last couple of days, inflation, inflation, inflation. I wanna hear what everyone has to say about it. How bad do you think it's going to get? What do you see happening?

Ron Paul: Well, the first thing I would do is make sure everybody's thinking the same thing for the definition of inflation. Because nine outta ten. And I imagine most of the people in the room will think inflation is when the CPI goes up and the government tells, oh, there's some inflation out there. And haven't studied Austrian economics and paid attention to Messes, he said, that's a distraction. Inflation is the increase in the money supply, and that's how you inflate it, and then you have ill effects from that.

You have malinvestment, you distort interest rates, and you caused the business cycle from that. But I think it's horrendous. I got fascinated with – Getting into politics and talking publicly about economics was after the breakdown of the Brenton Woods in 1971, literally because we were bankrupt and we couldn't support the dollar any longer. And at that time, the inflation rates got pretty high. But the one thing that you can depend on back then or even now is you can't believe what the government tells you in almost everything.

But especially on foreign policy or whether it's economic policy or statistics or the danger of COVID, the whole works. Look at that stuff with a bit of reluctance. But no, I don't think – They're talking more about the inflation, but it's always the prices. And that way you can blame something other than the Federal Reserve. See, how often do you hear the Federal Reserve mention along when they talk about inflation. Well, you can't have inflation without an instrument like the Federal Reserve and because they inflate the currency and they cause the problem.

The Federal Reserve is a taxing authority. It's an interference. It messes up the interest rates. It causes the malinvestment, but very few people would really spend much time on that. So if you're concerned about inflation, which everybody is getting concerned about, what they have to do is talk about, when are we gonna audit the fed and when are we gonna to get rid of the fed to solve the problem of inflation?

The instrument is, of course, a very powerful instrument, and that is that of the control of money supply and finding who to blame. And most of the time there's a lot of fudging and rigging of prices. So if prices are going up and a gold price is a reflection of interest rates, you can bet your bottom dollar that they'll rig the price of just about everything if it serves the interest of the government.

Buck Sexton: Oh, thank you, Dr. Paul. Grant, this morning you had a conversation with Muhammad, right? And the conversation turned to inflation or deflation. Some folks came up to me and said, can you give us a little more clarity on that back and forth?

Grant Williams: Yeah, for sure. I think it's important to understand that what Dr. Paul said is absolutely right about what the definition of inflation is. But the problem is, for the public, what they recognize inflation is rising prices. That's when it starts to become a problem for the general public. That's when they start writing to their congressman and complaining about the fact that prices are going up. So it is important to understand what real inflation is and what the inflation is that gets people agitated.

And again, Dr. Paul's right. What's happened over the last number of years is the Federal Reserve have interfered with money. And if you corrupt money, you corrupt society, ultimately, because everything comes down to transaction in a modern day society. So we've had 40 years of deflationary tailwinds. And if you have 40 years of mild deflation and a Federal Reserve that's willing to step in and prop up any weakness in the stock market, you have the perfect conditions for rising asset prices. And that's what we've seen.

So this deflationary pulse that's been fought by the Federal Reserve, really, if we look at someone like Japan, where they've had deflation for 20 years, everything's still functioning over there. What we've seen is a massive attempt to prop up asset prices. It's worked this far. But the problem come when we see inflation that is recognized by the public. And that in some ways is the end game for the Federal Reserve. Everything they've been able to do to keep the lid on all this for the last 20 years when the pressure's been really high, has been able to be completed because there's been no inflation as the public sees it. Now we've hit the point where the CPI's at almost six percent, PPI is up at almost nine percent. And these rising prices are starting to become a problem.

Back in the '70s, Paul Volker needed President Carter's permission and his blessing to raise interest rates. Carter was voted out of office, Reagan came in, he needed Reagan's permission to raise interest rates. And both presidents essentially gave the same speech to the nation, because inflation had become a problem. That's where we are right now. Inflation is starting to become a problem. The deflation tailwind is dissipating.

There are arguments that it still the main problem we have to face, but I don't think that's correct. I think inflation is the thing we have to worry about because if inflation sticks, the Federal Reserve will have to raise interest rates and everything. And I mean, everything from stock prices to bond prices to real estate prices to private equity, is now utterly dependent upon rates staying low forever. So that to me is the most important thing for people to understand that rates really cannot go up.

Buck Sexton: One quick thing. Anyone who wants to jump in on anything afterwards, by all means. Dan wants to jump in with a question, do you?

Dan Ferris: Yeah. So you're not buying transitory inflation and you're not buying COVID pure supply chain induced. It sounds like to me.

Grant Williams: The transitory – We spoke about this Daniel. If you look at the minutes of the Federal Reserve meetings for the last six months, they mentioned, I may get the numbers wrong, but May, June, August, September. May, June, August, there were between two and nine mentions of the word transitory. September, it wasn't mentioned once. So even the Federal Reserve Open Markets Committee is starting to come around to the idea that this isn't transitory. And that's a huge problem. If it does stick, it becomes a huge problem for the Federal Reserve.

Buck Sexton: Trish, what happens if this 1.5 to 1.7 to – Depending on the estimate, some people say you add the infrastructure bill on top of this, you're looking at a couple trillion more. If it actually goes through, and this spending, we're talking about inflation, we're talking about the effects in the economy. We've already spent, what was it? 1.9 trillion earlier this year in a direct stimulus Democrats went with that. What happens if these trillions go through in the Biden agenda, the Build Back Better plan?

Trish Regan: I think it's gonna fire back on him. I mean, I think you're gonna be in a situation where you have even more inflation. I hesitate to say hyperinflation only because when I think hyperinflation, I think Argentina, Venezuela, Germany years ago. We still have the benefit although Dr. Paul would not call this a benefit. He'd say this is a bit of a curse, I think, of being the world's reserve currency. And thus everybody still wants to be in US dollars, which helps us on the margin, but long-term may be a real detrimental thing, ultimately.

My concern about all of this really is what it means for your average American, your average American consumer, because our standard of living as Americans, it is constantly decrease, being depleted by this inflation. I mean, it's really pretty remarkable because it takes so much more money now to live than it did years ago.

And I love how no one in the Mainstream media ever reports on this. This got me. Last month they had incomes that came out and the New York Times is thrilled because they said, "Guess what? Incomes are finally going up." And I'm like, wait. Okay.

So we're going up like 1 percent? Has anybody bothered to look at CPI, which is up? At that point last month, it was 5.4 percent. In other words, real wages, they're not going up at all. This is just acting as a tax on American consumers, digging us further and further into debt, further and further into the hole, reducing our lifestyle.

Buck Sexton: John, what do you think about what the Biden administration's done so far to the economy and all the spending that's gone on because of COVID? What are the after effects gonna be?

John Tamny: Well, by definition, there's this myth even promoted by our side that spending provides a sugar high? No, it doesn't. Government spending is just politicized allocation of precious resources, whereby Marco Rubio and Elizabeth Warren allocating right resources, as opposed to Peter Thiel and Mark Zuckerberg. And so the damage to the economy is immediate. And so there's no question that if they get a bigger spending bill, that's going to harm the economy, there will be no near term growth.

If you look at it more broadly, I think it's important to stress a few things. Inflation is as old as money is. Inflation well predates central banks. Let's never forget that FDR devalued the dollar in 1933. Fed chair, Eugene Meyer begged them to not do it and resigned over his decision. He was powerless to fight FDR. In 1971, Arthur Burns begged Richard Nixon to not delink the dollar from gold.

And this is important because I would disagree with Dr. Paul. Inflation is not an increase in the money supply. And how we know this is let's imagine if we went back to a gold standard, which I think many of us would want.

If we went back to it, the dollar would be much more credible, globally. And use of it as a payment system would be much more global. It would be even used even more in global transactions. Good money is everywhere. Bad devalued money is scarce. Let's never forget in Weimar, Germany, the mark disappeared precisely because no one trusted it, but a dollar got you everywhere then.

Buck Sexton: Dr. Paul, did you want to respond briefly before we brought in the next question?

Ron Paul: Yeah. I wanted to touch quickly on this idea of deflation. People worry about the deflation, think that may come. And I don't think there's any concern about deflation. That means the money supply is gonna shrink and prices are going to go down like we had in the 1930s. We're not going to have that. The deception has to be that prices are going up for sinisters reason. People are making too many profits or union wages are too high, or somebody's fixing prices somewhere.

And then they will do what we did and saw done in the 1970s, and that is put on wage and price control, which is the worst thing you can do. So you control these things that they don't like. Now, we were told that no matter what, that they can handle things. If there's any chance of deflation or there's weakness where they need some dollars, it was Yelen, I believe, who said – Don't know. It was Barneki. He said, "Don't worry about it. We will always take care of you. We'll have helicopters out there if necessary."

And that's what we've been watching. Just go outdoors and the money keeps coming down. It used to be just QE. But the QE continues and then we still continue with a modified QE, $120 billion a month. And it's a purchases and it just goes on and on, but it's always cover up. It's always cover up for a very bad system. And it should be dealt with moral terms. If we thought of of the politicians who vote the deficits and then make sure the Federal Reserve will monetize, it's immoral because it's theft, it's counterfeit. But most people don't deal with it in that, but who suffers the most?

It's the middle class that suffers. They're the ones who really get squeezed on that. It is true the rich get richer and the poor get poor, and this middle class gets wiped out. And Australian economics has preached out for years and years. And I think it's so important to understand that we will concentrate on what we have to do, and that is curtailing government. That is the real problem that we have. And the inflation is gonna eat our lunch. It's all been already been eating the lunch of a lot of people already. I predict it's gonna get a lot worse.

Buck Sexton: That lunch is getting more expensive for sure.

Ron Paul: Pardon me?

Buck Sexton: The lunch is getting more expensive, eat out these days. You see, the price of beef, the price of a lot of things. Dan, I wanna give you a shot at the inflation, spending, what's coming next ball?

Dan Ferris: Inflation is a complicated topic. And the fed's relationship with inflation is a complicated topic. The fed prints a dollar of currency, they go into the market, they buy a dollar of income producing securities. That act in itself is fundamentally deflating, because you've removed income from the economy, you've increased bank reserves, and you've given the whole world a reason to suspect that maybe it's not a good idea to use those bank reserves and lend them and spend them.

So what we really look for is what has finally happened. Where is the lending and spending coming from? Well, it's coming from where it eventually always comes from, doesn't it? The trillions and trillions that you've asked us about. So that the spender becomes the government. That's where your inflation comes from.

To me, that's the real source of it. And what I talked about yesterday was the narrative. And what we're really talking about is the narrative, right? Transitory, frustrating, not transitory anymore, and then I said, oh shit, gas is $8.00 a gallon. That's the next step in the narrative. And by then, our gooses are cooked. You better own the right assets. You better be prepared for this.

Buck Sexton: Grant, supply chain. It was something that you were seeing popping up in the news a few weeks ago, then the photos, all of a sudden, of shipping. Well, container ships rather. All off the coast of California, hundreds of them. You've got truckers now.

I have a friend who runs a business who says, the truckers will say, I know we have a contract, but I can get three times as much if I dump your stuff on the side and pick up new haul. Things are getting pretty rough out there. People are worried about what's gonna be on the shelf at their store in the holidays. What really caused this and what can be done about it, and how bad is it gonna get in your mind?

Grant Williams: Well look, I mean, the old saying that the cure for high prices is high prices is never been more true with this. We have a supply chain problem because people have a high demand for goods. And a lot of that happens because we have a very recent memory through COVID of not being able to buy a toilet paper and bread.

So we have a memory now that is very recent of not being able to buy things. So knowing that a year and a half ago, you couldn't buy toilet paper, so if the price of toilet paper went up 20 percent, you'd probably gonna buy some because you're worried of being back in that again. So as these goods become scarcer, as the supply chain problems hit, people are prepared to pay higher prices to have access to these goods and services.

Well, those prices need to go higher to solve this supply chain problem. If the prices go high enough, people will suddenly go, you know what? I can't pay that, or I won't pay that. So I suspect higher price prices are gonna be the cure for this problem in the short term. The supply chain problem isn't that enormous, right? If you can't buy a used car for more than the price of a new car, you know what? You don't buy a used car. You just can't afford to pay those prices.

So there will be an equilibrium where the supply chain causes higher prices, and that will to tempo the demand. It's always been that way. The big problem of all this is the wages. When you talk about the truck driver, that's a really important fact. What we've had in all the inflations we've seen really since the '80s, we haven't seen, as Trish pointed out, wages go up commensurately with the inflation. Wage increases are very sticky.

You can lower prices again. If you jack your prices up due to shortages, you can lower your prices again as a producer. But try taking away chuck away from someone. Try going to a union official and saying, look, we gave you that 17 percent increase last year, we need to take half of it back again. That's not gonna happen.

So as we see a lot of companies, Amazon, Walmart, some of these really big companies, Starbucks, raising their minimum wage, some of them because they've been under pressure, some of them because they want a virtue signal be good corporate citizens.

It's great in the moment, but those wage price hikes are now baked into the cake. That's baked into their input costs. And they're not gonna go down. So I think this is a very important thing to understand. We are seeing for the first time in 40 years, wage prices go up. Even if it's nominal, and Trish's point is absolutely correct, these aren't real wages, but they will have to go up to keep up with real wage prices. And that wage price spiral is a real threat to all of this.

Buck Sexton: Yeah. Trish, what kind of political costs do you think the administration may run even if it is just photos of empty toy shelves? I mean, to the point that Grant's making, people aren't going to starve in this country. We're not worried about empty shelves in the Venezuela sense, the Maduro diet, so to speak. But what happens when people start to see what's actually going on here in real terms during the holiday season when we were told they were gonna Build Back Better?

Trish Regan: I think it's game over. I mean, I really think, and the poll numbers reflect this. I mean, it's just amazing how much the Biden administration is suffering politically because of all this. What happens in 24? We'll see. I mean, there's a long time and a lot can change between now and then. But at present, if this continues, people continue to pay more at the gas pump.

People have to continue to pay more for toys that maybe they can't get for their kids. I mean, your kid wants one special toy and you go outta your way to get it and it doesn't arrive or the price is more than you can afford. People take this quite personally, and they do want to blame someone. And they probably don't blame Jerome Powell as much as I think some of us do. They turn around and they say, who are the leaders in charge? And that's Biden. And I think he will pay a political cost for this, for sure.

Buck Sexton: John, what are you making of it?

John Tamny: Well, if look back to Adam Smith. I mean, I think it's fairly basic here. He is opening pages about a pin factory. A man alone in a pin factory could maybe produce one pin per day, but a man working with several coworkers where everyone is specializing in that same pin factory could produce tens of thousands.

So you think about something unsophisticated like that and then consider airplanes and computers and toys. Imagine the global cooperation of billions of workers entering into trillions of different contractual arrangements over the decades on the way to this global supply chain, and then a political class that thought it needed needed to guide us away from a virus decided to shut down the most sophisticated supply chain the world had ever known.

Is anyone surprised that we've got shortages right now? I mean, the shortages are a statement of the obvious, but what's offensive is when we call it supply chain shortages or inflation. No, this was central planning. This was the imposition of command and control where there had been freedom before. Let's be very clear about what happened. The political class, Republicans and Democrats, and everyone between caused this when they went for lockdowns as a virus mitigation strategy.

Buck Sexton: Dr. Paul, one of the features of the Trump presidency was a repeated call to bring back more industry to the US. Do you think what we're seeing both with the supply chain issue, but also tensions with China, which we're gonna return to, to spice things up in a little bit, makes people think now longer and harder about having more domestic US production. And in fact, it becomes a patriotic imperative for us to make things here, because if we are reliant on these supply chains and particularly if we're reliant on China, we're vulnerable.

Ron Paul: Well, I don't think that's a problem. The problem is lack of liberty, lack of free markets, lack of a sound currency, and letting people decide where to build. And if they should be built where the best deal is, we should be outta this economic planning. I think when I look at those ships standing out there and jobs going begging, nobody's taking the jobs, and then you have the price inflation going up.

This is all to me, a result of central economic planning. It all started before COVID came, because many of us had talked about the beginning of the downturn before COVID hit, because the cycle had made that point and they had to have this correction. We live by central economic planning, but I think they've been pretty sophisticated, they've been getting away with it more than they should.

So the downturn had started, then we ended up with COVID. Then we have some people who wanted to take advantage of COVID because they saw some advantages to wrecking our economy. And it wasn't an accident that the two were combined. So the economic planning has done it and that has allowed this to happen. So it started, it continues, even when you don't have COVID, you have the Federal Reserve rigging interest rates. So that's economic planning. You have stimulus, deficit spending. And it's always by Republicans and Democrats.

And we were at the end of the line for this, especially when they turn on COVID. I mean, when you start seeing trillions of dollars. And this whole idea, well, it's that Biden guy, he caused all these problem. He's caused a lot of trouble. But I tell you what, if you look at the statistics of the last 30, 40 years, Republicans are no angels when it comes to cutting back on spending. We don't have a free market. When I see the ships out there, all those problems, I simplify it, central economic planning doesn't work free up the market, free up the people.

Dan Ferris: Yes. Did you hear what he said? How many times have I told you they're all the same? Republicans, Democrats, they're all the same. You're an idiot if you think otherwise. You're picking teams. No, the left is good. The right is good. It's stupid. He's exactly right. And he knows. He was there for decades. The guy got reelected for promising not to spend money in Washington D.C. I promise you, he knows what he's talking about. And that's what I'm telling you.

Buck Sexton: So with that, Dan, if you had –

Ron Paul: He said it better than I did.

Buck Sexton: Yeah. With that, something that's a fun quick thing I like to ask people is, usually on other subject matter, but on this one I think it will work well. If we got you a couple of minutes in the oval office with this administration, just put aside that, well, this one good, this one bad, the previous.

If they were going to take your advice and based upon some of the shared principles you've identified with Dr. Paul here, so that things would get better, so that the ships wouldn't be all snuls, that we wouldn't the inflation that we're seeing and the money printing and all this. What would you tell them? What would you want them to do that could be a realistic implementation on a policy side? Or even take one or two things.

Dan Ferris: Realistic.

Buck Sexton: Yeah, realistic.

Dan Ferris: I'd ask him if I could have lunch and if I could get some good wine. I mean, I wouldn't ask him – Realistic, he's not gonna listen. He's doesn't even know what day it is. I mean, come on. Realistic?

Buck Sexton: I mean, it's true.

Dan Ferris: Realistic? I mean, realistic I'd say, Hey, Joe. I'd just say, let's go Brandon. That's what I'd say to him.

Buck Sexton: All right. Does anyone have a follow up? Cause I feel like this is a good moment for a follow up.

Ron Paul: I wonder what makes you think that things would be better if he was more lucid? Maybe we're better off with him not knowing what's going on.

Dan Ferris: Exactly. Exactly. If I could just get him not to show up for a year.

Ron Paul: There you go.

Buck Sexton: So I don't think we're gonna have the White House solving this anytime soon. We could agree on that one. Give me a sense if you would here. I've got so many great questions. Some of them are crowdsourced as well. But Grant, there has been some discussion recently of fedcoin. And I have a bunch of people asking different Bitcoin questions. But fedcoin, even Janet Gallen brought this up.

So it would be a digital currency, but not based on the blockchain system that the federal government controls, which a lot of people in this era of the IRS may be looking at bank accounts or transactions of $600.00 or more would say, this feels a little spooky. Do you think they're serious about fedcoin? And if they are, what would that mean?

Grant Williams: Well, the idea of a central bank digital currency is not a new one. The Chinese have been trialing their own, the DCEP for about a year now in certain parts of China. And realistically, whichever way you look at this, the future of money is probably gonna go digital. Blockchain has kind of opened people's eyes to that. The trouble with essentially coordinated government-backed digital currency is for you as Americans. That creates an enormous problem, because every single transaction you do is on the government ledger.

And so what it gives the government is enormous powers in terms of taxation, primarily. They can tax everything at source. But more worryingly, they can start to look at your spending habits. They can start to look at the things you spend money on. They can start dropping money into the accounts of people who are politically aligned with them.

For example, they can start taxing people who aren't politically aligned with them. And all these things sound like a kind of dystopian vision of the future. And maybe they don't come to pass, but the problem that we've seen with government is you give them the power to do something.

And Dr. Paul talked about central economic planning. I totally understand his point, but I would argue that what's actually happened is central economic reaction. None of this has been planned. They're basically putting out the last fire with centrally commanded dictates.

So if you realize the pressure the government is under, you realize the pressure the Federal Reserve is under and you give them the means by which they can solve many of those problems by taking money out of the public's pockets and directing spending, this creates tremendous temptation for a government and a central bank whose backs are against the wall.

So imagine if the fed was gonna say, right, we're gonna drop $100.00 into your account, but you can only spend it on these products. And you have to spend it within a month or that money goes away. All these abilities come with a central bank digital currency. And every central bank in the world, every major central bank in the world is either trialing them in the case of the Chinese, who people I talk to are very knowledgeable about this stuff, say are way ahead of Western central banks. The British are talking about Britcoin, which I think is kind of cool.

DECP are talking about their own one, the Bank of Japan are talking about their own one. These things are coming, and understanding not necessarily what they will do but the powers and the abilities they offer to governments are important to understand, because every single one of them is a solution to a problem that the government has that we don't have.

And the government's problem is they don't have enough money. Where is that money? It's in the hands of the public. And instead printing out of thin air, they are soon gonna reach the point where they have to take it, which is what these wealth taxes are all about.

So be very careful about these digital currencies and understand what powers a central bank mandated one gives to the Federal Reserve.

Dan Ferris: I got a question for you. Is the USD already a digital currency?

Grant Williams: You could argue. It is absolutely, but the central authorities don't have the means by which they directly take it outta your bank account just yet. They can show up with a warrant. They can take it outta your bank account. They freeze your bank account. But depositing and having a ledger of every single transaction you make with your money, they don't have that yet.

Dan Ferris: How far could we possibly be from that if they're the number one bank regulator?

Grant Williams: The trouble with it is you disintermediate the banking system. The Federal Reserve and the government becomes the banking system. And that is a problem. And some people would argue, that's why this won't happen. But everything Dr. Paul's talked about, the steps that have been taken are necessary to solve the problem. And that problem is only gonna get bigger, and the powers they are gonna need to solve those problems are only gonna get broader. And a digital currency at a stroke of a pen gives them remarkably wide powers. And it's very dangerous.

Dan Ferris: I feel like you and I are taking ten times as long to say what these three said with 20 words.

Grant Williams: You're absolutely right.

Buck Sexton: John, Grant just mentioned the wealth tax situation and it is now included as it stands in the Biden bill if it goes through or the Build Back Better agenda, whatever, they're calling it up on Capitol Hill. And it would include, I believe for the first time, someone can correct me if this is wrong, taking unrealized gains and taxing them.

Essentially at a certain level of wealth, a person would have to establish what their stock upside was and pay a tax without having made an actual sale on that transaction. Do you think, that is, feasible and serious, do you think – And by the way, this is something I wanna push to everybody in a moment. Do you think that's feasible and serious? And if so, why should we think they would stop there? 401ks are a big fat goose for the federal government if they decide they're gonna start taxing unrealized gains in the market.

John Tamny: Well, 17 of the first 20 years of Amazon, for instance, being public, at least one time in each of those 17 years, there was a 20 percent correction in Amazon during that year. So you think about this. If they chose to tax you at a certain time based on an unrealized gain, you could pay based on a huge gain that a year later would not be there. Let's remember in the early 2000s, Amazon went down to about $7.00 a share. So it's an impossibility. It cannot happen. There's just no way you could pull this off.

But it's important to point out that assuming you could Institute a wealth tax, it cannot be forgotten that the rich are the most important drivers of economic progress. And they are precisely because they've got unspent wealth. Economists believe economic growth is driven by consumption. No, investment drives economic growth. The rich uniquely have investment funds. And so once you start attacking the wealth of those with the most, you are attacking the very wealth that drives all advance in an economy. It would be economically disastrous.

Buck Sexton: Trish, fun history here. As we all know, the income tax started out as attacks on the very, very wealthy in this country, a little over 100 years ago if memory serves. So assuming the implementation that John's talking about is a challenge, what do you think the game is here? Is it just including a little bit of a class warfare, you didn't bill that stuff into the bill or they actually gonna find a way to start taking a wealth tax? I believe they've got one in France, they've tried in a few other places. Didn't work out very well.

Trish Regan: It didn't work, right? I mean, and he was out of a job. It was Oland, right? They tried that it didn't work. Look, to quote Margaret Thatcher, we all know it well. At some point, you're gonna run out of other people's money here. The reality is, if they actually wanted to do what they say they wanted to do or want to do, they could do it. I mean, think about, I call it the fat cat private equity tax loophole.

Right now if you're a private equity banker on Wall Street, your income is treated as investment. So you got basically a 20 percent savings right off the bat. Well, it turns out the private equity industry gives a whole lot of money to Washington D.C, like to the tune of 625 million in this last election cycle. So what do you know? Nobody's going after them to pay their, "fair share."

So they continue to be able to treat their income as though it's investment, even though that's actually how they make their living. And it really is technically income. So I'm troubled by this. I think it's very much a class warfare thing. I don't think it's gonna get 'em anywhere, but they're gonna continue to perpetuate this because they wanna look like they're sticking it to someone. And don't forget, I think there's a real – I think there's a selfishness, frankly, to a lot of our leaders in Washington, D.C.

And maybe they go there for the right reasons when they grow up as kids being really idealistic, and they wanna fix and change the world. But then they realize self-interest is the one and only thing that's gonna keep them sort of coming back there. So they've gotta do something that they think is politically expedient. And for Biden and for a lot of Democrats right now, it's pointing the finger at the billionaires and saying, we're gonna go after you.

Buck Sexton: Dr. Paul, you saw a lot in your days in Congress. Right now, the Biden White House is claiming. And that's just again, cause this is who's in charge right now. I'm not trying to make it political. They're claiming that the cost, this is the tagline, this is the selling point. The cost of the multi-trillion dollar Build Back Better bill is zero. This is what they repeat endlessly. The cost is zero. What game are they playing?

Ron Paul: Self-serving game they play in Washington and it means nothing. It might means nothing to them, they just go back and forth. But a few years ago there was a big debate over the value added sales tax or flat tax. And that was well debated. And there were bills in introduced. Because they knew I was anti-tax, the supporter was saying, come on, get on our bill, get on our bill. And I never got on one of those bills because I thought they were missing the whole question. It isn't the method of taxation. I claimed spending is a tax. It taxes the economy. You tax it if you collect a little bit by the income tax or capital gains tax. You borrow money and you have to pay it back. You have the fed monetizing it.

As soon as you spend the money, it's taxed, it's never paid for except with the instruction of the currency. And this is the reason why they don't get anywhere. Then they talk about these things. If you ever did some of these things you suggest and logic tells you, you should do it, it's sort of like saying, oh, okay, we heard a rumor that the fed was going to announce tomorrow morning that they were going to start raising interest rates deliberately.

And it's gonna start tomorrow and it's gonna be deliberate for a year, because interest rates have been too low and it's anti-market. Nobody would believe that. It is not gonna happen. Or if the Congress would come out and say, well, yeah. Some people say, don't you just need some good people up there and change who runs the house of representative and senate. Change it and it will work.

No, it is so embedded that if you cut a little bit of spending, Nope, they don't cut any spending and they're not gonna lower interest rates. It's different. I think that two years ago when those overnight rates went up to over ten percent, I think it was a telling point of how bad this was, because that's when they restored QE and they've been continuing with it.

They can't cut spending, they can't cut printing, they can't cut running rough shot over our liberties, and they can't stop militarizing everything. The big thing this week was how soon's Biden gonna start war with China. This sort of thing. It goes on and on, but how many times have people been blamed? They say, all throughout our history wars are good for the economy.

Well, I heard George W. Bush argue that case, wars are good and he got his little war going. But believe me, it's not good for liberty and it's not good for the economy. The only thing that we should be talking about is how you define personal liberty and what the government can do to preserve that and let you do what you want with your life and your money and your property.

If you make a mistake, you suffer the consequences. And whether you're in gold or cryptos or whatever, you don't want the government interfering, but you should have one rule, don't fraud. That's against it. Don't fraud and don't lie. But that isn't the case. We're in deep, you know what? Because this is a real mess and they they're totally trapped on doing anything, any little effort. There are no Paul Volkers out there that will come to your rescue.

Dan Ferris: I'm so glad you evoked the –Yeah. I am so glad you evoked the war is good for the economy fallacy. It is the broken window fallacy, right? The broken window fallacy is a little boy throws a rock through the shop window and breaks it. Well, that's great, because that's good for the guy who makes glass, right?

But what you never see is always the things you don't see and can't measure. That's the real destruction of taxes and inflation. And it's the real destruction of war, because you don't see what the guy who owned that first window would have bought with the money that is now he's spending it just to tread water. Right? Brilliant. As usual.

Buck Sexton: Where interest rates going, Dan? And when.

Dan Ferris: Interest rates? This is gonna sound ridiculous.

Buck Sexton: People ask me to ask you that specifically about that.

Dan Ferris: From a guy who is really worried about inflation, but I'm actually sitting here watching bonds go down, looking for a rally at this moment. So I'm looking for 'em to go down in the near term.

And look, we've seen the playbook. Bank of Japan gave us the playbook that the fed is a few years behind. The fed just hasn't started buying equities yet. Right? But we know the playbook and we know it results in to date, roughly 11 trillion of negative yielding sovereign debt. Supposed to be the safest thing in the world, but you're guaranteed to lose money holding it. So, oddly, I have to say kind of down over the next few years.

Buck Sexton: John, we hear about modern monetary theory these days, right? The idea that you just spend what you need to spend and then deal with inflation as it comes, loosely defined.

It comes up in discussions generally about economic advisors to folks like Bernie Sanders, Alexandria Ocasio-Cortez, the political left seems to talk about modern monetary theory more openly than ever before. I know people on the right who say, aren't we just doing that and not calling it that? How far are we from some version of MMT, where the only real break you have is when inflation gets so bad that the peasants are out there with the pitchforks, so to speak?

John Tamny: Well, it cannot be stressed enough that money's sole purpose is to circulate consumable goods. Without production, money has no value. There's no basis for it. And there's a reason that Honduras spends very little money. It's not that its politicians are cheap, there's just no production in Honduras. And the United States, the richest country in the world, and politicians have arrogated to themselves a percentage of the production of the most productive people on earth.

And so this notion that you can create money, puts the cart before the horse. Money is a consequence of production, it's not a driver of it. Economists think it's a driver of it. But if that were true, we could make East St. Louis a rich city tomorrow just by creating money and putting it there. You can create it all you want. It would achieve nothing. I want you to imagine. Let's imagine we put it in West Baltimore. You could put it in the banks there, but it would disappear as quickly as it arrived because money seeks out its best opportunity.

And so this notion of modern monetary theory insults basic economics. There's only demand after production. MMT presumes that you can print demand. No, no, no, demand is a consequence you have to produce first always. And MMT gets it backwards. Are we going in that direction? No. What we're going in the direction of is in the United States, politicians have access to the most productive people on earth and they pluck the holy hell out of them.

Buck Sexton: Trish, we got a lot of questions from folks about China and specifically China-Taiwan, some of the saber rattling. That's a term we'll always hear. Right? We've used it, I'm sure, in the news broadcast. Do you worry about a Chinese taking invasion of Taiwan? And what do you think that would do to the markets if it actually happened?

Trish Regan: Yes. I worry about it. I worry about a lot of things. It's not top of my radar right now. I think inflation is my number one concern. And I worry about what I call the Chinifiacation, if you would, of the United States of America, given what they want to do with the IRS in poking around in our bank accounts given what we've seen Big Tech do, and Mark Zuckerberg's metaverse that he's been talking about where we would have an alternative reality controlled by Big Tech.

There are a lot of things to worry about. I do think that that would be – Yeah, I mean, that would be highly problematic. And we becoming to this sort of, where do we want to be in the world? Do we care enough about Taiwan that we'd be willing to engage in some kind of catastrophic event?

And, look, I think that, that would just be a horrible, horrible, horrible situation on every front. And not to sound too isolationist, and those that know me know I'm not. But we have to pick and choose very carefully here. And if Taiwan is something that we want, then I think that there are things that will need to be done soon. To Dr. Paul's point, I hope that it would never come to that. I think that at some point we have to turn inward and rely more on ourselves and domestic production so that we don't go down the course that we may.

Buck Sexton: Dr. Paul, do you worry about it. And if it happens, what should the United States do?

Ron Paul: The first thing I would not do is I wouldn't get involved in it if it didn't have anything to do with national security. And if we look at what we've done, especially since World War II, the first thing is the restraints that have been placed on the Congress and on the people, is you're not supposed to get involved unless you have a declaration of war. And we've fought all these wars. Millions of people have died over this. First thing I would do is if they get into a squabble over there, that's their business.

And I would not send anybody here or any of your kids there over there, because the results won't be any better than Afghanistan. We held the 20 years over there and people were just angry because we left too soon. There's still people who want us to go back to Vietnam because we lose faith. We lost face on them.

So now, I think non-intervention in your personal life, non-intervention your economic life and the money you have, and non-intervention in foreign policy, they are good policies that the world would be a lot better off and there'd be a much greater chance of peace and prosperity.

But what we have done over these many decades is we have bought a lot of stuff from China. I remember in high school, some of my teachers got redrafted, sent over there and killed fighting with the Chinese. Made no sense whatsoever.

And now, Nixon was a real bummer, almost everything he did, but I liked the idea that we would at least talk to the Chinese. That was better than shooting and killing each other. But the whole thing is, right now, is really easy to bash China. This country, if you want to run an election in a republican district, you'd better be willing to really bash China.

But what's the purpose? We spend a lot more money on military than they do. And we print up the money and they take all our fiat money and we buy all their stuff, and then they save their money. Then they buy up a lot of competition. They've been able to buy up minerals and everything else around the world.

And in a way, we have ironically subsidized them by buying all their stuff, but I just do not think that it's worth getting involved. First thing is this whole thing is we're just pestering people. When we send in, we have to show our might, we have to send in our warships into the straits and right up to the border of China. There are such things as false flags and mistakes made and has happened internally, people will do it, and some people won a war without and they would orchestrate it.

So we should have a much greater desire and an understanding of why we don't need these wars and bank to the issue. Wars make us destitute. I remember the depression, but I remember World War II, and we were poor in World War II. And this idea that World War II ended the depression, economically speaking, has no truth to it whatsoever.

Buck Sexton: Anyone else on China and Taiwan?

Grant Williams: Yeah. Just a couple of points. Whenever you read about this China situation, particularly with regards to the US and particularly regards Taiwan, you have to understand the lens through which you're getting your information, which is Western Media. I spent best part of 20 years out in Asia and I still have a lot of friends out there. And the conversations I've had recently really put a different slant on this.

So what did China want if they talk about inviting Taiwan? Well, there's a sovereignty issue that Chinese believe it’s still part of the mainland, but the main thing they want is to semi-conduct their production. That's really the jewel in the crown. Now, the Chinese don't need to invite Taiwan.

The Chinese are already in Taiwan going to the engineers at Taiwan, semiconductor UMC, the big fabs there, the big foundries, and basically tripling the wages of their engineers and say, "Look, here's what you're doing in Taiwan. Why don't you get on a plane? There are now direct flights between China and Taiwan. You're an hour away from home. You're gonna get three times the money. It's the same language, it's the same cuisine."

25 percent of Taiwan's working age males earn their living in Mainland China. So they don't need to necessarily invade China to get this technology. The second part is people talk about how a blockage of the oil for China would be a disaster for them. They've got something like 51 days, sorry, 151 days of oil supplies.

The US could block, put an embargo on oil supplies in China, and it would turn this thing over in a heartbeat. But with the US moving away from Afghanistan, what we see in Taiwan, there are some very loud pro-democracy voices, but the vast majority of the wealth made in Taiwan is made on the mainland.

There's a very, very clear set of dots to be joined that says Taiwan actually voluntarily goes back to the mainland. We get reports of how it's anti-democratic, the democracy in Taiwan is so important. If you go to the ground in Taiwan, you'll see it's not such a big deal. And the loud squeaky wheels are the democrats.

So there is a very clear path the Taiwanese might actually just say, "You know what? We consider ourselves part of the mainland. It doesn't need to be a shot fired." You haven't read that in the media over here, but talk to people that live in the region, talk to people that work in China. And that is a very, very distinct possibility that you're not gonna read about anywhere over here. So just when you hear about this, it has to be a shooting war, don't believe that. Do some research.

Buck Sexton: Dan, anything else? Anyone else want to add them to this conversation?

Dan Ferris: Well, I just like to say that my guess is if there were something to happen, it wouldn't be very bloody, and it wouldn't be as there's so much cross border investment from mainland and Taiwan and vice versa. So there's an incentive to keep it peaceful. But more broadly to Dr. Paul's point, it cannot be stressed enough that to visit China today as an American is to feel like you are a very welcome person.

You feel more at home than the average person because everywhere you look there's a McDonald's Burger King KFC, Apple Store, Nike store. Everything over there is American. The Chinese people say what you will about Xi. The Chinese people are conducting a love affair, and it's a passionate one with all things American.

Apple sells a fifth of its iPhones. They're the second largest market for McDonald's 4,200 Starbucks. They're on the way to tens of thousands. It is a massive market for US goods. And so, I find it just strange. China was much bigger threat to us when it was a desperately poor communist country than it is now as a country. That is, people are finally tasting the fruits of economic freedom. Are they as free as we are? No. But these are people who love all things American, and all you need to do is visit there to see this.

Buck Sexton: Yeah.

Grant Williams: What'd he say?

Buck Sexton: Okay. So we're getting to the point here where we just have a last few moments, and I wanted to give you each the sort of like the pageant, if you will, at the end where we can say, what you want the people here to take away from where we are right now in the economy, how things are going in the US, and what you see going into next year.

Obviously, we're basically in November. People, they're looking at 2022. COVID, how bad is it gonna be this winter? What does it mean for the economy? What does it mean if the Biden package goes through? We get some big things on the horizon. We'll just go in order. Grant, what do you think?

Grant Williams: The simple answer is we don't know the answers to any of those questions, right? We're all speculating about an unknowable future. So the one thing I would implore all of you to do is to pay attention and to not take things that you read at face value, understand the problems facing the government, facing the Federal Reserve. They're very, very real, and they are not discrete problems of 2021, they are the culmination of problems that was set in motion in 1971.

This is a 50-year, 60-year problem that's been building up here, and we are reaching the point where it becomes too big a problem to solve with regular policies which we've had before. So things will happen, measures will be forced upon governments, they will be confiscated in nature, they'll be desperate in nature.

And the only way that they can do any of this thing is unfortunately to Dr. Paul's point to remove the money from your pockets and your bank accounts, and to remove your personal freedoms. So be aware of that, pay attention to that, and understand what's happening because you're not going to find that in mainstream media, you need to dig in places that perhaps you're not used to. But please, please understand, read, and educate yourselves about the dire situation, not just America, but in the entire Western Democratic world. Is it?

Buck Sexton: Thank you. Dr. Paul.

Ron Paul: This form was good because you went on a lot of issues, political issues, economic issues. But usually, it would lead me into a more generalized approach because I see so many problems, but I also simplify it to believing that free people and less government is a big solution to the problems that we have.

So I do talk about that a whole lot, and more or less was driven me in the politics, not to be in politics, but to change the system. And I think that is the most important thing that we can do because all these problems we've talked about, most of them can be solved in a free society, and John Adams warned that even our constitution isn't worth much if you don't have a moral people. And sometimes I think we still have a problem there about how people act and treat each other.

But my summation to this is to quote Bastiat, The Law. This is a little pamphlet. If you haven't read the Bastiat, The Law, you should. It's a small little pamphlet by Hayek. And he talks about what is legal, what is legal plunder. An the area is if the government says so, if they pass a law, they can take from A and give it to B, and all of a sudden, you have this monster that we have, is efficient government that you run up deficits and you print the money and your tax on all this. And his solution to the law is not complex. He said, "If you personally can't do it, you're not a lot of senior congressman to do it. If you can't rob your neighbor of funds because you want to do good someplace in the world or for helping your kids or you're in need and you take the definition of rights and say anything about he needs something or demand something that you have a right to it and you have a right to take it from somebody, if you can't do it, you can't watch it.”

And fortunately in this world today, most of us are still very much aware that we aren't supposed to hurt people, we're not supposed to kill people, and we're supposed to get along with people. We should be charitable. And at the same time though, we have such a temptation people say, "Except, I need to do this because this person is gonna have any bread in the morning if that happens."

They have to realize the world is better off and more prosperous, less poverty, less starvation, less wars, all these things by turning it back to the people. That's why I stick with the general principles rather than individual looking at each saying, "But I'll try my best to describe what happens to the individual issues like monetary policy and the different things that we have to talk about."

But for me, the issue is the preservation of liberty. I think we can apply it to money. I want competition and money. I talk about gold and I talk about Crypto, but that's not the issue, you want freedom of choice, because our country hasn't provided that freedom of choice, and that's what we need to get back. And that is not complex. That debate has been going on for several thousand years. I'm gonna continue at that.

Trish Regan: We're here. Now we need that freedom. My biggest concern, and I feel this in a very acute way now, in a way that I never have in my entire reporting career, I feel that our freedom very much is under threat. And it's not just our freedom to prosper, our freedom to spend our money as we choose our freedom to grow our wealth, it's our freedom of speech as well. And certainly Dr. Paul, you know this well.

I know it as well, myself. I got in trouble the other day with YouTube because I did a video on stagflation because somehow, this had hit the big tech nerve. And I'm like, "Really? I'm just explaining stagflation."

But you know why it hit a nerve? Because there is the threat of stagflation right now, and they see that as a political thing. And there is a desire to keep a certain crowd in charge. Now, that can turn on you pretty quick. I mean, think about if you had a Republican in the White House that wanted to make sure that he or she stayed there, and therefore, was working with big tech and maybe offering certain things like, "We won't break you up. You don't have to worry about anti-trust." And then Big Tech is suddenly doing what the Republicans want. I mean, it can switch on a dime depending on who's there.

And so, this is my biggest concern. I worry about it from an economic standpoint, in terms of our freedom to spend our money as we choose, our freedom to succeed, and our freedom to talk about all these issues as we do.

And again, I think you, sir, know this very, very well, because I think I spoke to you shortly after Facebook tried to take down your page and I'm like, "My goodness, this is just a man who's preaching peace and the opportunity for prosperity." But this is how crazy the world is. So I leave you with that.

Buck Sexton: John, the 30,000 foot view.

John Tamny: Mine would be more go-forward optimistic. Let's never forget that a bad day in the United States is an amazing day anywhere else. Let's never forget the great depression. But the great depression was by global standards, boom time. And so let's keep that in mind. It's so easy in a country this rich and prosperous to point out the bad things. And I would argue that the lockdowns were the biggest human rights violation of the 21st century by far yet we persist, and we continue to.

And so, it's easy to get caught up in the bad stuff. Let's remember that people were predicting the demise of the United States before the United States even became a country. They've been wrong for 245 years. And my guess is they'll continue to be incorrect.

Americans are remarkably resilient people because we descend from all the crazy industrious people who came here from around the world wanting something better. And I think that makes us unique. And I think it sets us up to prevail against all sorts of negativity. Now is not the time to lose faith, be optimistic.

Dan Ferris: I like the theme of free speech. It's under attack. It's been completely perverted, right? Because now, speech is violence, and violence is seen as an acceptable means to the end of squelching the allegedly violent speech. It's been completely flipped upside down. And we seem too many people. I won't say this crowd or even most people.

Too many people seem to have forgotten that civilization began when the first caveman called his neighbor a son of a bitch instead of trying to kill him. That's when civilization began, right? That's when we learned that sticks and stones can break my bones, but words can never hurt me. And words are far superior than sticks and stones if you want to grow a great society and get along and prosper.

Buck Sexton: Well, that's going to be it for the great American panel. Everybody, please say a thank you here to the tremendous assembled brainpower to my right. Hope you have really enjoyed it.

Thank you for those of you who came up to me and said, "Hey, pose this question to them." And we obviously could have gone a whole lot more, but I know you've had a day of a lot of this and you'll have more tomorrow. We thank you so much for coming and for your time. Thanks, everybody.

[End of Audio]

Get the Investor Hour podcast delivered to your inbox

Subscribe for FREE. Get the Stansberry Investor Hour podcast delivered straight to your inbox.